The markets are showing an extraordinary ability to focus on the positive whilst proving to be immune to terrible data. Stock indices across Europe and the US closed higher on Friday despite data revealing that 20.5 million US jobs have been lost and the unemployment rate striking 14.7%. There is a strong feeling that the worst is behind us which boosting risk sentiment. However, the current optimism combined with fear of missing out raises doubts over whether the markets are truly comprehending what 14.7% US unemployment means.

The Pound is pushing higher, versus both the US Dollar and Euro and investment confidence in the UK is expected to receive a boost after Boris Johnson eased lockdown measures in England and as the number of coronavirus daily deaths were at the lowest level in a month. People in England can now exercise outside more frequently whilst those who haven’t been able to work from home are encouraged to return to work today. Construction sites and manufacturing plants will start reopening whilst those working from home are encouraged to still do so. After 7 weeks in lock down there is finally some visibility as the PM laid out a three-stage plan to easing lockdown measures.

Furlough scheme extension?

Adding to the improving mood, rumours are also circulating that Chancellor Rishi Sunak will extend the government’s hugely popular job retention scheme until September. This will be at 60%, rather than the current 80% although it will also include topping up staff’s pay packets who are going back to work on a part time basis. There is no question that this is a hugely expensive scheme for the government. However, it has also proved to be extremely popular and could go a long way to ensuring that consumer confidence returns quickly which will be essential for any chance of a rapid recovery for the UK economy.

There is no high impacting data due for release today. Week long Brexit trade talks kick off today and could drive the pound.

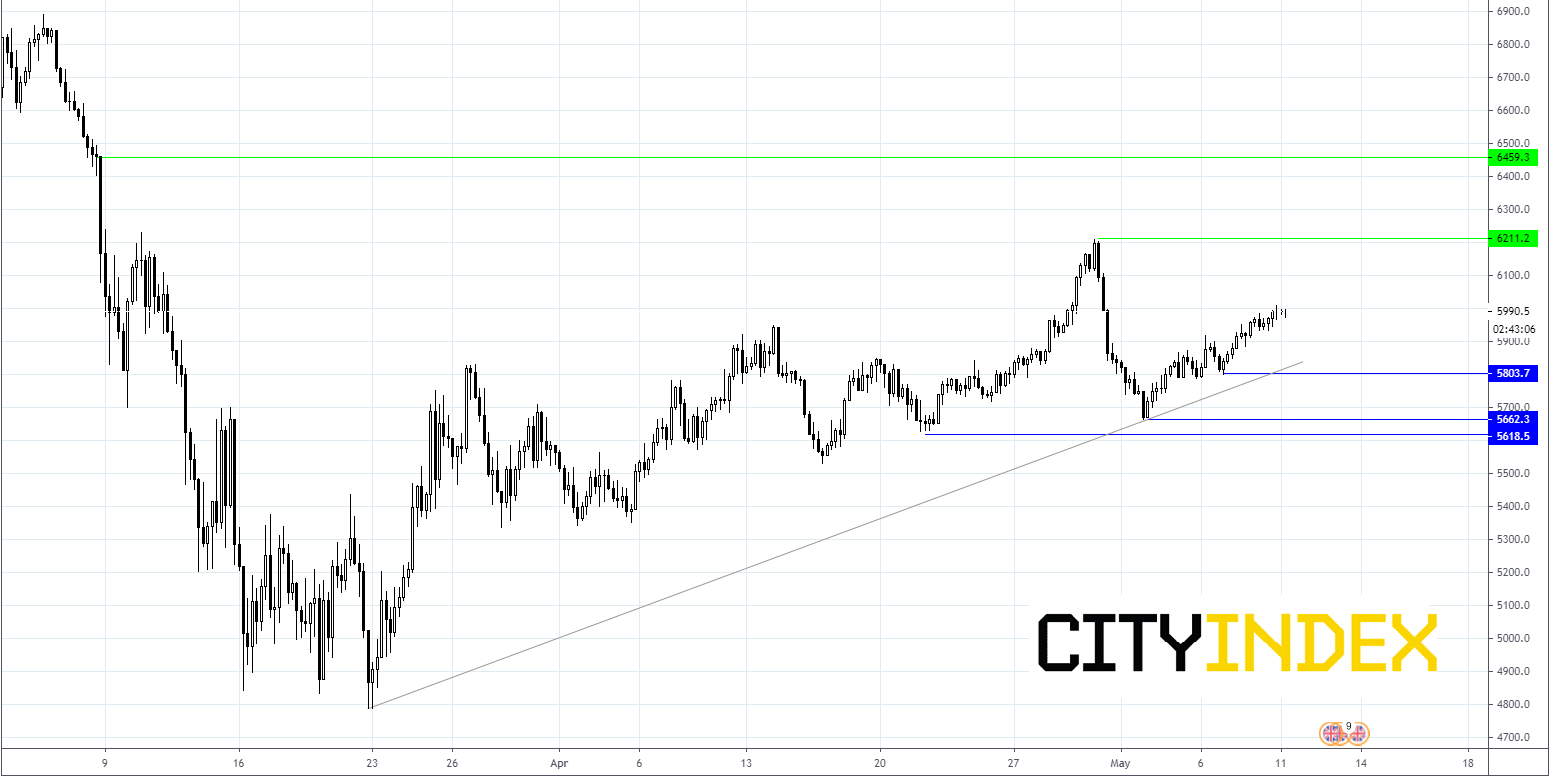

FTSE Chart