Live Blog Wrap Up!

Matt Weller, 7:20 GMT (2:20am ET)

Whew - It feels like we’re still in the proverbial “eye of the storm,” and what a tempest it’s been so far!

Voting results have slowed to a trickle, so we’re closing down tonight’s live blog. You can scroll back through about 6,000 words over the last eight hours to see how the whole night evolved, but as a brief recap of our inaugural Election Night Live Blog:

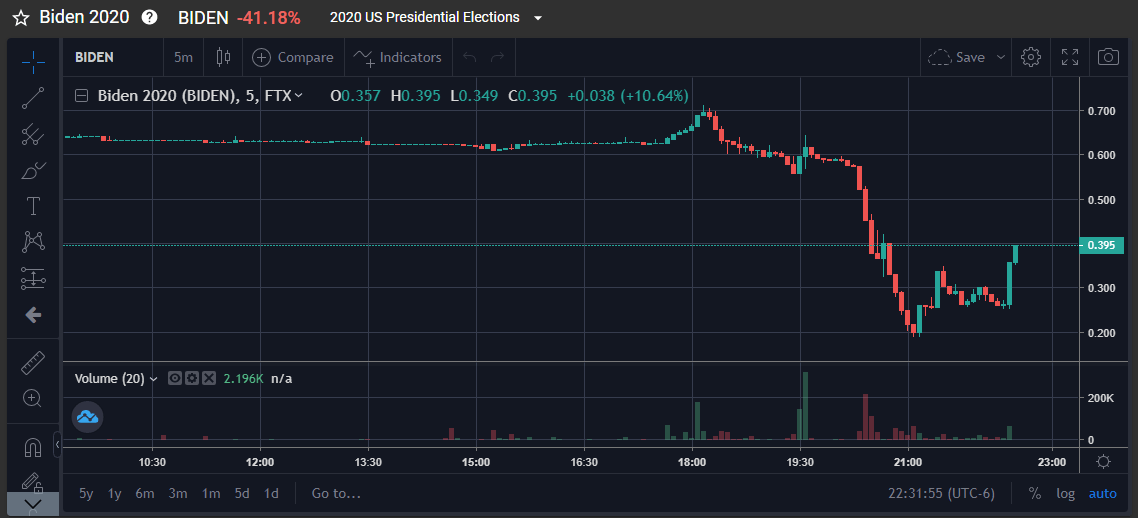

- Early results in Florida showed Trump dramatically outperforming his polls…

- …combined with strong leads in the incomplete votes in Georgia and Florida, many traders rushed to put on the trades that worked in 2016: long the US dollar and technology stocks…

- …and Joe Biden’s odds in prediction markets sunk as low as 20%.

- Just when it seemed like all hope was lost, Biden put in a strong performance to win Southwest swing states like Nevada and, crucially Arizona…

- …and late ballots from Georgia’s deep blue Atlanta suburbs put the former Vice President back in the race, with prediction markets now showing a slight lean toward Biden as we await the final counts from Georgia, Wisconsin, Michigan, and of course, Pennsylvania.

- Separately, the race for control of the US Senate remains up in the air, with Georgia’s tightly-contested special elections potentially tipping the scales in the weeks to come. Even if Biden pulls out a narrow victory, he may have to contend with a Republican-controlled Senate.

- Technology stocks and Treasury bonds were the big winners on the night, along with the US dollar to a lesser extent.

- As of writing, President Trump is poised to give a speech about the night, and we’ll be expecting final results from Georgia, Wisconsin, and Michigan (perhaps enough to call the national election?) in the next 18 hours or so. [Note the couple updates from my colleague Tony Sycamore below contextualizing a couple of the morning's market moves]

So that’s where we stand as this tired US analyst finally hits the sack. We will continue to cover every meaningful development on our Analysis page, and my colleague Fiona Cincotta will have a full recap of the night and market moves out in the next couple hours.

Stay safe, and best of luck with your trading!

U.S. election – A "Blue Ripple" helps EURUSD

Tony Sycamore, 11:00am GMT (7:00am ET)

As I finish up for the evening, media outlets are yet to call most of the important battleground states in the U.S Presidential election, and few of the competitive Senate races. Betting markets have flipped again and have Joe Biden back as the front runner paying $1.63, while Trump is now paying $2.60 on Betfair.

The latest gyration in fortunes, a result of Biden holding onto a narrow lead in Nevada, a state that the Democrats had expected to take. If Biden hangs on in Nevada and Wisconsin where he also holds a very narrow lead then he just needs either Michigan/Pennsylvania/Georgia to fall his way to get him to the 270 electoral votes he needs.

The issue remains is the mail-in ballot counting rules in some of these swing states mean the outcome may still be days away.

This not only leads to the delayed outcome election scenario markets have feared. It is also likely to result in a contested election if any of the aforementioned states turning into the “tipping point” state and a legal challenge is virtually guaranteed.

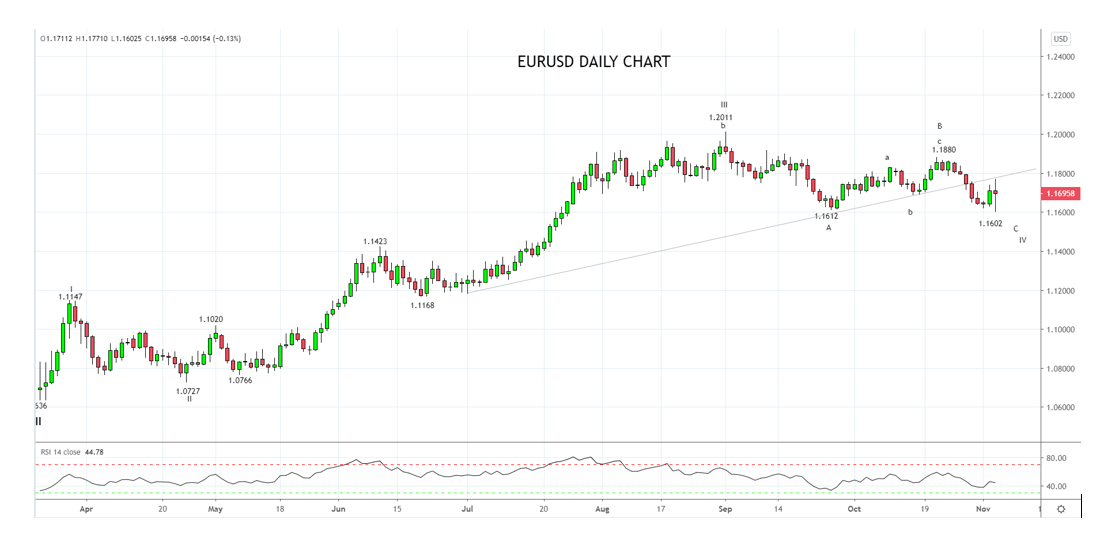

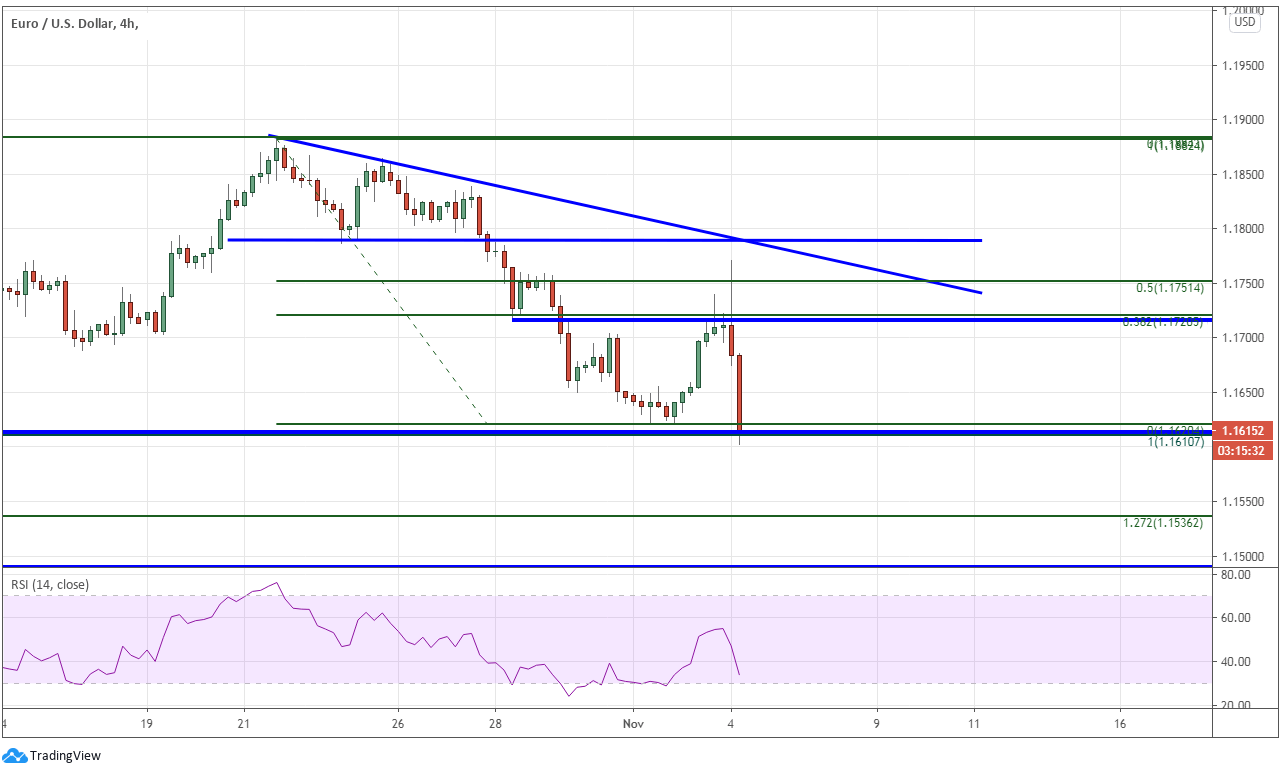

Nonetheless, the sighting of a “Blue Ripple” has helped the EURUSD trade back above 1.1700 after testing key support at 1.1600 earlier today. To provide more reassurance the uptrend has returned, the EURUSD would need to reclaim resistance at 1.1800.

Source Tradingview. The figures stated areas of the 4th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

U.S. election – we have seen this before!

Tony Sycamore, 10:20 GMT (5:20am ET)

For those feeling a touch of déjà vu about the 2020 U.S. election, Joe Biden has thus far won more votes than Trump. Biden’s at 67.5 million, Trump’s at 65.8 million.However as we learned in 2016, it’s not the popular vote that determines a winner. It’s all about the Electoral College and those key battleground states who outside of court proceedings still have a crucial part to play. Regardless of the outcome of the Presidential race, following Brexit, the 2020 and 2016 U.S. elections and the 2017 Australian Federal Election polling methods remain either deeply flawed or people are not willing to share their true intentions, or a combination of both.

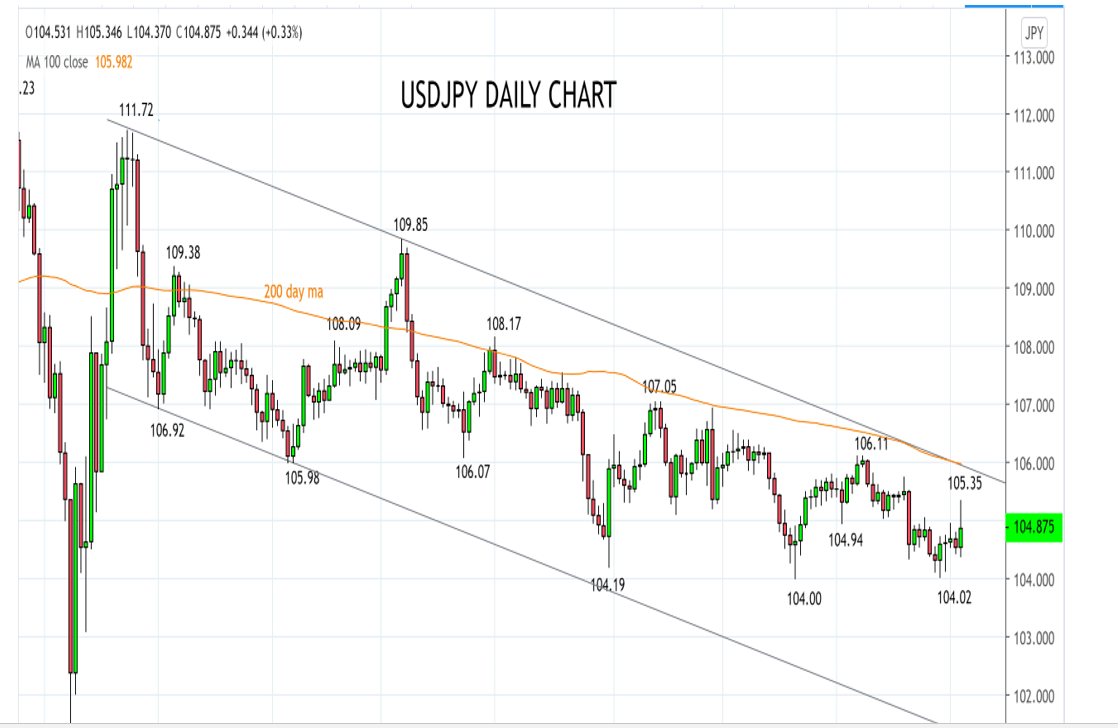

For currency traders, one pair that has the potential to move very quickly in the coming days is USDJPY. On the downside 104.20/00 has been very well supported in recent days and months. While topside the 200 day moving average and channel resistance offer good resistance 106.00/10.

A sustained break of either of these levels is likely to see a 200 pip move for USDJPY in the direction of the break.

Source Tradingview. The figures stated areas of the 4th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

AUDUSD uncomfortably perched

Tony Sycamore, 7:07 GMT (2:07am ET)

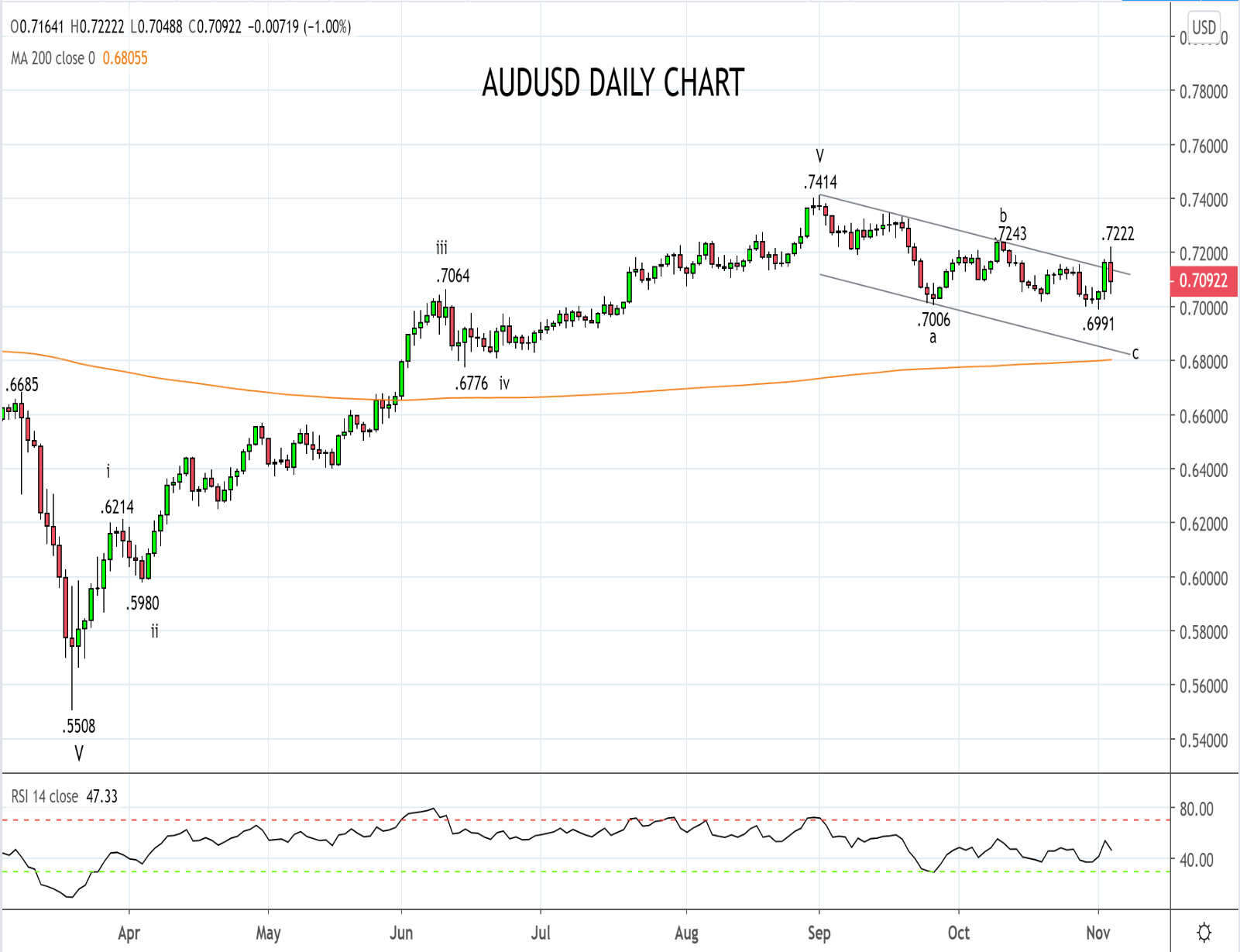

The AUDUSD traditionally a good barometer of the world as it stands remains uncomfortably perched near the .7100 handle, after a round trip today of almost 175 pips.

As things stand according to Bloomberg projections, Biden currently leads the electoral college votes 223 to 212. However, Trump looks set to win enough of the undecided states to take him over the 270 required. This is reflected in the betting markets with Trump now paying $1.59, while Biden sits at $2.56 according to Betfair.

The real question and one likely to play a big hand in the fate of the AUDUSD is what sort of stimulus package lies ahead under a Trump White House and a Democrat controlled House of Representatives?

In the lead up to today’s election, it was thought that this outcome would be for a continuation of the ongoing stalemate over COVID19 aid and less fiscal support than the markets had hoped for under a Blue Wave. All of which would see the AUDUSD underperform, with risks back to and below .7000c.

Source Tradingview. The figures stated areas of the 4th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Watching Michigan, Wisconsin and USDCNY

Tony Sycamore, 6:29 GMT (1:29am ET)

Two states that are now starting to garner closer attention in this tightly contested race are Michigan and Wisconsin. Before today there was an expectation that the Democrats would record comfortable wins in both states.

At this point, the vote is closer than expected with Trump just ahead in both states. However, his lead is likely attributable to election day votes which favour the Republicans. While the mail-in votes that tend to favour the Democrats are still to be counted.

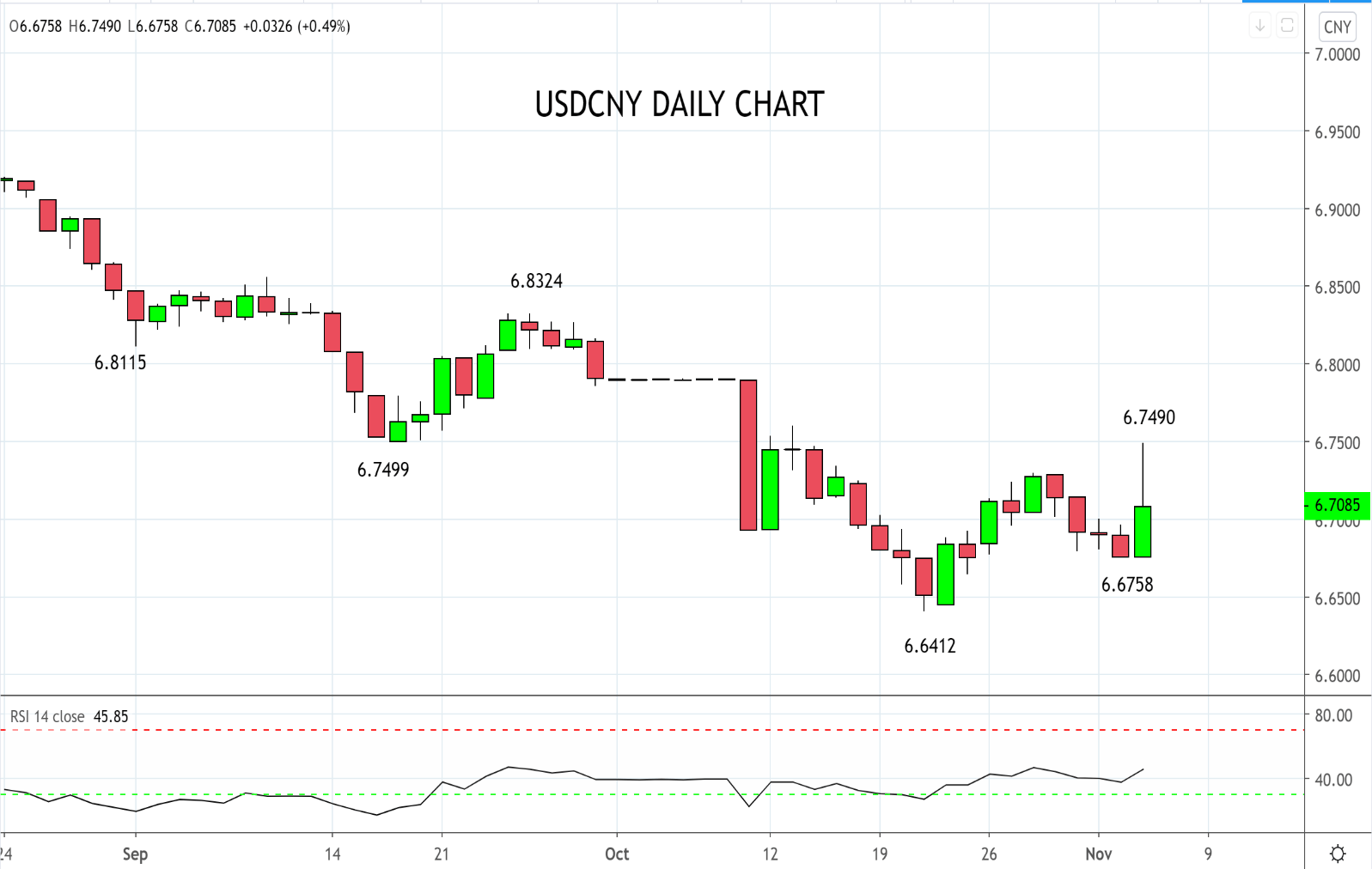

If you’re feeling the tension, spare a moment to take a quick look at the price action in the Chinese currency the yuan today.

As can be seen, USDCNY rallied up towards 6.7500 as the betting markets began to price in a Trump win and a continuation of Trump's hawkish China policies.

In line with the Trump odds easing over the past hours, USDCNY has eased back towards 6.7115 at the time of writing.

Source Tradingview. The figures stated areas of the 4th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Market Check-In

Matt Weller, 6:10 GMT (1:10am ET)

Six hours ago (but it feels like 60!), we noted the prices of some key markets we’d be watching tonight. Below, we recap those pre-result prices and update the current levels in parentheses:

- DJIA futures = 27,564 (27,463, -0.6%)

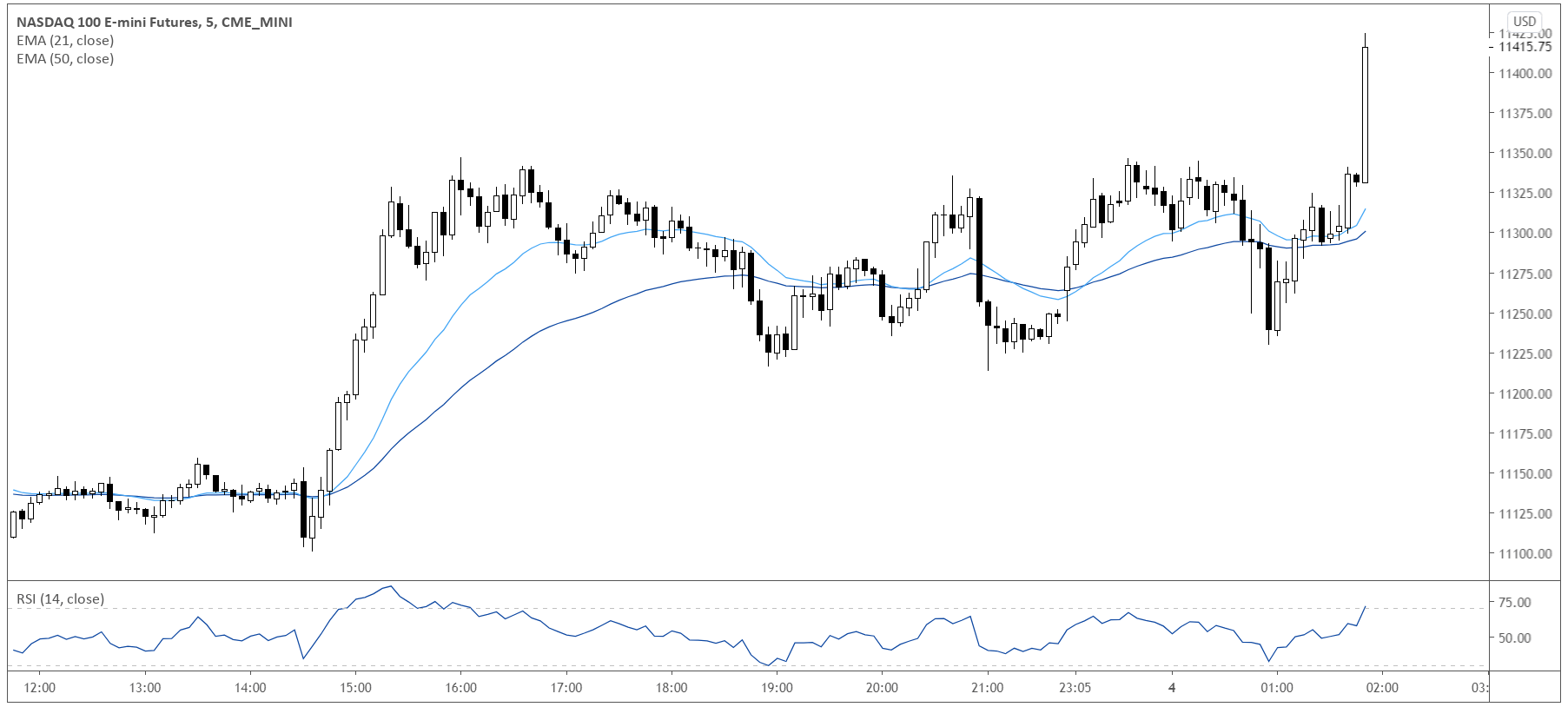

- Nasdaq futures = 11,315 (11,533, +1.9%)

- EUR/USD = 1.1756 (1.1662, -0.8%)

- USD/JPY = 104.64 (104.89 +0.2%)

- AUD/USD = 0.7139 (0.7108, -0.4%)

- WTI Crude Oil = 38.60 (38.56, -0.0%)

- Gold = 1914 (1897, +0.9%)

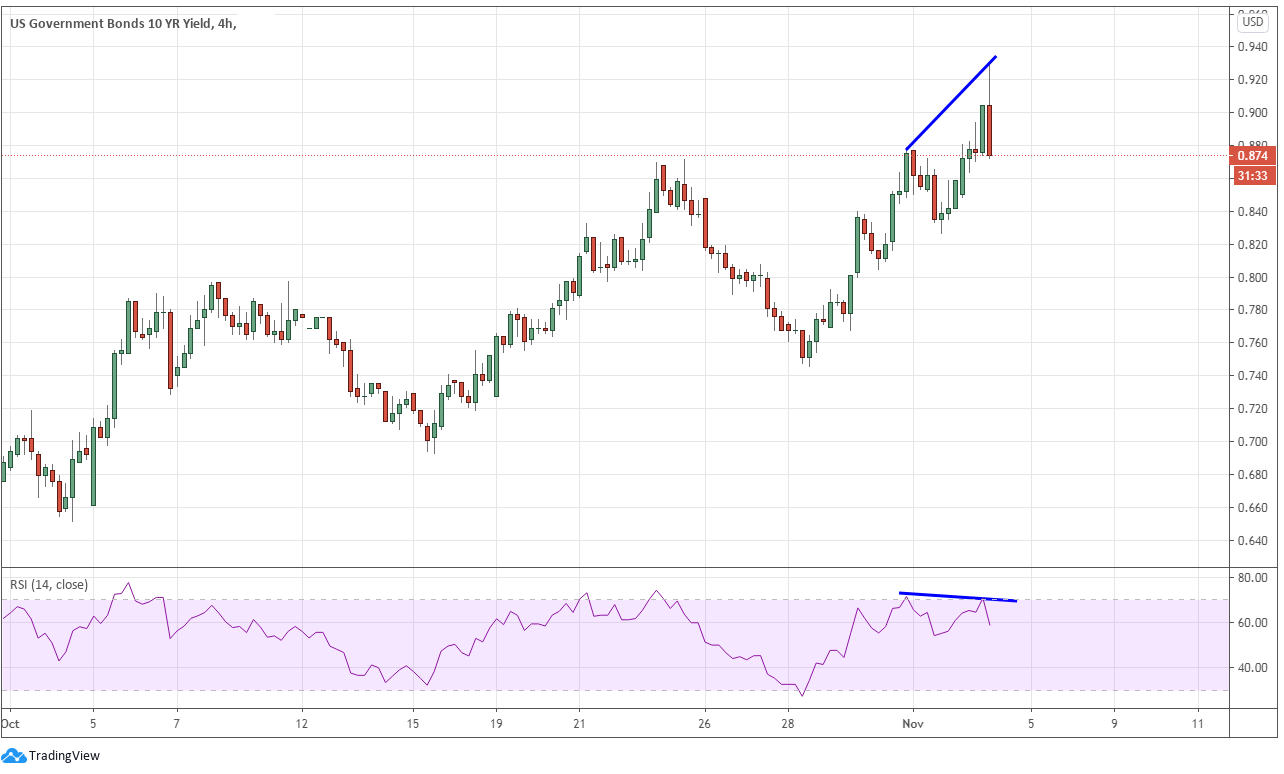

- 10yr Treasury Yield = 0.90% (0.81%, -9bps)

On balance, the movements have been relatively limited, with volatility in the middle and two notable exceptions. Tech stocks are surging and the 10-year treasury bond is as well (yields falling sharply). Perhaps Big Tech companies have joined the global “safe haven” club given their ability to generate excess cash flow in any environment?

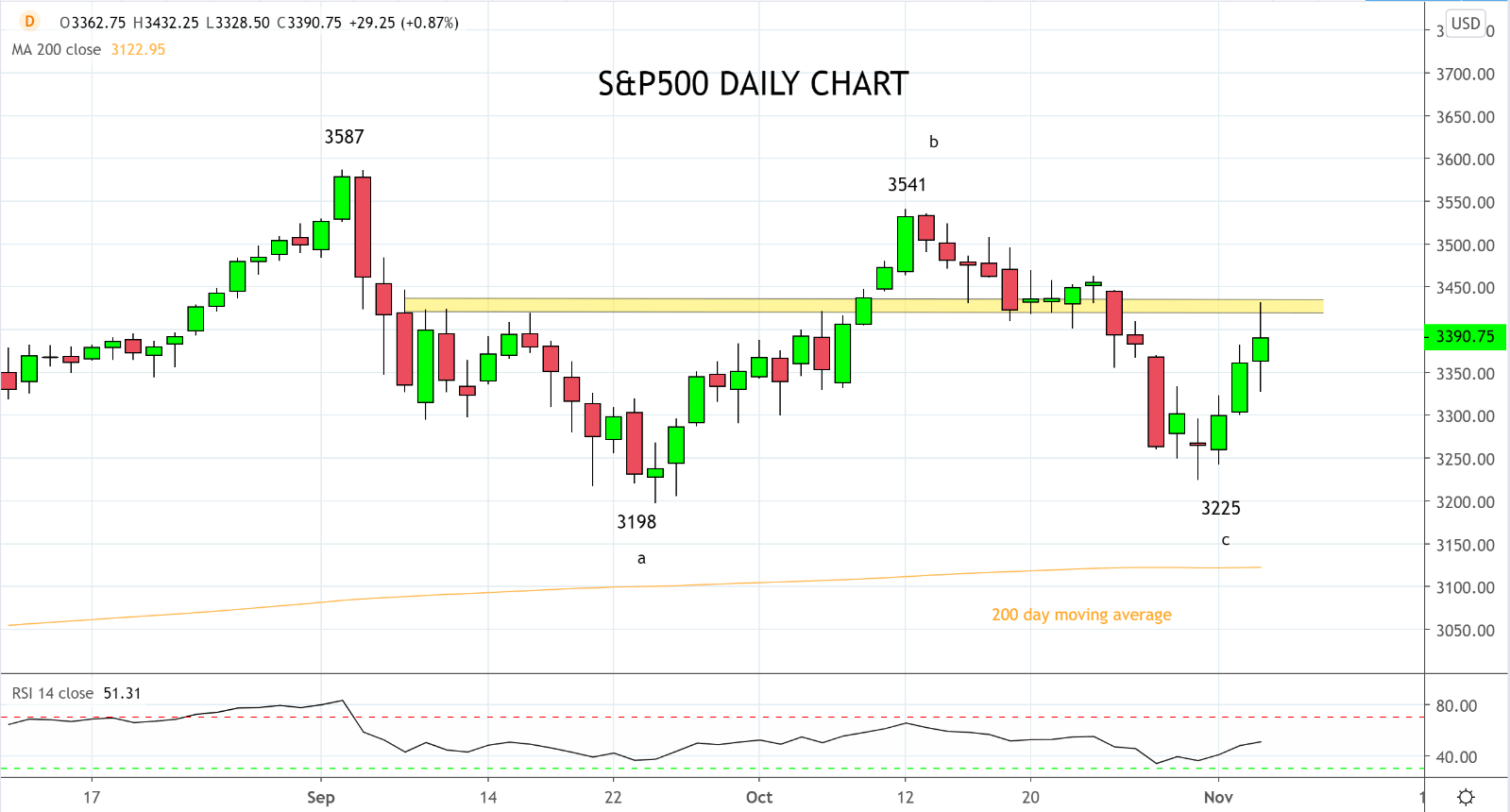

S&P500 stalled

Tony Sycamore, 6:01 GMT (1:01am ET)

