Look to EUR/AUD and EUR/NZD for Stock Market Direction

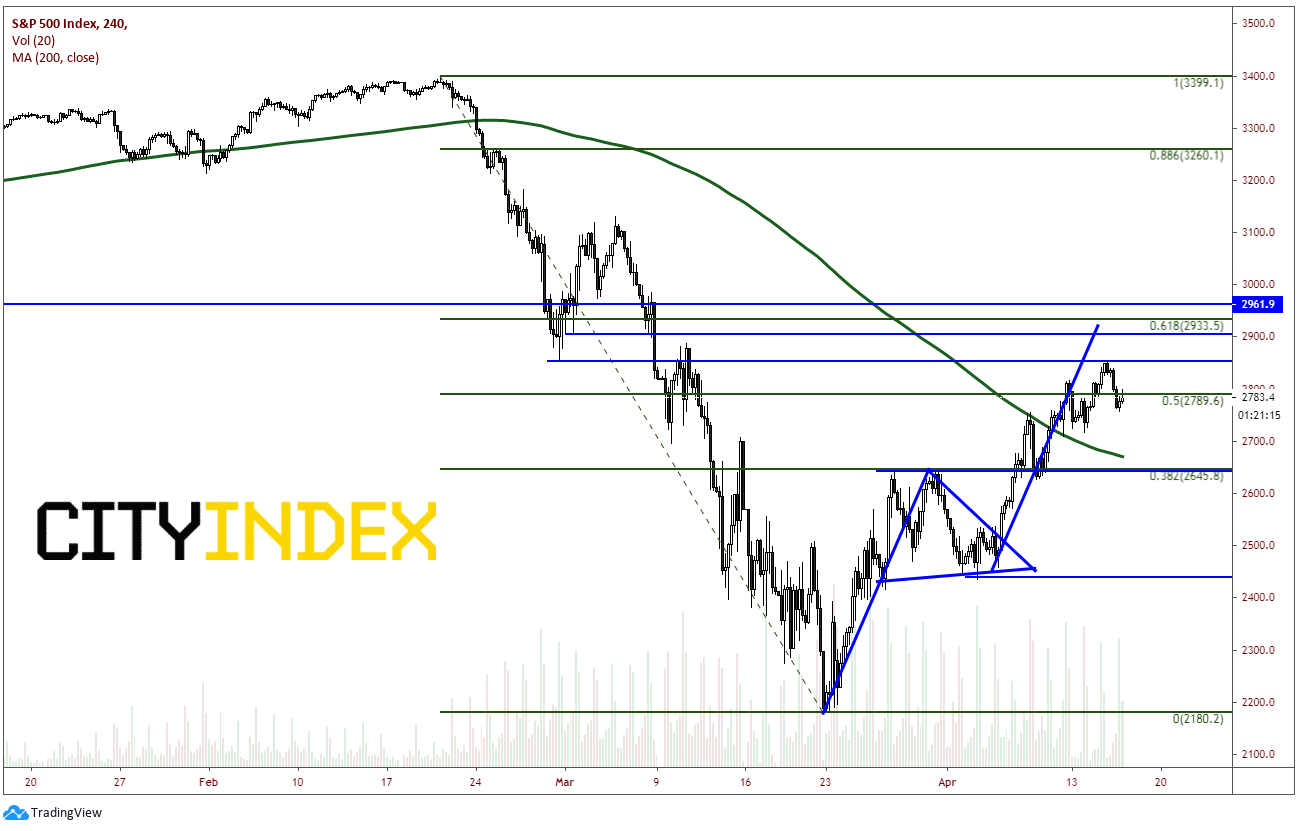

After putting in a low on March 23rd, the S&P 500 has been moving aggressively higher, only pausing at the 38.2% Fibonacci retracement level from the February 20th highs to the March 23rd lows. It broke out of a pennant formation on the move higher which targeted near 2900/2925, near horizontal resistance and the 61.8% Fibonacci retracement level of the previously mentioned timeframe. Today, price halted at minor horizontal resistance and moved lower to test yesterday’s daily low and put in an ominous, dark candlestick.

