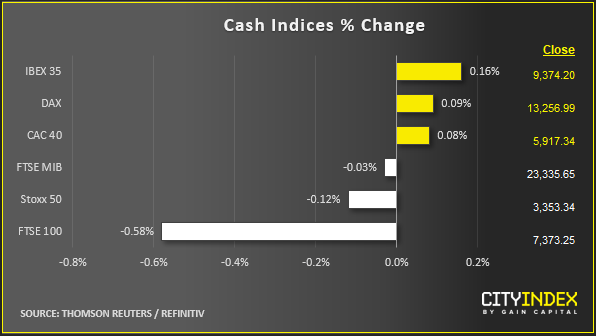

Stock market snapshot as of [29/11/2019 3:50 pm]

- European shares are trying to shake off the jitters that robbed key Asia Pacific markets of a positive closing session for the month. The DAX edged back into a second attempt at positive trading as Wall Street business got underway. Likewise, U.S. participants, returning after Thursday’s Thanksgiving holiday closure, look to be of in a similar mood, judging by stock index futures that swung off lows into the cash session. That move was not enough for cash markets to open higher

- Throughout Europe’s latest slowdown, there have been seams of positivity, with growth, or at least stability, persisting in places. More data of that ilk on Friday provided a fillip to the region’s shares and the euro. Chiefly, Germany’s jobs market surprised to the upside in November, with 16,000 leaving the unemployment register instead of the 6,000 joiners expected. With October unemployment ticking down to 9.7%, the promising jobless count bodes well for a further drop in the percentage. This follows Thursday data showing Germany’s CPI remaining unexpectedly positive this month

- Tough to see much aversion in price action so far. US and Eurozone benchmark yields manage to add the odd basis point or two, though gold is bid.

- Oil has yet to get up off the floor after this week’s U.S. inventory print showed an eye-popping build

- After Beijing’s warning that it would retaliate against the new U.S. bill that supports Hong Kong’s pro-democracy campaigners, proceedings have a little edge. Note a tiny uptick in the CBOE VIX Volatility gauge. A lack of detail as to what China’s response might be—if anything substantive—is another reason for stock markets to hold back. With a positive month in the bag, there’s less incentive to risk fresh long positions on its last trading day

Stocks/sectors on the move

- The low-risk proxy of the Utilities sector wins the most flows in Europe and on Wall Street, though there was also a stock-specific driver on Friday (see below). The only other S&P 500 segment in the black was similarly staid Real Estate. Energy was deepest into negative. A little more of a mixed contribution from major European industrial segments: technology and Health Care were also just about aloft

- Carl Zeiss Meditech was a key EU health aggregate driver, hitting an all-time high and last up 2.6%. Strong operating leverage offers the chance of a margin upgrade according to one brokerage, ahead of earnings next Friday

- Micro Focus, Britain’s beleaguered ‘legacy’ software group, rose 1% after a filing showed BlackRock increasing its stake to 6.5% from 6.2%

- Ocado has surged 15%-12% on a deal with Japan's biggest grocer, Aeon. As per other international deals, OCDO will supply logistics and know-how to help develop Aeon's e-commerce operations, as internet food shopping takes off in Japan

- E.ON, German-based multi-national, multi-utility, rose 4%. There’s no gain to celebrate for UK employees of the group’s Npower unit, where thousands of jobs will be axed. E.ON also raised guidance based on benefits from this year’s Innogy acquisition, though net debt has surged €23bn since end-2018

- No great shakes for U.S. traditional retailers on Black Friday so far, particularly with Amazon showing signs of yet more records in its key season. Macy’s traded down 0.5%, Nordstrom lost 0.9%, Best Buy rose 2%. Amazon was flat

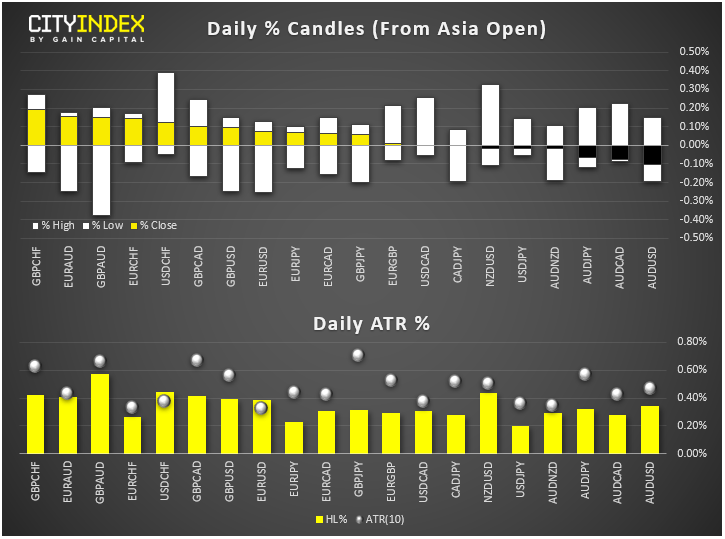

FX snapshot as of [29/11/2019 3:50 pm]

View our guide on how to interpret the FX Dashboard

FX markets, including commentary from Senior Technical Analyst Fawad Razaqzada

- EUR/USD broke back below the psychologically charged $1.10 level, notes Market Analyst Fiona Cincotta

- EUR/USD’s struggles continue despite an unexpected pickup in Eurozone inflation with CPI climbing to 1.0% y/y from 0.7% and core CPI to 1.3% from 1.1%. Earlier, German retail sales missed expectations by a mile: -1.9% m/m vs. -0.2%

- DXY: The dollar remained poised for ninth straight session of gains at last look, its best streak in almost four years. The greenback benefits from a finely balanced assessment of the U.S.-Sino situation, with current uncertainty looking priced

- USD/JPY: Lack of yen traction is more evidence that any aversive feel to markets isn’t running deep right now

- GBP/USD: there’s more action in the options than the spot. Two-week implied volatility is up 6 vols to capture trading immediately following Britain’s election, when upsets can come regardless of the Conservative victory polls project

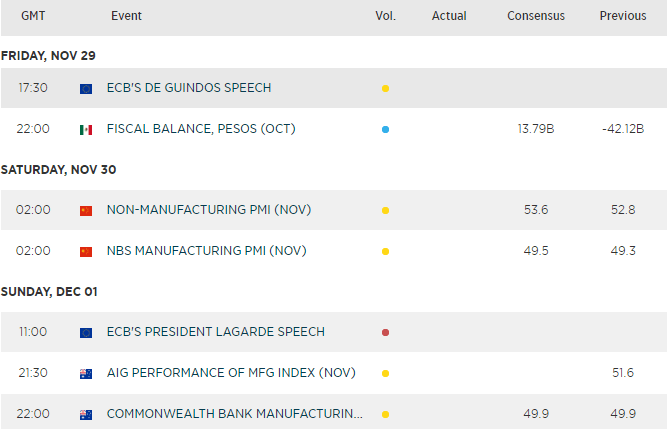

Upcoming economic highlights

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM