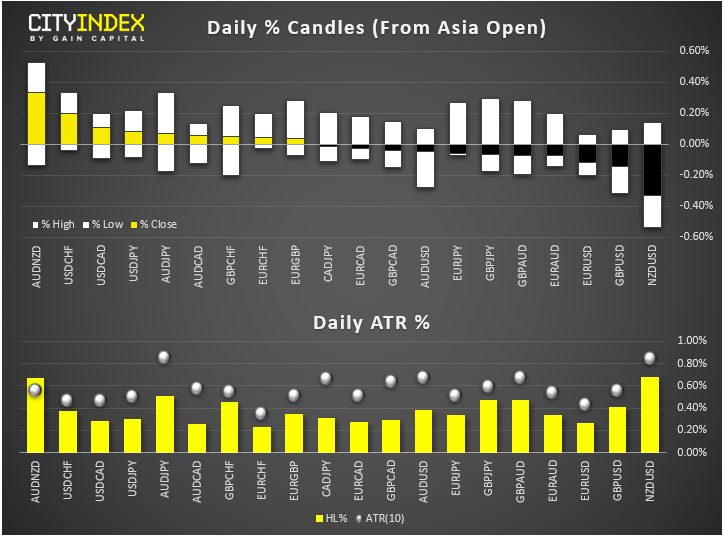

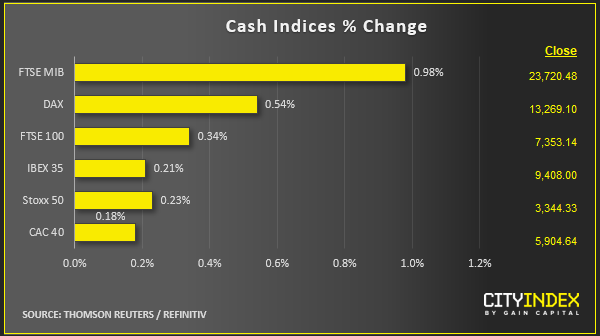

- Market update as at 13:00 GMT: European stocks and US index futures were higher. In FX, the New Zealand dollar and British pound were among the weakest majors, while the US and Australian dollars outperformed. And among key commodities, crude oil was higher and gold lower. All eyes were on Trump, who was set to make a key speech on trade policy.

View our guide on how to interpret the FX Dashboard

- NZD lost ground as falling inflation expectations raised the probability of a rate cut ahead of the RBNZ meeting tomorrow, while disappointing UK data hurt GBP, amid ongoing elections uncertainty.

- Gold was still holding below last week’s low, with the bulls desperately trying to defend that key $1450 long-term support level. Meanwhile, Bitcoin has returned to an old resistance zone, now potentially support, as it holds inside a falling wedge pattern. But will it manage to break out and push higher? HERE is what we think of the crypto.

- Donald Trump is scheduled to discuss the nation's trade policy at the Economic Club of New York, at 17:00 GMT. The markets will be closely-following the President’s words for any further positive news on the issue of the US-China trade war.

- UK’s latest employment and wages data disappointed expectations, adding to those weaker GDP and manufacturing production data from the day before. The pound, already down before the news, struggled to make back the losses from yesterday’s highs. Average weekly earnings excluding bonus printed +3.6% on a 3-month moving average basis compared to a year earlier. This was lower than +3.8% reported in the previous month and expectations for this month. What’s more, employment fell the most in 4 years, though the unemployment rate still ticked lower to 3.8% from 3.9% previously. And the more up-to-date data painted a not-so-great picture: Jobless claims rose +33K in October, easily surpassing estimates of +24.2K and the prior month’s reading of 21.1K.

- There was good news from Germany as a closely-watched survey of institutional investors and analysts revealed their 6-month economic outlook for Germany improved sharply from the month before. At -2.1, the German ZEW Economic Sentiment index made a big leap towards the optimism level of >0 from -22.8 the month before, easily beating expectations f -13.2. The news lifted European indices after a slow start, with the German DAX index being among the outperformers with a gain 0.5% of at the time of writing.

- In UK company news, Vodafone has returned to two-bar growth - rebounding service revenues justify giving Vodafone the benefit of the doubt, for now, says my colleague Ken Odeluga. Meanwhile ITV shares also perked up after the company reiterated its full-year revenue guidance.

Latest market news

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM

Yesterday 11:30 AM