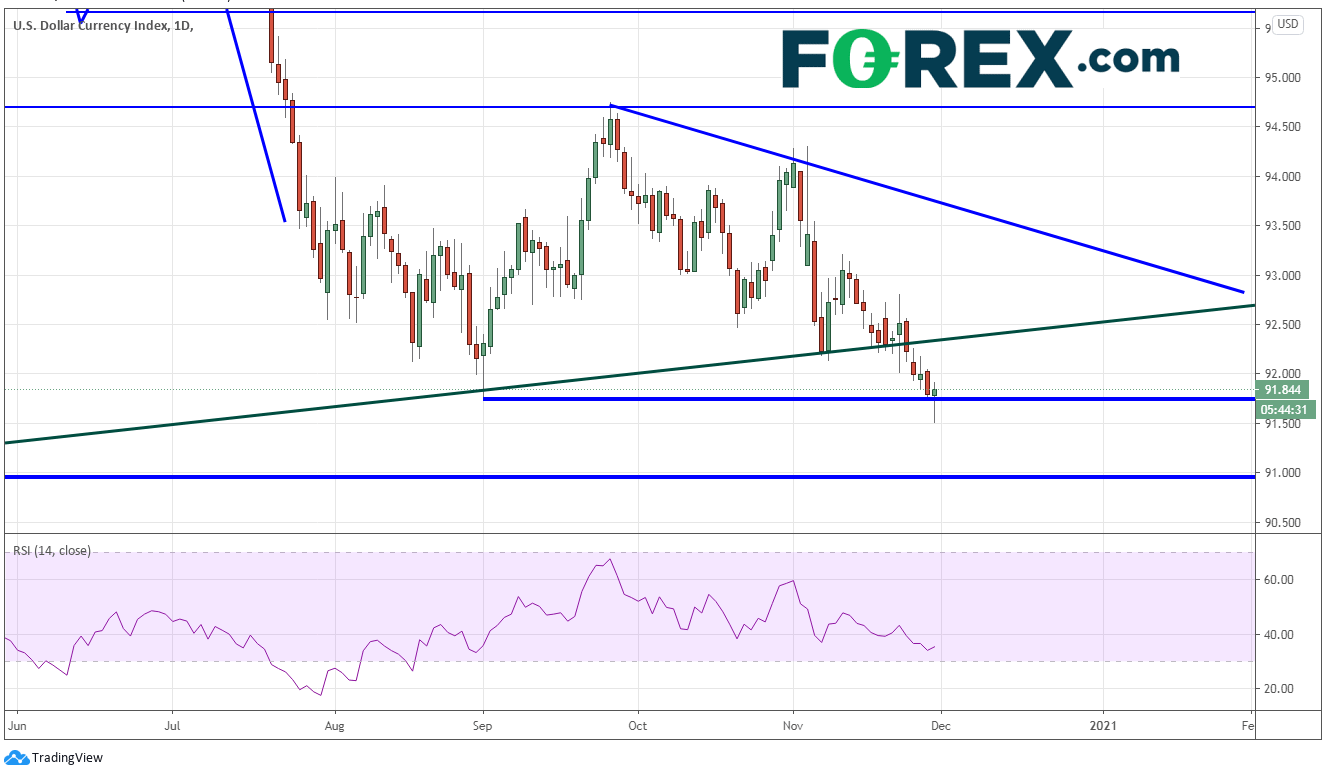

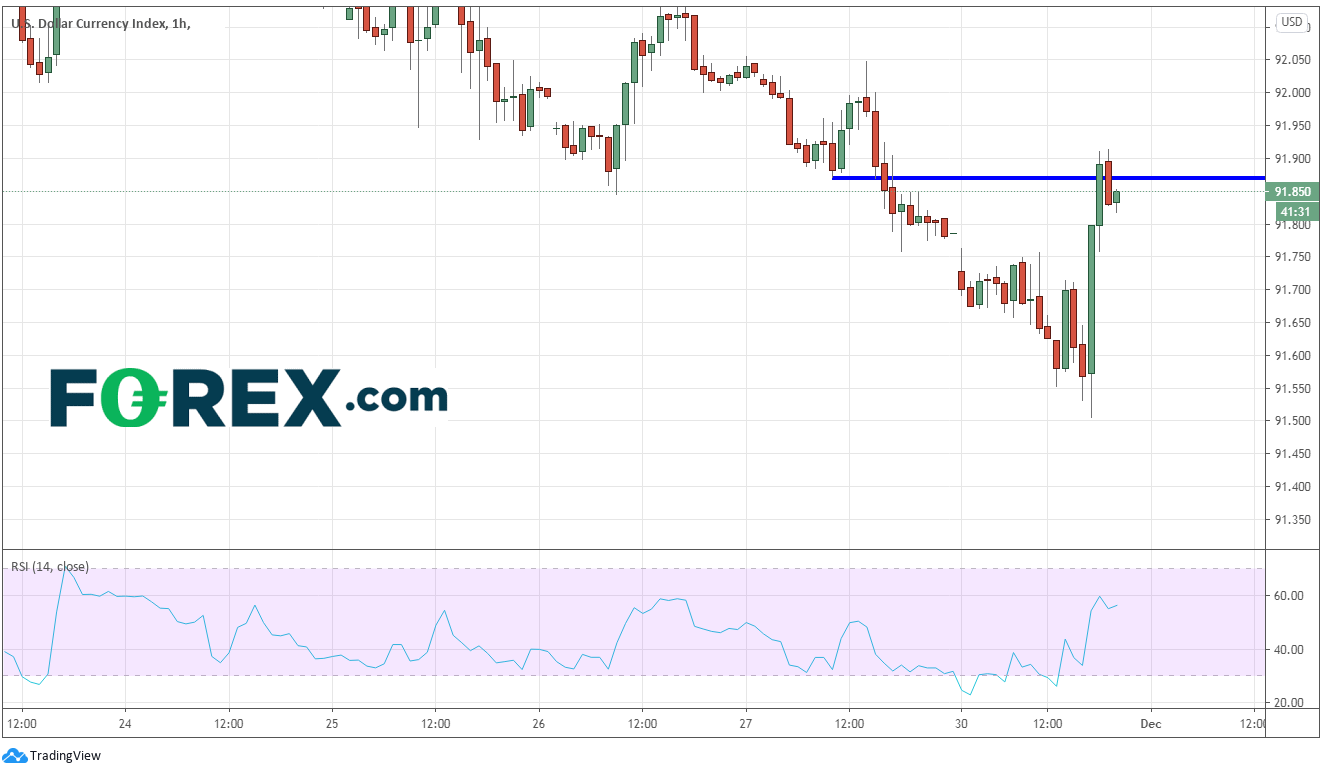

Heading into the 11:00am EST London fix, the DXY reversed and moved higher as central banks, pension funds and hedge funds took advantage of the low price to cover short US Dollar positions for month-end. If price closes the day between 91.75 and 92.00, it will form a beautiful hanging man on a daily timeframe right at support. However, although a one day reversal candle can indicate a short-term direction change, it does not necessary indicate a new trend.

Source: Tradingview, FOREX.com

Should the DXY hold resistance, price will continue with the longer-term trend and move lower.

