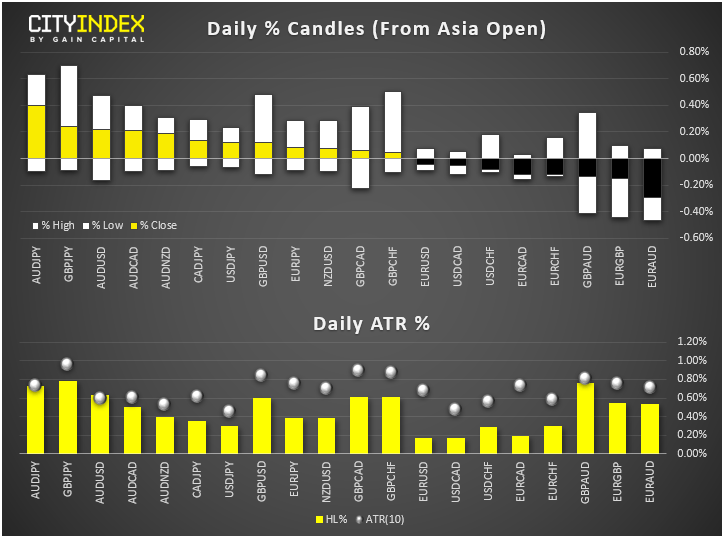

- At midday in London, the AUD and GBP were the strongest while the EUR and JPY were the weakest among the major currencies, giving FX a “risk-on” tone.

- GBP/USD jumped after the Supreme Court said the prorogation case is justiciable i.e. it is a legal case and not just a political one and so PM Johnson's suspension of parliament was unlawful. If the Speaker John Bercow decides to end the parliament's suspension, the odds for a no-deal Brexit would fall further and so should be a positive outcome for sterling. However, today’s ruling also means that political uncertainty has increased with opposition leader Jeremy Corbyn calling for the PM’s resignation. But will Boris Johnson re-announce a prorogation? Or perhaps, will he resign? Anything is possible, so stay very nimble if you trade the GBP.

- EUR/USD was unable to break back above 1.10 following yesterday’s Germany PMI disaster. It didn’t move much in reaction to German IFO survey, which beat on the “current assessment” front (which came in at assessment 98.5 vs. 96.9 expected and 97.4 prior), but the “expectations” index disappointed (falling to 90.8 vs 92 expected, from 91.3 previously). We continue to think the EUR/USD could be heading to a new post-ECB low below 1.0925 in the coming days.

- AUD rose as RBA Governor Lowe in a speech earlier said what many had already expected: further monetary policy easing may well be required.

- As per my colleague Matt Simpson, “BoJ’s Kuroda has said the central bank will ease without hesitation and pay particular focus to the output gap and heightening risks. BoJ held policy steady this month but they appear to be laying the foundations for a lively meeting. This comes as Japan’s manufacturing PMI contracted for a fourth consecutive month and at its fastest rate since February.”

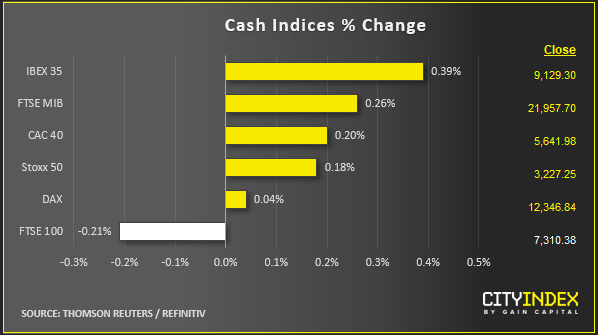

- Equities remained within their tight ranges with the bulls still in overall control amid hopes over a US-China trade deal, although ongoing global growth concerns kept the bears lurking around. US Treasury Secretary Steven Mnuchin said trade talks between US and China are set to continue next month. China, meanwhile, has granted tariff waivers for around 23 million tonnes of US soybean imports. But for the FTSE, the “GBP up = FTSE down” equation worked nicely for the bears once again, although with the global indices rising the downside could be short-lived for the UK benchmark index.

Latest market news

Yesterday 10:15 PM

Yesterday 12:34 PM

Yesterday 12:00 PM