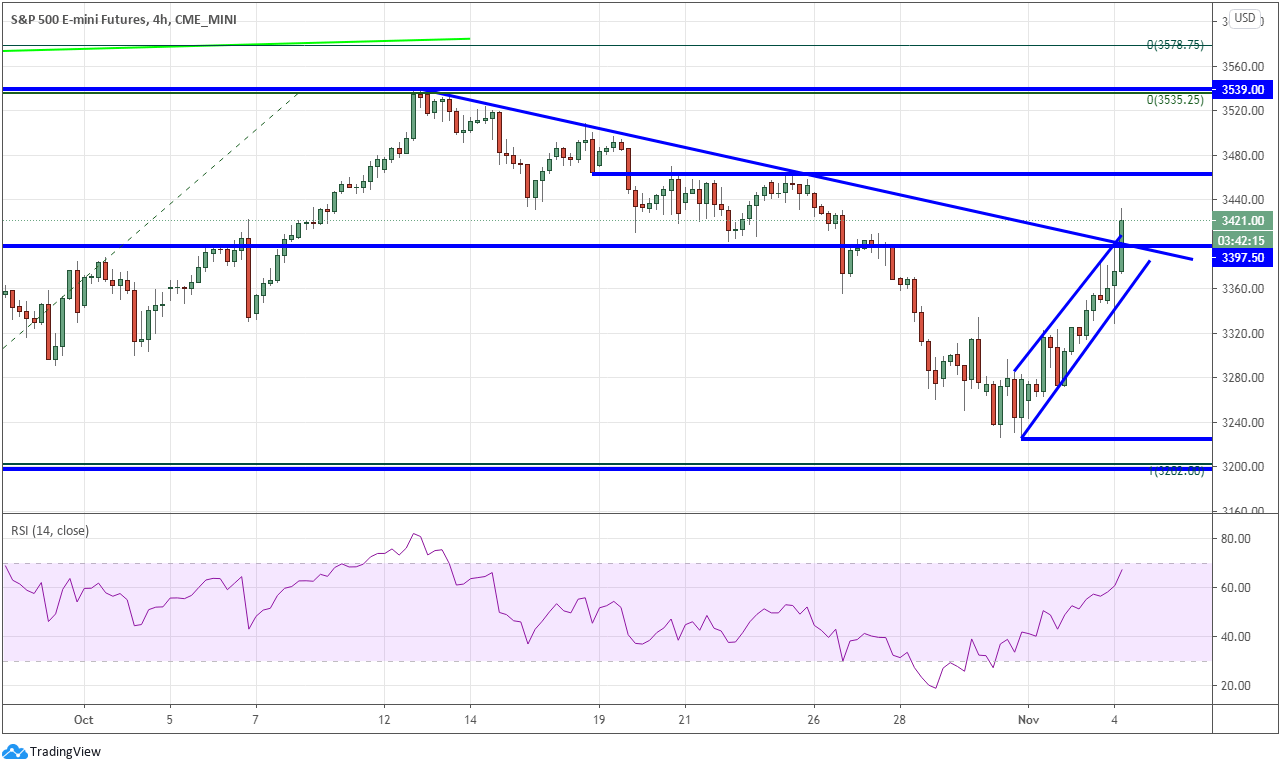

As we watch on from afar and await more results to drop, one of the key takeaways has been the way that markets have respected key technical levels.

For example, the S&P500 after recovering from its mid-session dive to 3330 was unable to break the layer of decisive resistance 3420 area.

3420 is a level that first became noticeable in early September as resistance, before becoming crucial support one month later.

If the S&P500 can make a sustained break above 3420/30, it should set up a retest of the September 3587 high.

Source Tradingview. The figures stated areas of the 4th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Biden “Feeling Good”, Trump to Rebut

Matt Weller, 5:55 GMT (12:55am ET)

As suspected, Joe Biden didn’t say anything we don’t already know at his speech. The former Vice President noted that he believes he’s on track to win the election and urged patience until all the votes are counted. He noted that he feels confident in Arizona and is “feeling good” about Wisconsin, Michigan, and Pennsylvania.

Separately, President Donald Trump tweeted “We are up BIG, but they are trying to STEAL the Election. We will never let them do it. Votes cannot be cast after the Poles are closed!” President Trump has just indicated that he will also make a statement tonight.

Looks like one of the most contentious campaigns in history may be heading to a contentious conclusion, which could be the worst-case scenario for risk appetite and markets…

Biden To Take the Stage

Matt Weller, 5:40 GMT (12:40am ET)

In a bit of an unexpected development, Democratic President Joe Biden is set to deliver a speech in Delaware imminently. It’s certainly premature to declare victory or defeat, so it may be more of a false alarm than anything. We’ll update if there are any meaningful developments on this front.

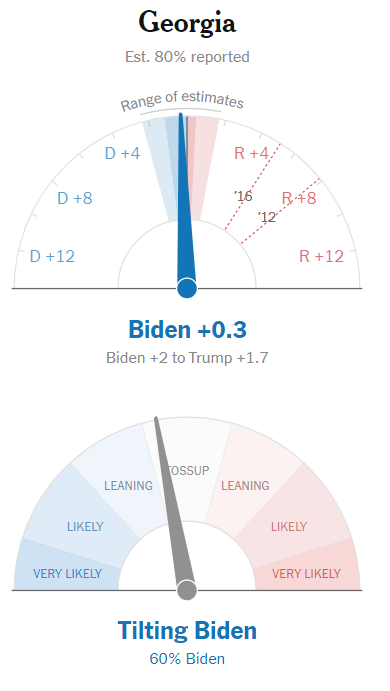

Here’s a Late One That Could Shake Up the Race

Matt Weller, 5:17 GMT (12:17am ET)

Our old friend, the NYT Needle, has seemingly revived from the dead on a state that Republicans had marked in their column hours ago. Based on the NYT’s methodology, the needle now projects Biden as the slight favorite in the Peach State. We’re obviously a bit skeptical given Trump’s outperformance in Florida, and we won’t get a result from Georgia tonight in any event, but a win there would dramatically widen Biden’s (rhyme not intended) path to the White House.

One to watch for traders over the next 24-48 hours…

Source: NYT Upshot

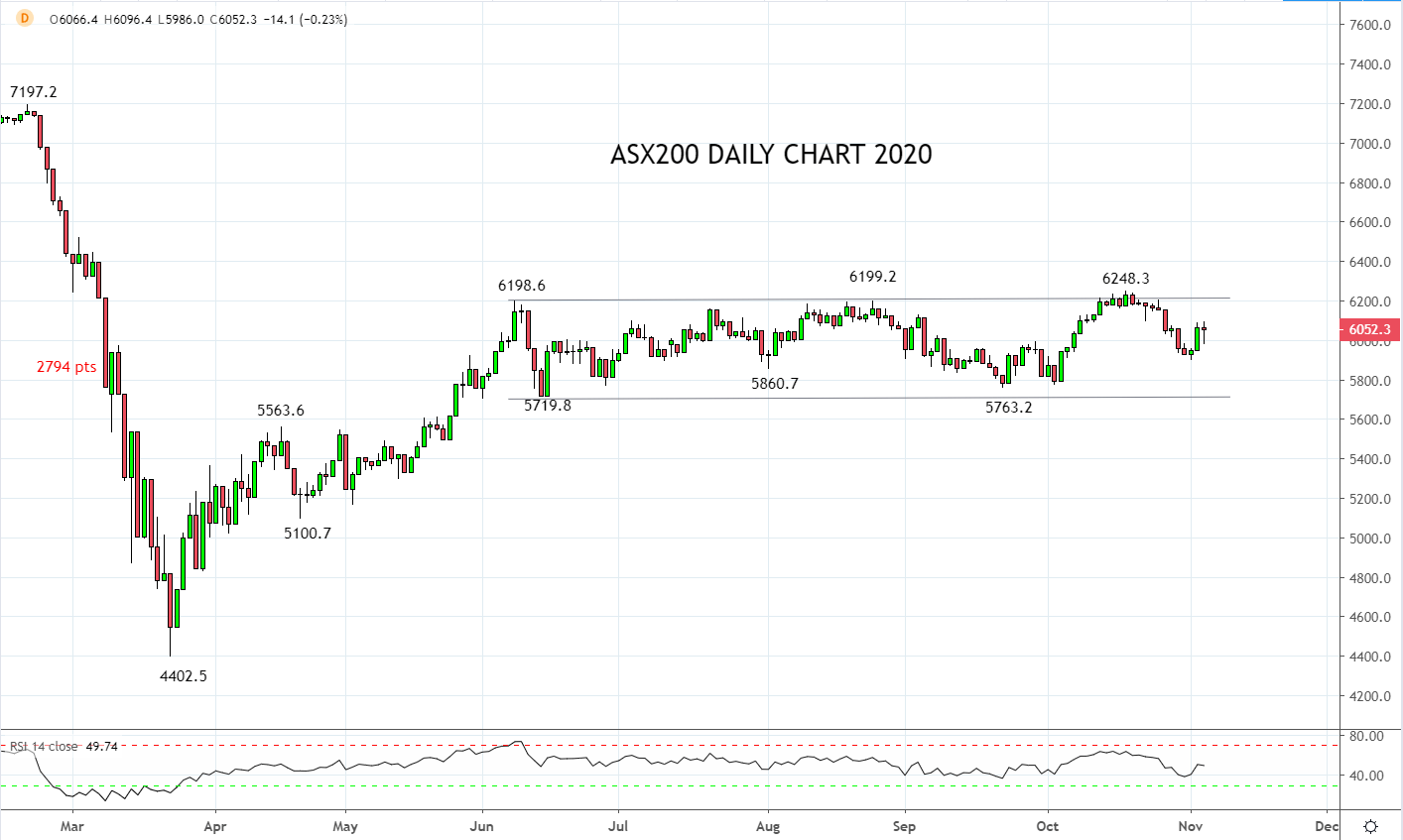

Asian equities trading higher into the close

Tony Sycamore, 5:14 GMT (12:14am ET)

As pointed out by our colleagues, there remains a long way to go before a clear winner is decided.

Reflecting this, betting markets now have Donald Trump out to $1.87 after being in as tight as $1.30. Joe Biden who was as far as $5.00 a few hours ago has come back into $2.08.

In line with this, support has returned to gold and it is now trading back near $1900 after the second test of intraday support ahead of $1880.

After a rapid 1.3% intraday sell-off, the ASX200 looks set to close marginally lower near 6050, while the Nikkei has responded well to a weaker JPY and is currently trading up approximately 2%, near 23750.

Source Tradingview. The figures stated areas of the 4th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Scraping the Bottom of the Barrel Now…

Matt Weller, 4:58 GMT (11:58pm ET)

Polls close at 12:00PM ET in the following states:

- Hawaii

Polls close at 1:00AM ET in the following states:

- Alaska

We’ll just mention the 49th and 50th states in the union together. Interestingly, there is a tight Senate race in Alaska (Sullivan vs. Gross), and with the way things are shaping up, it could conceivably impact which party controls the Senate for the next two years…but we likely won’t know the result of Georgia’s runoff race for weeks.

Regardless, the “Blue Wave” scenario where Democrats take a commanding lead of the Senate (53+ votes) is likely off the table now, so some of the more dramatic policy proposals (massive “Green New Deal”, “Packing” the Supreme Court, etc) will be hard to enact even if Biden ultimately pulls it out and Democrats are able to secure a 50-51 seat majority.

I Don’t Want to Say I Told You So, But…

Matt Weller, 4:44 GMT (11:44pm ET)

We warned at the start of the blog (seriously, scroll down through 4,000+ words) that incomplete state results would be even less predictive of the full outcome than usual, but traders may have ignored that advice and gotten ahead of themselves:

- After bottoming near 20% to win on some betting markets, Biden has rebounded to ~40% now

- USD/JPY is unwinding its big spike above 105.00

- Gold has bounced back to retest 1900

- Even US indices are coming off their overnight highs!

Source: Bloomberg

*Tap Tap* Is This Thing On?

Matt Weller, 4:30 GMT (11:30pm ET)

After a bout of excitement a bit over an hour ago, markets have stalled out across the board as traders await the next clear signal from the ballots. We should start getting more results from some of the slower Upper Midwest states mentioned below, as well as a continued trickle of votes from Arizona.

Outside of that, it looks like we won’t get final results from Georgia, which is leaning toward Trump but not yet a foregone conclusion with a large vote share from more liberal Atlanta suburbs outstanding.

For traders’ sakes, hopefully the market will glom onto another theme sooner rather than later.

Key Upper Midwest State Final Count Timelines

Matt Weller, 4:22 GMT (11:22pm ET)

Good note here on timelines for the key Upper Midwest States from FiveThirtyEight’s Nathaniel Rakich:

“We should have near-complete unofficial results from Wisconsin early tomorrow morning, as Milwaukee is expected to finish counting around 6 a.m. Eastern. Michigan originally said it would take until Friday to count all of its votes, but officials have revised that estimate to say they’ll be done tomorrow as well. Finally, Pennsylvania results probably won’t be known until Friday.”

All Hail King Dollar!

Matt Weller, 4:09 GMT (11:09pm ET)

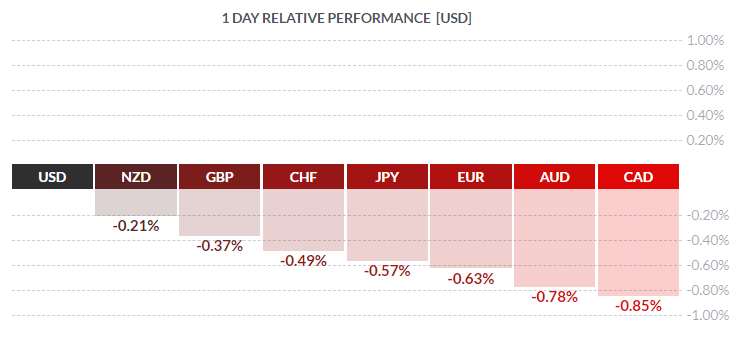

While the race for President is still up in the air, it’s clear who the winner is in the FX market so far this election night: the US dollar. The greenback is trading higher against all of its major rivals, with some of the more risk-sensitive currencies like the Australian and Canadian dollars bringing up the rear so far:

Source: FinViz

We had speculated that FX traders may sell the buck if there was an unclear result from the election, but so far, the world’s reserve currency remains on top, even with treasury bond yields falling across the curve.

West Coast, Reporting For Duty!

Matt Weller, 3:53 GMT (10:53pm ET)

Polls close at 11:00PM ET in the following states:

- California

- Idaho

- Oregon

- Washington

There’s not much to watch when it comes to these states; they’re almost certain to go Biden/Trump/Biden/Biden respectively, with no particularly tight Senate seats in play. Traders remain hyper-focused on results from Arizona, where Biden has taken a somewhat surprising 9-point lead with 75% of the vote counted. A win there would open up a narrow “backup plan” for the former Vice President, even if he loses Pennsylvania (whenever that result becomes final).

Like Kissing Your Sister…

Matt Weller, 3:41 GMT (10:41pm ET)

We don’t want to spend too much time on it, as it’s still a long shot, but this is exactly the sort of map you’d need to see for an electoral college tie. If Biden takes Michigan, Wisconsin, Nevada, and Arizona (where the early count has been somewhat favorable to him), but Trump takes Pennsylvania and Ohio (in addition to Florida, Georgia, and North Carolina), the winner of the White House may come down to some of the non-state district electoral votes like ME-2 or NE-2.

Needless to say, a gross electoral college tie (or < 280 vote win) would be the most 2020 development we could imagine…

Joe Perry 03:20 GMT (10:20pm ET)

As the vote tallies continue to mount, battle ground states are still up for grabs and odds are favoring a Trump victory at this point. As a result, stocks are moving higher on lower taxes and hopes of better trade deals. Next resistance 3460. The US Dollar has reversed its HUGE move earlier and is pulling back.

Reminder: Pennsylvania Won’t Have a Result Tonight

Matt Weller, 3:24 GMT (10:24pm ET)

For anyone staying up late hitting that refresh button:

- Thank you – glad to see you’re enjoying the live blog!

- If you’re expecting a clear national result tonight…don’t hold your breath.

Some counties in Pennsylvania can’t even start counting early ballots today, and Philadelphia just declared that nearly 300k votes won’t be counted tonight. This is undoubtedly the most important swing state on the map, and almost certain to be the “tipping point state” that decides the Presidential race overall, but we’ll likely still be counting ballots through at least Friday from the Keystone State.

Keep that in mind before you put on trades that aggressively favor one candidate or the other!

Technology Eats the World, Small Caps Left Out to Dry

Matt Weller, 3:11 GMT (10:11pm ET)

With Trump now priced as the 3:1 favorite on BetFair, equity traders are aggressively putting on pro-Trump trades. Nasdaq 100 futures, as we noted earlier, are now trading higher by over 2% on the night, while shares on the small-cap focused Russell 2000 are essentially flat. In other words, traders are betting that the odds of a massive stimulus bill to “bail out” struggling smaller businesses are falling, which could allow big technology behemoths to continue to gobble up market share.

Another Round of States To Watch…Though No New Swing States

Matt Weller, 2:51 GMT (9:51 ET)

Polls close at 10:00PM ET in the following states:

- Iowa

- Montana

- Nevada

- Utah

While some of these states may be “in play,” they’re unlikely to be the ones that ultimately decide the election, so traders will likely be more focused on tallying the ongoing results from some of the earlier swing states we highlighted above. It’s during this window that we’ll likely get as-final-as-possible-given-the-large-share-of-early-votes results from other states, so even if major media companies aren’t comfortable enough to call the outcomes by this period, traders will likely settle into their final positions for the night based, at least when it comes to the Presidential race.

That said, there is a duo of key Senate races we’ll be watching in this window, including a dead heat in Iowa (Ernst vs. Greenfield) and a slight Republican lead in Montana (Daines vs. Bullock). If the Senate picture is still unclear as the night rolls on, these races may be the ones to tip the scales, so they’ll be worth watching closely.

Treasury Yields Tank

Matt Weller, 2:48 GMT (9:48 ET)

After peaking above 0.93% earlier in the night, the yield on the benchmark 10-year treasury bond has fallen to just 0.82% now. This mirrors a big risk-off reaction that we’ve seen across the board (USD up, oil down, etc…) as traders price in higher odds of an extremely tight election that is decided in the courts and may be seen as controversial. Our “Election Night Becomes Election Week (Or Month)” Theory is looking increasingly likely…

Joe Perry 02:45 GMT (9:45PM ET)

Whoa….US Dollar taking off as odds of winning now favor a Trump victory. EUR/USD testing the 1.1600 support level.

Watch for stocks to move lower if this keep up!

Trump Moves to Odds-On Favorite on BetFair

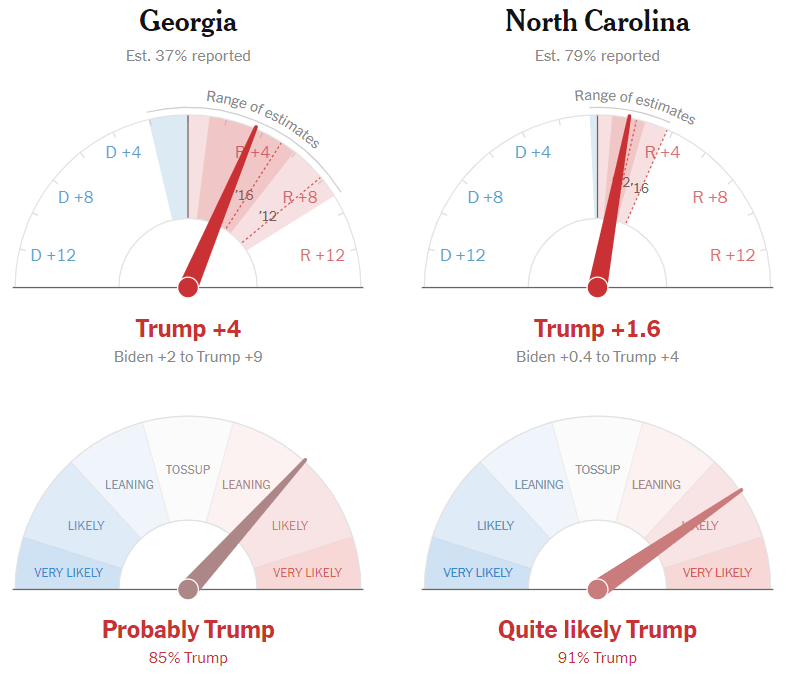

Matt Weller, 2:26 GMT (9:26 ET)

PredictIt remains down, but Trump is now the odds-on favorite at BetFair. Earlier we noted that Democrats may have a similar sinking feeling to four years ago but it was premature based on the results from just one key swing state. With Trump now looking like a strong favorite in both Georgia and North Carolina, the national race is now essentially a coin flip (that again, is not likely to have a definitive result tonight regardless).

Source: NYT Upshot

Separately, Democrats were able to pick up a Senate seat in Colorado, though with Republicans potentially beating their polls (at least in the Southeast), a “Blue Wave” is looking less likely than it did at the start of the night.

Joe Perry 02:15 GMT (9:15PM ET)

With no surprises at the top of the hour in the polls that closed, markets remain complacent waiting for the next big announcement. Arizona, Pennsylvania, Michigan, Minnesota, Wisconsin, Ohio, and Texas all remain in play.

10 Yields are one of the biggest movers on the nights so far, and may put in a bearish engulfing candle on the 240 minute chart, down 3.35%.

Nasdaq Futures Hit New Highs

Matt Weller, 2:07 GMT (9:07 ET)

After that swoon in risk assets as Florida shifted to Trump, markets have generally settled down over the last hour or so. One interesting exception is the Nasdaq 100 futures, which are hitting their highest levels of the night. Both Trump and Biden have expressed some level of skepticism toward big technology companies, but if a global pandemic can’t derail these behemoths perhaps traders are growing convinced that a little thing like an election won’t either!

Source: TradingView, GAIN Capital

Joe Perry 01:50 GMT (8:50pm ET)

Gold sure looks a lot like the S&P 500 over the last few days. Gold futures spiked lower from 1918 through the upward sloping channel down to a low near 1880. It cl