FX & Stock market snapshots as of [14/08/2019 0340 GMT]

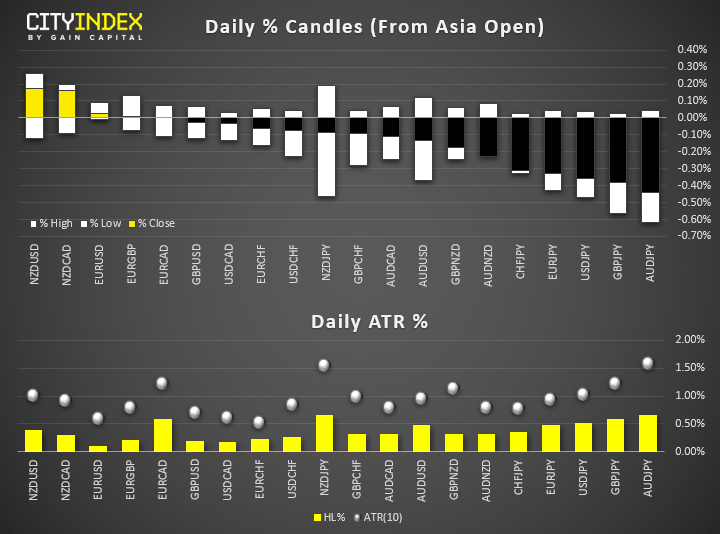

- In today’s Asia session, risk sensitive related pairs; AUD/JPY, GBP/JPY, EUR/JPY and USD/JPY are the worst performers after a resurgence of risk appetite was seen in yesterday’s U.S. session. The U.S. administration has delayed the implementation of the 10% tariffs on several Chinese imports; finished products such as phones, laptops and toys to take effect on 15 Dec from the earlier planned date of 01 Sep.

- Profit-taking on these JPY crosses can be attributed to weaker key economic data from China. Retail sales for Jul came in at 7.6% y/y (below expectation of 8.6% y/y) versus 9.8% y/y in Jun. Industrial production for Jul came in at 4.8% y/y (below expectation of 5.8%) versus 6.3% y/y in Jun.

- The growth rate of industrial production in China has weakened to a 17-year low on the backdrop of sluggish domestic demand and uncertainties over the on-going trade dispute between U.S. and China.

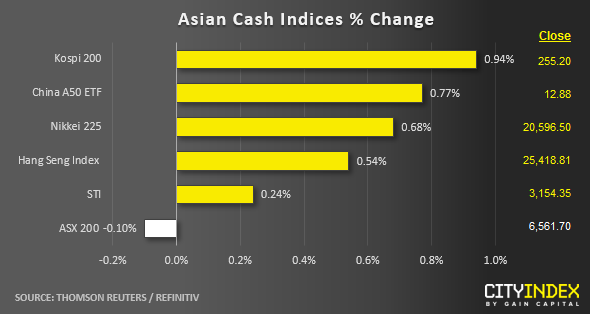

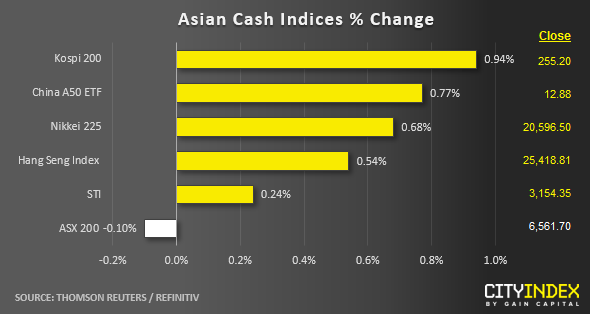

- Ahead of the European session open, most Asian stock markets are trading in the black; taking the cue from overnight gains seen in the U.S. stock markets after the U.S. administration de-escalated its trade tension with China.

- South Korea’s Kospi 200 is leading the pack with a gain of 0.94% as at Asian mid-session with outperformance seen in the Energy and Technology sectors (up by 2.7% and 1.5% respectively).

- The outlier is Australia’s ASX 200 with a small loss of -0.10% where key financials stocks underperformed. Commonwealth Bank of Australia is down by -3.2% after it goes ex-dividend. A loss of -0.3 % was seen in National Australia Bank after it reported flat growth in Q3 profit.

- The S&P 500 E-mini futures has inched down slightly by -0.20% in today’s Asia session to print a current intraday low of 2923.

Up Next

- Germany GDP Q2 out later at 0600 GMT where consensus is set at -0.1 q/q & -0.3% y/y

- U.K. CPI for Jul at 0830 GMT where consensus is set at 1.9% y/y below 2.0% y/y seen in Jun for headline inflation.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM