Stock market snapshot as of [11/12/2019 1:59 pm]

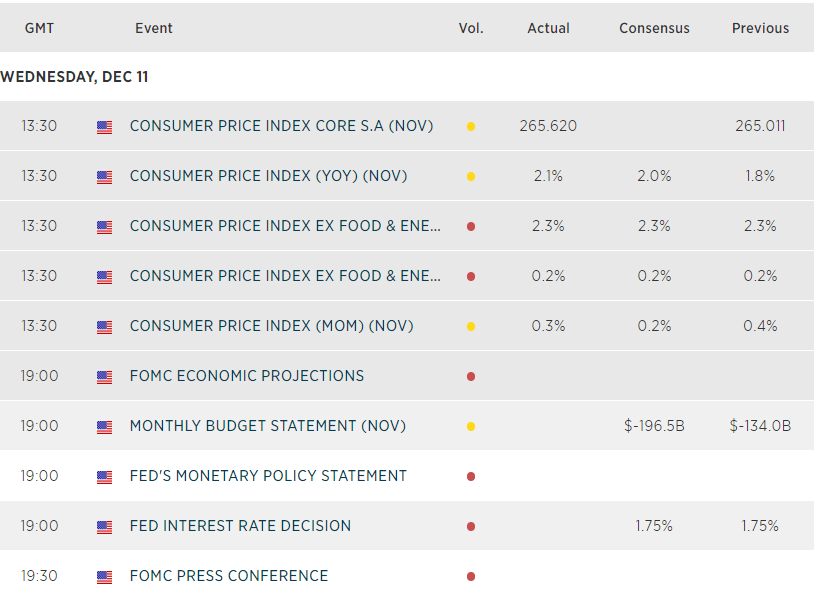

- U.S. equity futures have drifted higher into the open ahead of the last Federal Reserve policy decision of the year as uncertainty over of trade negotiations between America and China, persist. Treasuries advance as the 15th December date on which the U.S. is supposed to lift tariffs on certain Chinese goods looms

- White House officials haven’t given much away though the lack of negative signals facilitates an uplift for sentiment. Trade adviser Peter Navarro said he had no indication that President Donald Trump will do “anything other than have a great deal or put the tariffs on”

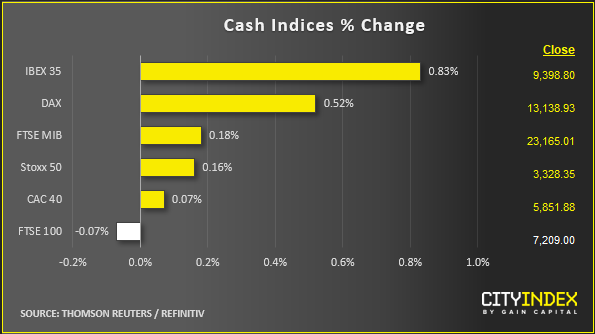

- The Stoxx Europe 600 gauge also managed to shrug off declines in real estate shares after Asian shares were mostly higher

Stocks/sectors on the move

- Home Depot Inc. dropped in pre-market trading after reducing sales forecasts

- GameStop results missed, weighing on the pre-opening price to the tune of 18%

- DropBox also fell as its chief customer officer resigned

- Safe-haven utilities shares led the most in-demand sectors in Europe, whilst Germany’s real estate sector led the region’s decliners

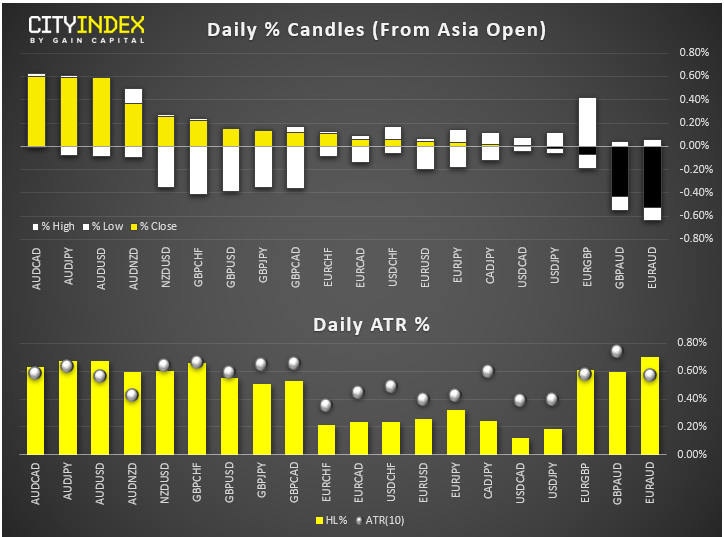

FX snapshot as of [11/12/2019 1:59 pm]

View our guide on how to interpret the FX Dashboard

FX markets and gold

- The dollar is mixed as Sweden’s krona leads after inflation topped expectations, paving the way for a rare G10 rate hike at the Riksbank meeting next week

- Another weight on the greenback is abating sterling pressure. The pound initially fell after an update to YouGov’s MRP poll, which correctly predicted the 2017 election outcome

- A combination of profit taking following GBP/USD’s 114-odd pip drop from Tuesday’s near 9-month highs, plus pre-Fed statement caution probably accounts for the ease off in downward pound pressure

Upcoming economic highlights

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM