FX & Stock market snapshots as of [08/08/2019 0610 GMT]

- After a higher fixing on the onshore USD/CNY at 7.0039 in today’s early Asian session by PBOC, up from the yesterday’s fix at 6.9996; the offshore USD/CNH has started to drift down by 398 pips from its intraday high of 7.10332 to print a low of 7.0634.

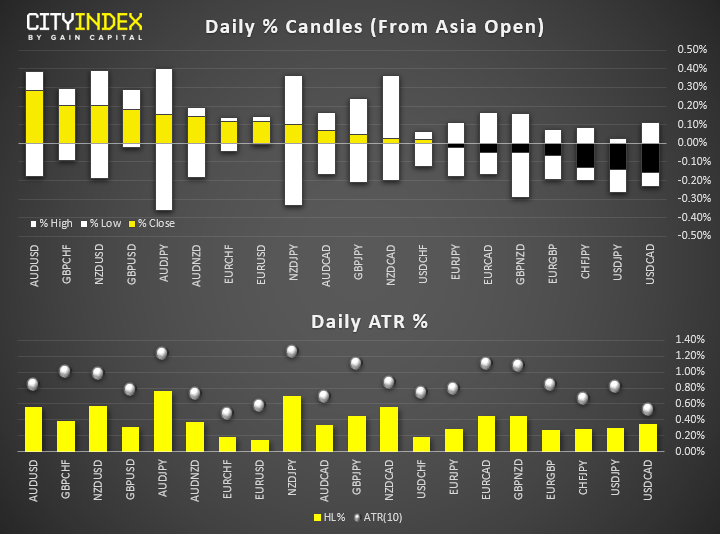

- A lower USD/CNH has managed to add a “smoothing effect” on the on-going trade tensions between U.S. and China where risk sensitive currencies such as the AUD/USD has managed to increase its gains from yesterday overnight U.S. session and make it the top performer in today’s Asia mid-session.

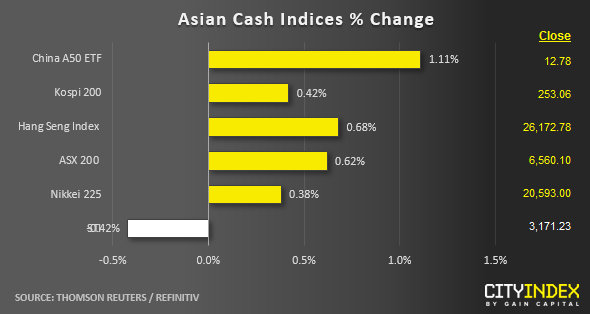

- Ahead of the European opening session, most Asian stocks have started to show signs of stabilisation from this Mon’s steep losses with several positive trade related news flows.

- China’s exports for Jul has managed to beat expectations with a growth rate of 3.3% y/y that surpassed significantly over a consensus reading of -2.0% y/y.

- Also, the on-going trade dispute between Japan and South Korea has started to show signs of easing where Japan granted approval for a high-tech export to South Korea for the first time since stricter curbs took effect in Jul.

- The S&P E-mini futures has inched up higher by 0.50% to print a current intraday high of 2895 in today’s Asian session. In addition, European stock indices CFD futures are gaining as well with the German DAX and FTSE 100 up by 1.15% and 0.45% respectively.

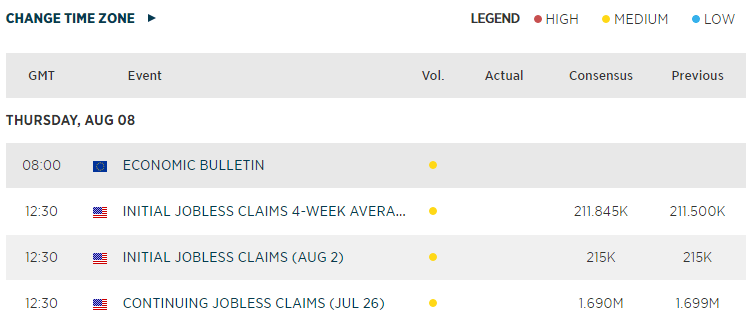

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 08:33 AM