L’Oreal: further rise expected

L'Oreal, the personal care company, reported that 3Q revenue grew 1.6% on a like-for-like basis (-2.0% reported) to 7.04 billion euros, while 9-month like-for-like revenue was down 7.4% (-8.6% reported) to 20.11 billion euros. The company stated: "As a result, in a sanitary environment which remains difficult and uncertain, our performance in the third quarter strengthens our ambition to achieve like-for-like growth for the second half, and to deliver solid profitability."

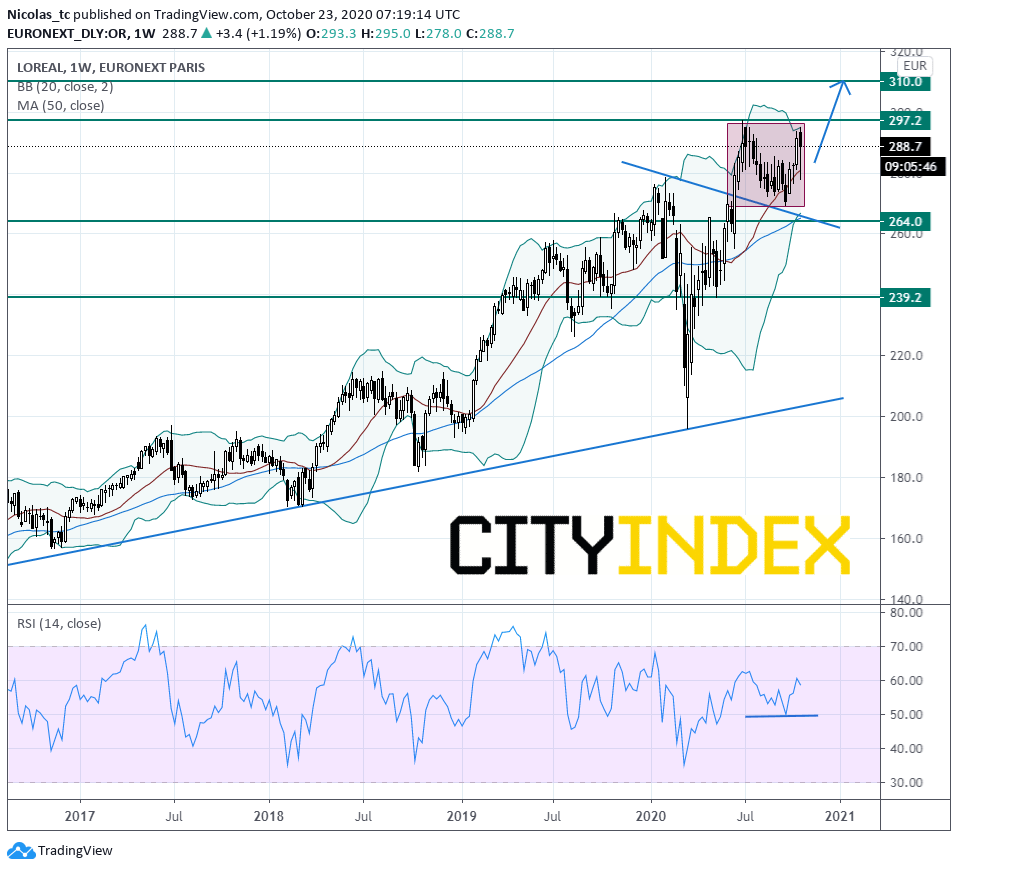

From a chartist point of view, the stock price remains in consolidation mode within a long term bullish trend. Prices are holding above a key support zone around 264E (internal trend line + lower Bollinger band + horizontal support). The weekly RSI has landed on its neutrality area at 50% and is turning up. Readers may want to consider the potential for opening Long positions above 264E. A break above the former high at 297.5E would open the way to a further rise towards 310E (Fibonacci projection target). Alternatively, a break below 264E would call for a reversal down trend towards 239.2E.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM