- All FX majors and crosses remains within their typical daily ranges, although JPY and CHF are the strongest majors and NZD and AUD the weakest.

USD/CNY is anchored to recent highs around 7.1725, adding pressure to AUD and NZD. - Fed’s Daly is the latest CB member to voice support for monetary and fiscal stimulus working together, adding she doesn’t see political issues as a policy maker.

- The Australian press sees 0.5 million jobs at risk if China has a hard landing.

- A Reuters poll shows that economists think there’s a 30% probability of a significant correction in equity markets this year, and 80% think monetary policy easing is still a net positive for equities.

- Peter Navarro sees little progress in trade talks occurring soon and urged the Fed to do its job and cut rates.

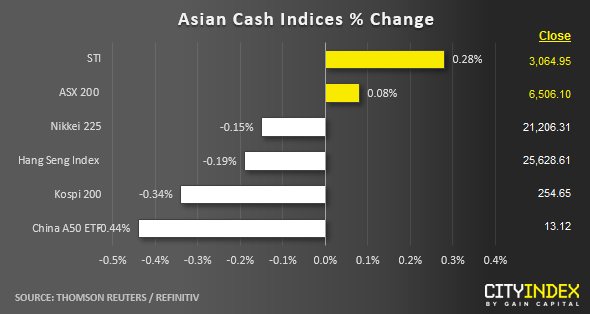

- Lacklustre trading is the theme to describe for Asia stock markets today as market participants wait for more updates on trade developments between U.S. and China.

- In a media briefing yesterday, U.S. Treasury Secretary Mnuchin said that U.S. trade officials expect Chinese trade negotiators to visit Washington but did not mention whether the previously planned Sep meeting would take place. On the other hand, White House trade advisor Navarro had sounded less optimistic and played down a quick resolution.

- Traders are still adopting a cautious stance towards Hong Kong stocks as the City braces herself for a potential 2-day general strike to start on next Monday as a planned mass demonstration march for this Sat has been banned by the local police. The Hang Seng Index has inched down by -0.19%, dragged down by the Industrials sector (-1.52%).

- After a positive close of 0.65% seen in the S&P 500 yesterday, the S&P 500 E-min futures has started to see some profit taking in today’s Asian session; down by -0.26% to print a current intraday low of 2875.

Up Next:

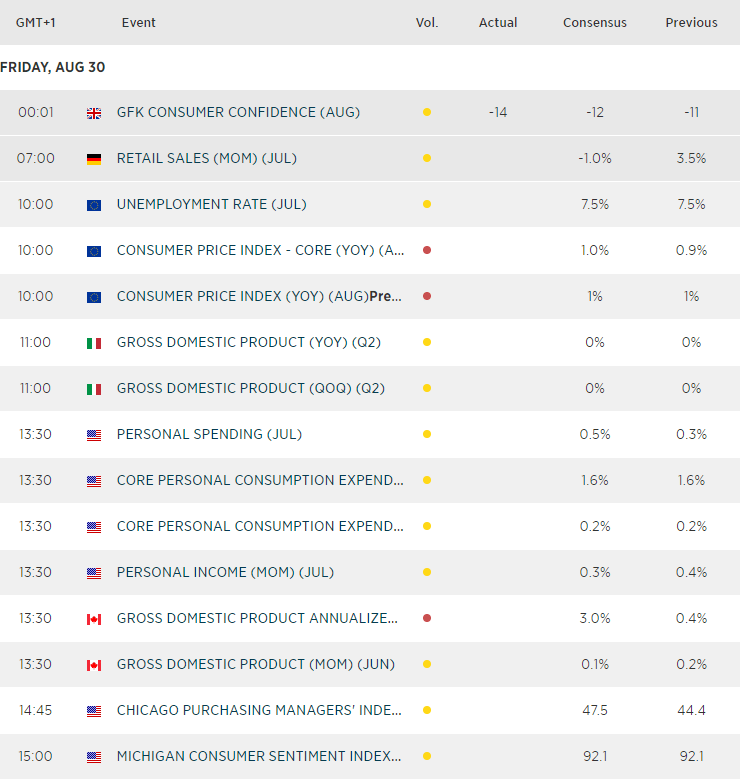

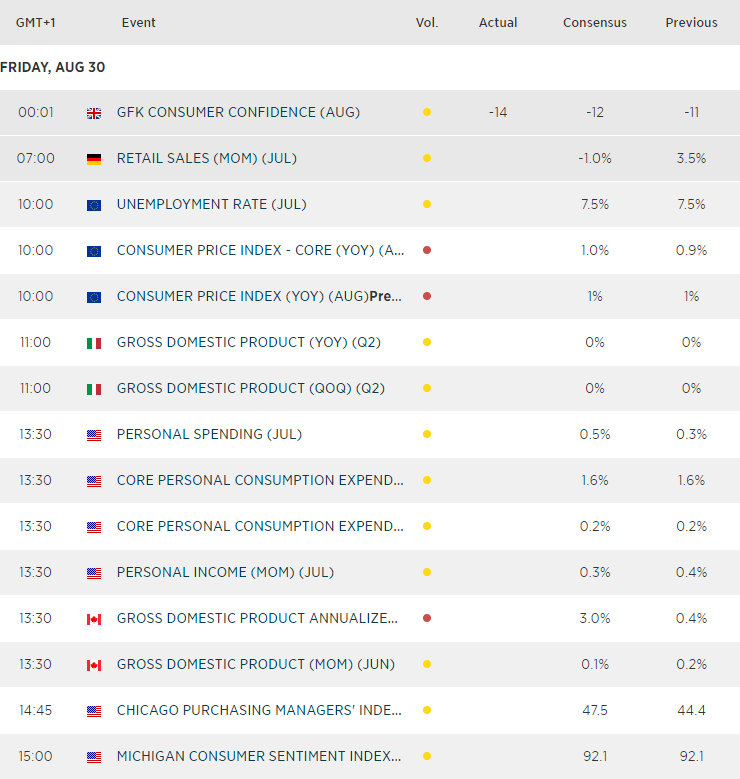

- European ESI (Economic Sentiment Indicator) is released, which provides a broad view of Euro zone economies for business, consumer, construction, retail trade and industrial sectors. Currently I’s lowest since March 2016 and been trending lower since its December 2017 peak, we’re not expecting a solid recovery later today.

- Germany CPI for Aug where consensus is set at 1.2% y/y over 1.1 y/y recorded in Jul. A weaker than expected data print is likely to add impetus for ECB to kickstart a monetary easing cycle at the upcoming Sep policy meeting.

- U.S. Q2 GDP where consensus is set at 2.0% y/y.

Latest market news

Today 08:15 AM