Source: Tradingview, CME, City Index

So, the question to ask now is: Why did stocks stop moving higher HERE? Was it the minor horizontal resistance? Was it the expectations of weaker data (the move started overnight)? Was it more bad coronavirus news? Sometimes we don’t know, and that’s ok. But we should always be looking for clues as to why, so that when we see it again, we may already have an answer!

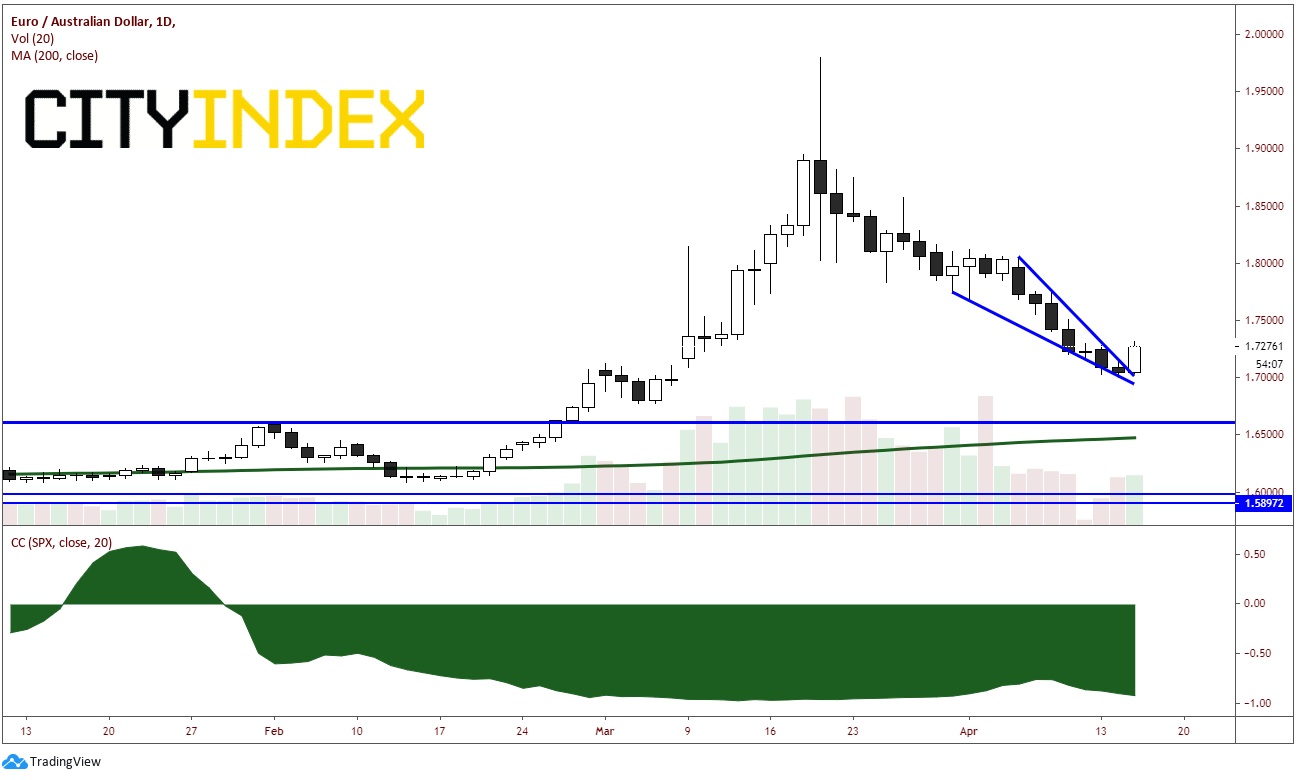

Let’s look at EUR/AUD. The currency pair is highly negatively correlated with the S&P 500. That is, when the EUR/AUD moves in one direction, the S&P 500 moves in the opposite direction. The current correlation coefficient is -0.92. With this context in mind, the price movement of the pair has formed a descending wedge and has broken higher today. The target of a descending wedge is a 100% retracement of the wedge, which is near 1.8000. Therefore, because of strong correlation, if EUR/AUD is breaking higher, the S&P 500 should be moving lower.

Source: Tradingview, City Index

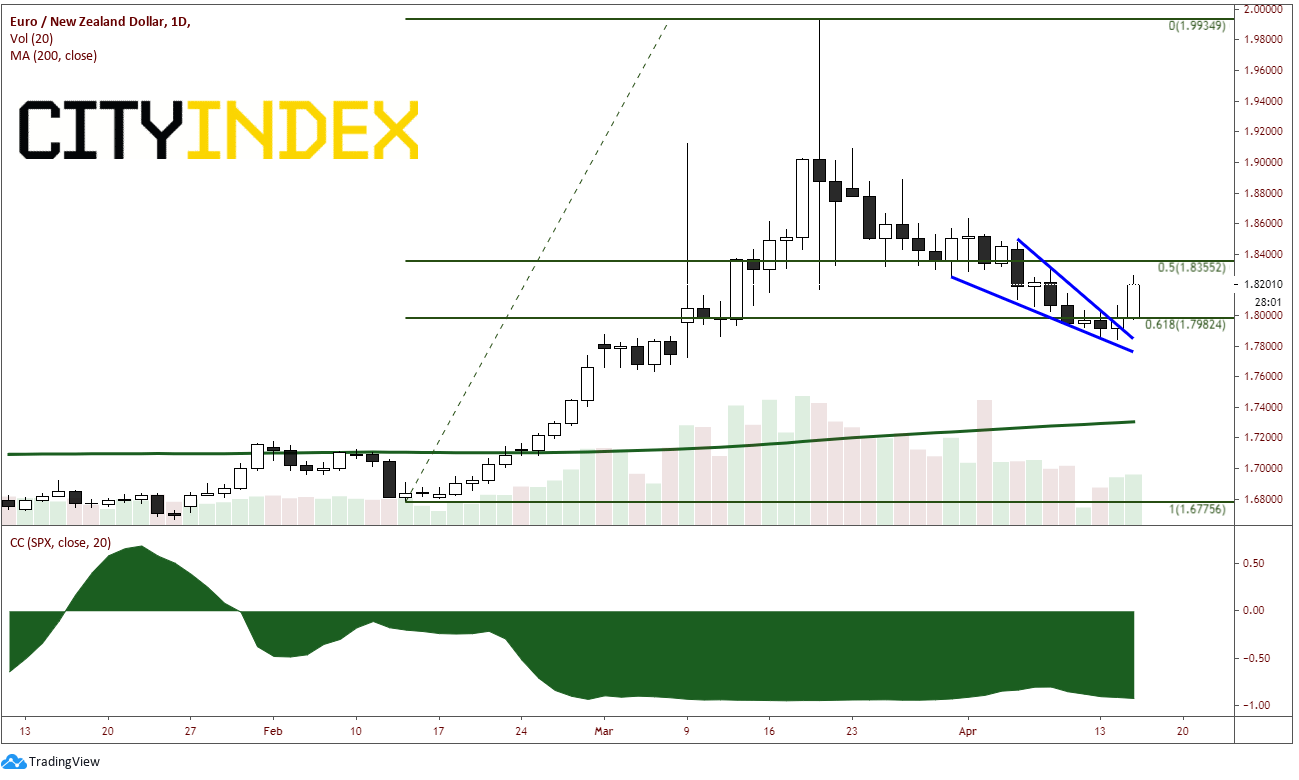

Now let’s similarly look at EUR/NZD. Similarly, EUR/NZD is also highly negatively correlation with the S&P 500. As with EUR/AUD, the correlation coefficient is also -0.92. In addition, the price movement of the EUR/NZD has also formed a descending wedge, with a target of 1.8475 at the 100% retracement of the falling wedge. One of the few differences between the price action of EUR/AUD and EUR/NZD is that EUR/NZD fell less than EUR/AUD from the March 19th highs, and therefore, broke out of its descending wedge yesterday instead of today!

Source: Tradingview, City Index

Today, the S&P 500 closed -2.35%, EUR/AUD closed +1.33% and EUR/NZD closed +1.22%. If you are looking for a reason that stock indices have turned, you can always look at the EUR/AUD and EUR/NZD to see what they are doing.