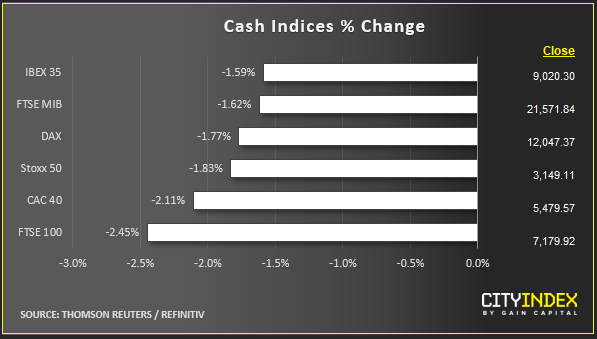

Stock market snapshot as of [2/10/2019 2:17 PM]

- ADP’s monthly payrolls take has disappointed. Generally seen as a curtain raiser for official payrolls that are usually released days afterwards, the ADP came out at 135,000 when 140,000 was expected. Crucially, the previous month's reading was revised sharply lower to 157,000 from 195,000

- Foreboding about the NFP data due on Friday is thereby rising, particularly after the heavyweight ISM manufacturing series out on Tuesday fell to its lowest in 10 years. The factory ISM’s jobs component also missed forecasts, so whilst investors are often ambivalent about how closely ADP tracks NFP, alarming signals about critical monthly payrolls are keeping stock markets pinned lower for a second session

- A well-founded revival of risk aversion is already receiving some corroboration from decent signs that gold is set to resume its rally

- Politics aren’t helping. In Washington, the Democrats’ impeachment ‘dragnet’ is drawing in more close White House associates of Donald Trump. In the UK, Prime Minister Boris Johnson has laid out his alternative Brexit plan to take to Brussels. The details suggest its chances of EU approval will be limited

Stocks/sectors on the move

- All 13 European ‘super sectors’ are down on the day, with the mining & metals Materials segment faring worst, possibly with an eye to recent data suggesting a global manufacturing slowdown. Materials dumps 2.3% led by copper-focused miners Antofagasta and Poland’s KGM, in step with a confirmed downdraft in copper prices. Energy also hurts particularly badly, falling 2.3%, led by crude oil producers, including a 2.8% drop for BP and Shell down 2.5%.

- Stateside, financial shares continue to be roiled, mostly by the decision of leading brokerage Schwab to abolish some trading fees, hitting rivals. E-Trade was a pre-market standout among these, falling 6%. TD Ameritrade fell 4%

- Housebuilder Lennar had more positive news, beating third quarter estimates, reaping a 3% rise

- Ford light vehicle sales were lacklustre, falling 5%, though at least better than the 6% decrease forecast. The news lifted prices in pre-market orders

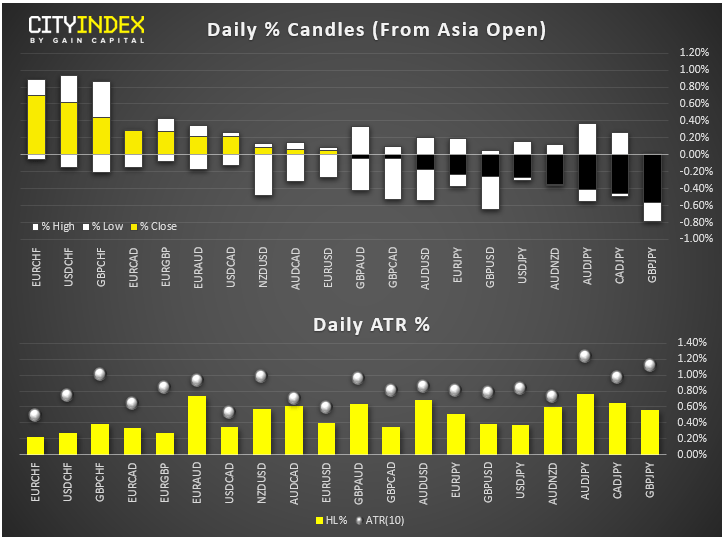

FX snapshot as of [2/10/2019 2:17 PM]

FX markets

- Sterling is a tough act to beat on the downside, as it remains weak amid Brexit crisis suspense. Still, growing ‘risk-off’ pits the pound against a surging yen, to create a volatile pound drop that may yet run further in the U.S. session, given that GBP/JPY’s ATR appeaed to have room to run at last look

- On the upside, the euro’s rise versus franc looks circumstantial when seen against the franc’s upswing against the dollar, underscoring that haven-seeking is the prevailing instinct in the market right now

- Overall, current geopolitical conditions aren’t favouring the dollar, as DXY settles into its second falling session. Still, it’s worth bearing in mind that the greenback hit its best levels since May 2017 just days ago.

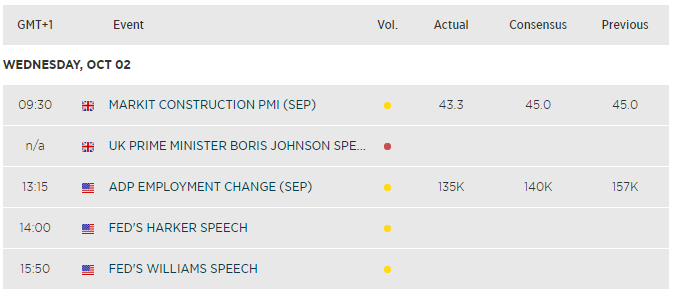

Upcoming economic highlights

Latest market news

Today 08:18 AM

Yesterday 10:40 PM