FX Brief:

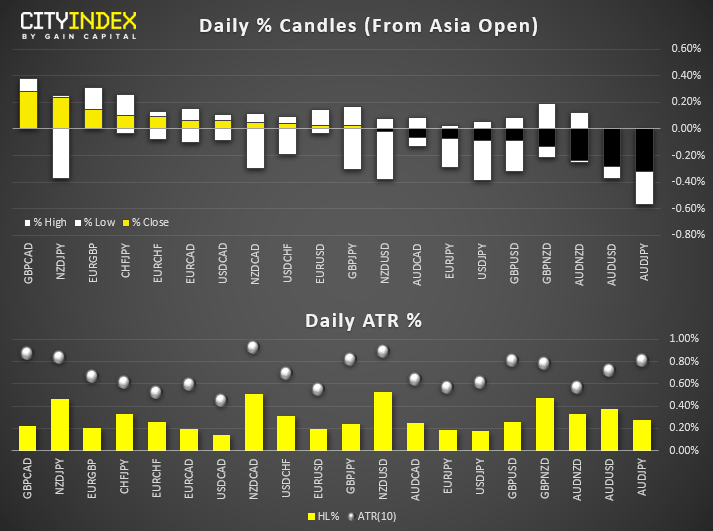

- AUD and CAD are the weakest majors on reports that China don’t want to discuss industrial policy reform of government subsidies, creating yet another setback for the much-hyped trade deal.

AUD/USD has pared most of Friday’s gains and the Japanese yen was slightly bid, seeing AUD/JPY as the largest mover of the day and shedding nearly -0.6% at the low of the session, and currently down -0.3% at the time of writing. - AUD/USD was also weighed down by another weak construction PMI print. At 42.6 it marks the 13th consecutive month in decline, down from 44.6 previously.

- Fed member Esther George says they may have to reconsider rates if consumer confidence diminishes and that she’s waiting to see if the latest round of tariffs have weighed on consumer spending.

- A second whistle blower has come forward against Donald Trump, who alleges to have first-hand knowledge of Trump attempting to get Ukraine to investigate a political rival.

Equity Brief:

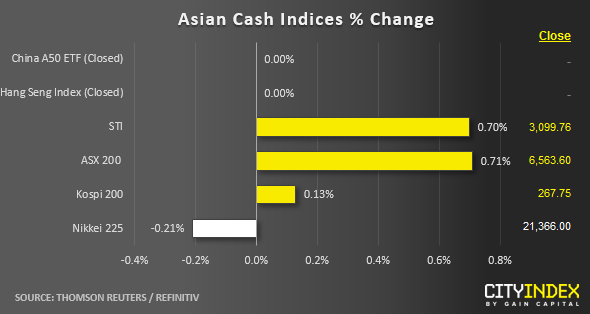

- The current positive performances seen in Singapore’s STI and Australia’s ASX 200 have taken place on the backdrop of a tense week ahead as high-level U.S-China trade talks resume in Washington on Thurs and Fri ahead of a planned increase in tariffs to 30% on US$250 billion worth of Chinese goods on 15 Oct.

- Bloomberg has reported that Chinese officials have indicated China is reluctant to agree to a broad trade deal as proposed by U.S. President Trump and will be not be willing to discuss commitments on reforming Chinese industrial policy or government subsidies towards SOEs (state owned enterprises); the sticking points that have caused previous negotiation talks to break down.

- Hong Kong anti-government protestors have continued to stage mass protests on the street against the HKSAR government’s invocation of an emergency law that has banned the usage of masks in public which has triggered a backlash. The Hong Kong stock market is closed for a public holiday today and will resume trading tomorrow with the local China stock market after a week-long break to celebrate China’s National Day.

- The S&P 500 E-Mini futures has dipped by -0.39% in today’s Asia session to print an intraday low of 2928 after a rally of 1.42% recorded on last Fri, 07 Oct 2019 on the hopes of more dovish actions from the U.S. central bank.

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM