Lloyds Banking Group shares mostly contain a fall after disappointing profits to around 2%.

The miss largely relates to the one-off cost of moving the wealth business away from Standard Life. Another unwelcome surprise PPI provision, £100m, also played a part. Because the cut-off for further compensation is August, any further PPI hits will, probably, be limited.

The quarter was more solid beneath such upsets. Efficiency progressed: cost-to-income ratio fell to 44.7, eyeing 40, targeted by end-2020. Net interest margin was a basis-point above investor’s average 2.9% forecast. Non-interest income and impairments all topped consensus.

Some of the stock’s mid-session dip was partly on another sobering Bank of England statement. Reduced inflation forecasts and a moderate uplift of growth expectations kept the 19-month rate outlook intact. As such, net interest income growth will remain subdued. Acceleration of Lloyds’s wealth and insurance businesses is also set to stay out of reach. The stock’s lead against FTSE 100 rivals could therefore invite rotation.

Yet Lloyds retains 2019 targets. Assuming “current strong performance” continues, minor consensus downgrades aside, it’s difficult to see rivals matching its combination of thin markets risk and structured UK exposure. Consequently, the stock’s relative outperformance should continue.

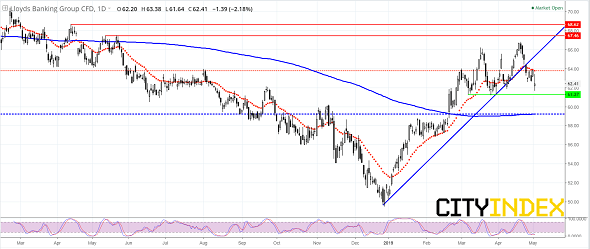

Technical chart points

- Recent failure around 65p-66p swing highs echoes instances a month ago

- Buyers appear wary to tackle 67.46p-68.62p caps that protects c. 72.50p-74p 2016/2017 peaks

- Instead they will look for support again at 61.3p March lows

- 21-day exponential trend (red), around 64p, is a further challenge

- Loss of nearby support could bring focus on the flat 200-day trend (blue) below ‘psychological’ 60p

Lloyds Banking Group CFD – daily [02/05/2019 14:58:58]

Source: City Index