Market Brief: As-Expected NFP Dwarfed by Tariff Hangover

- Non-Farm Payrolls showed the US economy added 164k jobs in July, exactly as expected by economists. Previous job growth was revised slightly lower, though the wage component of the report beat expectations at +0.3% m/m. The unemployment rate ticked up to 3.7% due to higher participation in the labor market (a so-called “good” rise in unemployment).

- Confirming many traders’ suspicions from yesterday, CNBC reported that President Trump was “open to delaying or halting new tariffs” if China takes positive action. Meanwhile, Chinese media stated that Beijing “won’t give an inch” to Trump.

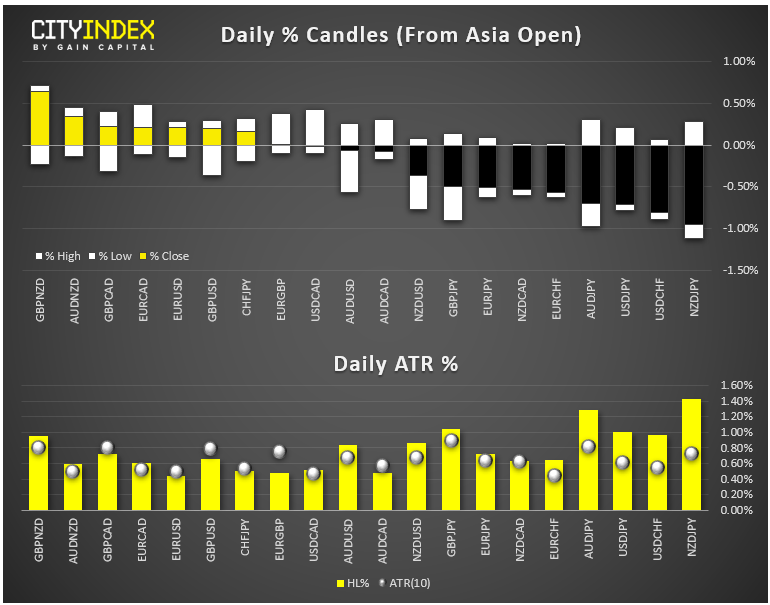

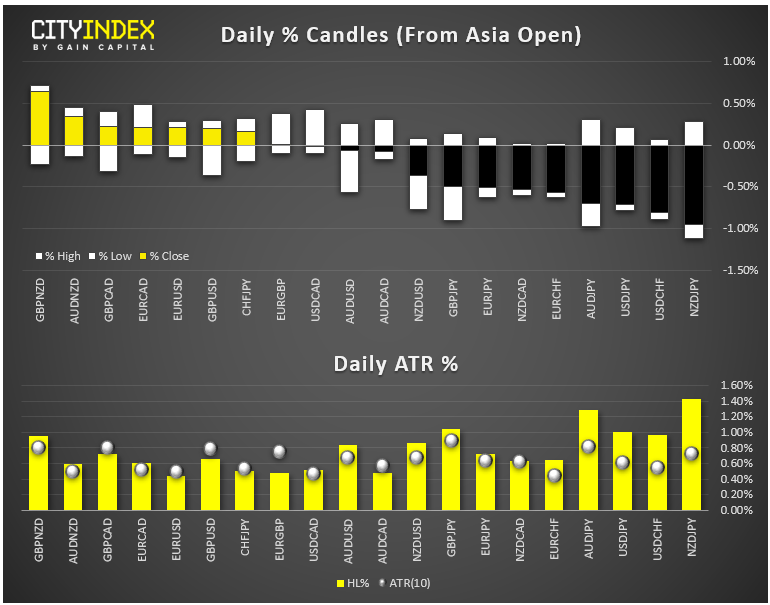

- FX: The safe haven Swiss franc and Japanese yen were the strongest major currencies on the day, while the China-linked Australian and New Zealand dollars brought up the rear.

- Commodities: Gold tacked on another 1.5% today, while oil recovered nearly 3% after yesterday’s shellacking. Copper is testing a 2-year low on global trade tensions.

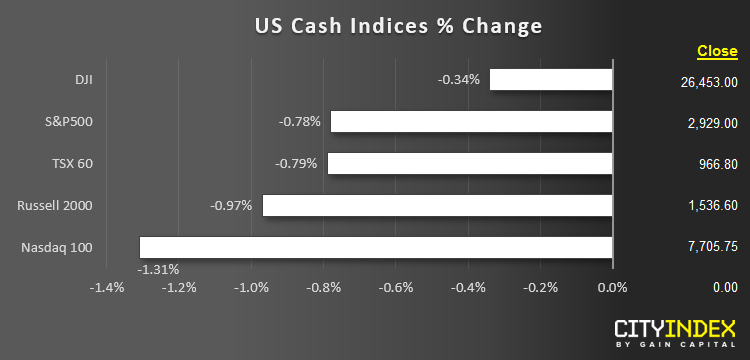

- US indices recovered off their midday, but still closed lower on the day.

- REITS (XLRE) were the strongest sector while Technology (XLK) brought up the rear.

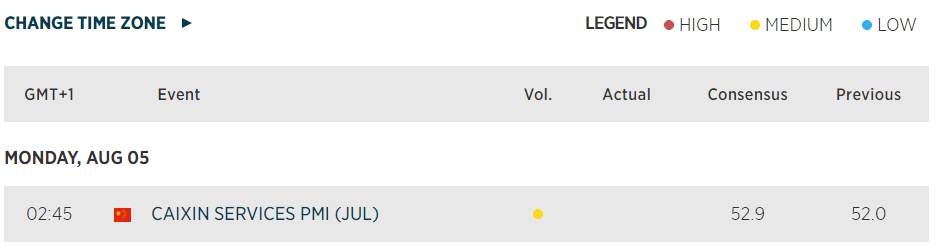

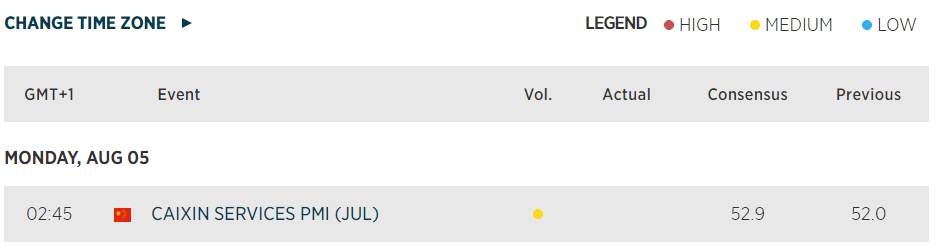

- See the key economic reports and trends we'll be watching in the week to come!

- Stocks on the Move:

- Oil giants Exxon (XOM, -1%) and Chevron (CVX, +0%) saw lackluster reactions to earnings reports.

- Apple (AAPL, -2%) and Goldman Sachs (GS, -1%) were the biggest contributors to the Dow’s weakness today.

- Value stalwarts Berkshire Hathaway (BRK.B, +1%) and Johnson and Johnson (JNJ) were able to buck the weak trend of the broader indices.