Source: Tradingview, FOREX.com

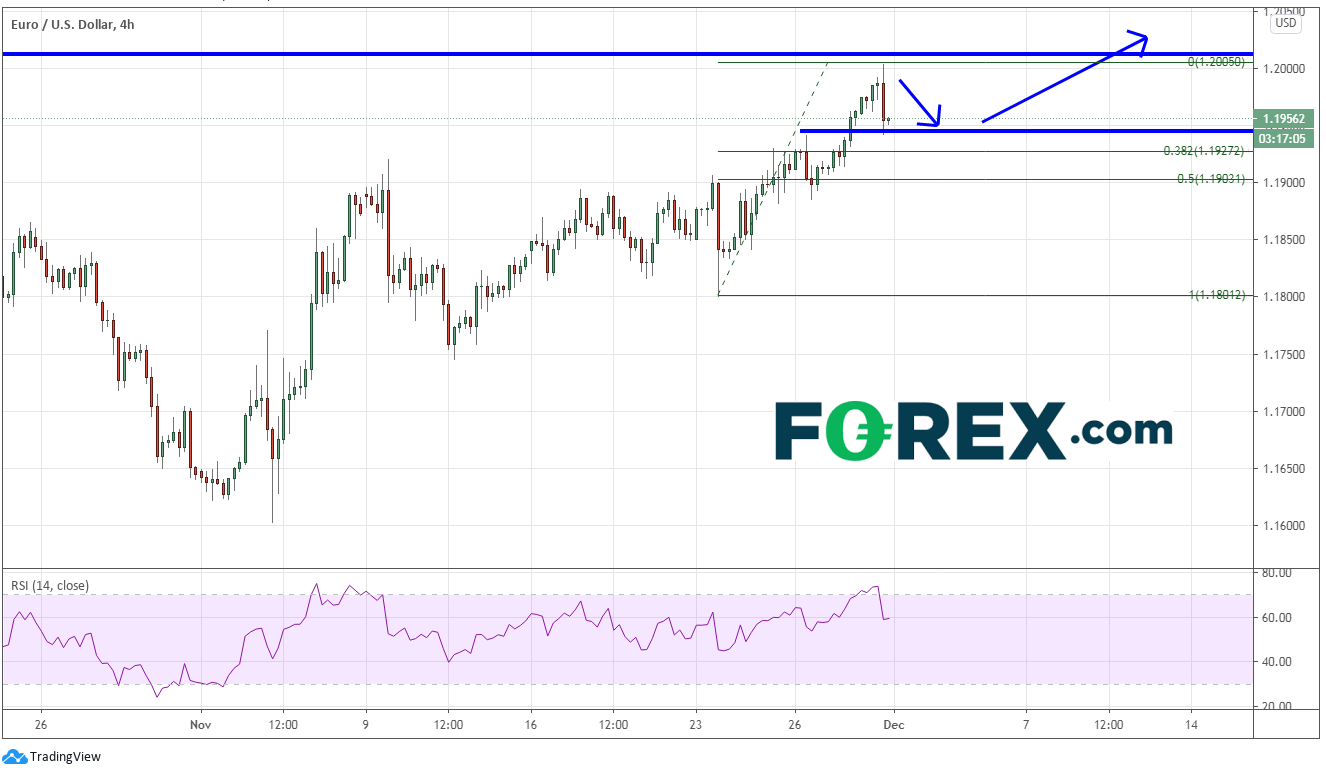

EUR/USD peaked today just 7 pips shy of the September 1st highs near 1.2011. Bears sold into the resistance as the US Dollar went bid. However, bulls are buying near support near 1.1950. The quick selloff also allowed for the RSI to unwind back into neutral territory. Watch for more support at the 38.2% Fibonacci retracement from the November 23rd lows to today’s highs near 1.1927 and then the 50% retracement near 1.1900.

Source: Tradingview, FOREX.com

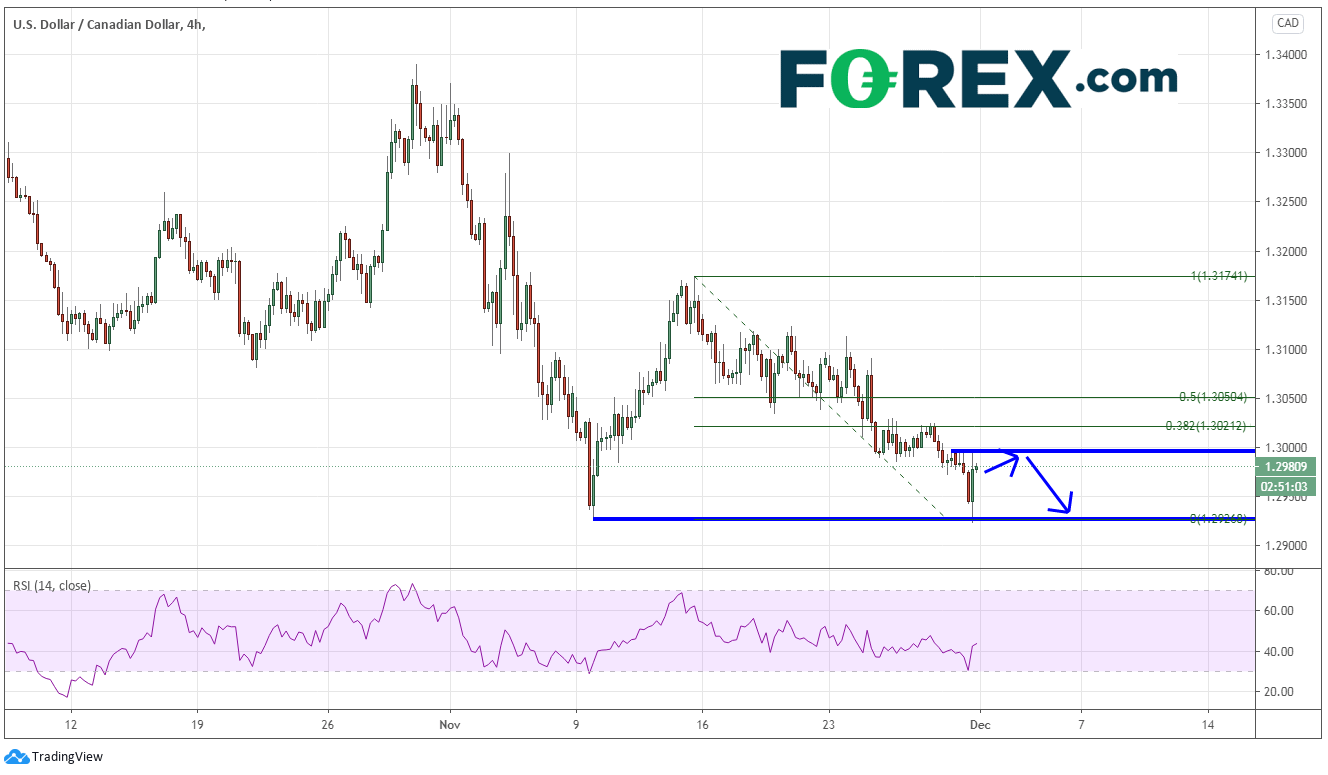

USD/CAD can be looked at in much of the same way as EUR/USD. The bid in the USD into month-end also caused USD/CAD TO rally. Sellers were sitting near 1.3000 looking to take advantage of the bounce to previous highs and the psychological round number resistance. The bounce also gave time for the RSI to unwind back into neutral territory. Watch for resistance back at the 38.2% Fibonacci retracement level from the highs of November 13th to today's lows, near 1.3021 and then the 50% retracement level near 1.3050.

Source: Tradingview, FOREX.com

Many of the US Dollar pairs look similar to the EUR/USD and USD/CAD. Watch for traders to take advantage of the US Dollar bounce to possibly add to positions, while looking for the longer-term move lower to continue.