Manufacturing PMI confirm FX status quo

Today’s flurry of manufacturing and services surveys from the US, China and Eurozone confirmed what the market had suspected; a cooling off in the pace […]

Today’s flurry of manufacturing and services surveys from the US, China and Eurozone confirmed what the market had suspected; a cooling off in the pace […]

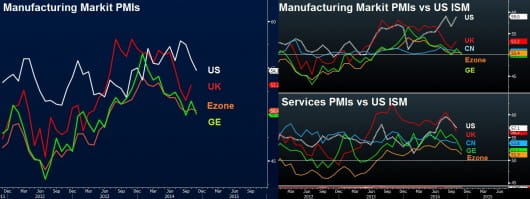

Today’s flurry of manufacturing and services surveys from the US, China and Eurozone confirmed what the market had suspected; a cooling off in the pace of expansion in US manufacturing, despite remaining the highest rate in the G7 –, while both Germany and China eked out an expansion, albeit at a slower pace, as did the pan-Eurozone measure of both sectors. France remained in contraction territory. The US dollar took a breather, following non-committal minutes of the October FOMC.

US manufacturing, as measured by the Markit survey, fell to 54.7 in October, posting its third monthly decline. New orders fell to 55.2, reaching their lowest reading since January 2014, while new export orders fell to the lowest level since June 2013.

The Philadelphia Fed’s Business Outlook Survey shot up to 40.8 in November, hitting the highest level since December 1993 after nearly doubling from the October figure. There was also optimism in the Philly Fed’s individual sub-components, such as price, employment and new orders.

The US index of leading indicators rose to a three-month high of 0.9%, with eight of the ten indicators in the index contributing to the improvement. These were led by factory orders and favourable interest rates spread between short and long-term interest rates.

The Eurozone’s Markit PMI for factories and services activity unexpectedly fell to 51.4 in November, the lowest in 16 months, from 52.1 in October. China’s factory PMI fell to 50.0 in November from 50.4 in October, touching a six-month low. Germany’s composite PMI (combining manufacturing and services) expanded at the slowest pace in 16 months, highlighting that the Eurozone’s biggest member faces an on-going risk of slipping back into recession, despite narrowly escaping it in Q3.

One cannot delve in FX trading without being able to differentiate between impulsive price moves and those temporary moves, known as corrective. As EUR/USD retests the 1.2570 region for the fourth session out of five, and GBP/USD does the same around 1.5730, one should expect the US dollar index to consolidate near 88.0 for now, especially as USD/JPY retreats off 119.00 after six consecutive daily gains. USD buying remains the path of least resistance thanks to further ECB easing, elections in Japan and low inflation in the UK, all of which will reinforce the policy divergence relative to the US.