Link REIT Issues a Profit Warning

Link REIT (823), a real estate investment trust, announced that the company would expect a loss in full year results ending March 31 due to the decline in the valuation of the properties and the establishment of a support scheme and multi-prolonged measures to support tenants. The company said: "the appraised value of our investment properties is expected to be 193.2 billion Hong Kong dollars as at 31 March 2020 (a decline of 12.3% when compared to the appraised value of 220.4 billion Hong Kong dollars as at 30 September 2019).

Besides, Hong Kong's 1Q GDP sank 8.9% on year (-6.5% expected), the largest decline in record, according to the government. The gloomy economic activity could affect Link REIT as the portfolio of Link REIT focuses on the Hong Kong market.

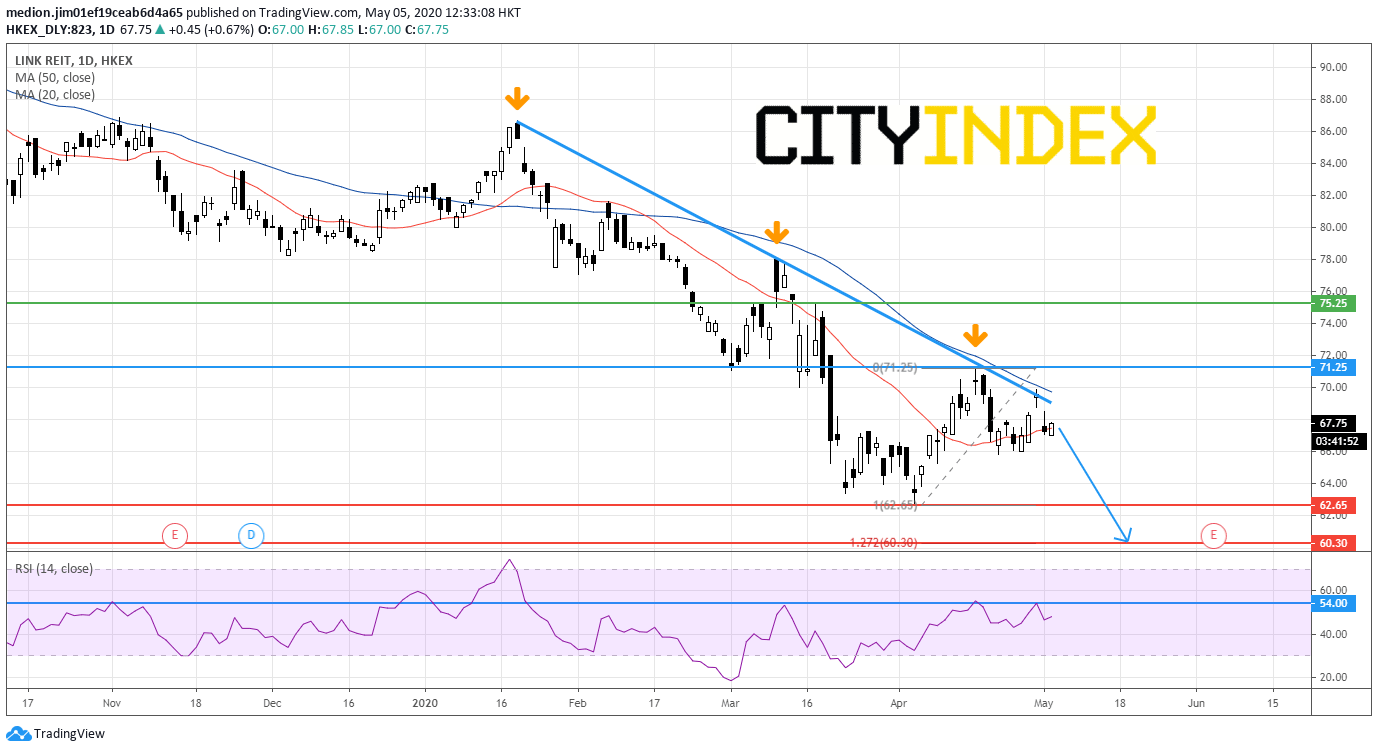

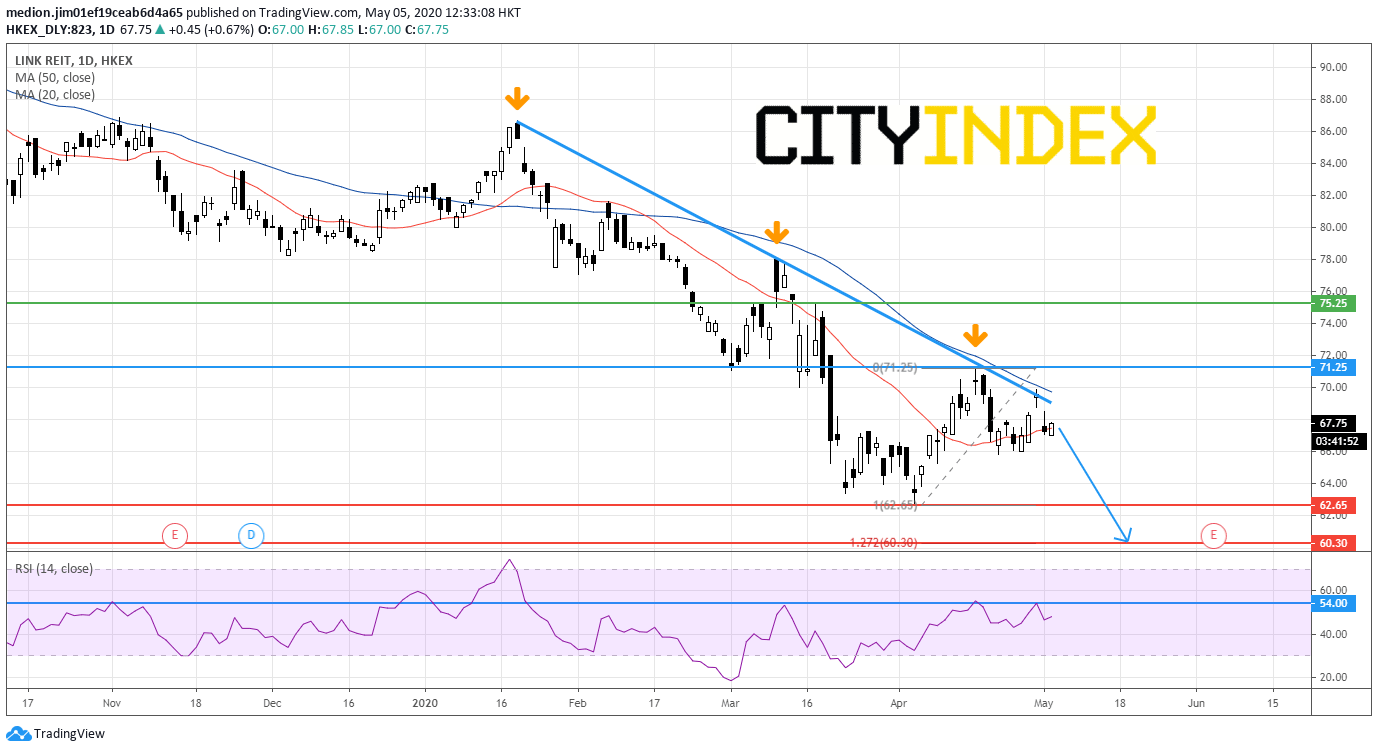

From a technical point of view, the stock remains capped by a declining trend line drawn from January top on a daily chart. The declining 50-day moving average is also acting as resistance. The RSI also failed to penetrate the previous high at 54, suggesting the lack of upward momentum for the prices. As long as the previous high at $71.25 is not surpassed, the stock could consider another down leg to the previous bottom at $62.65 and the 127.2 retracement level at $60.30.

In an alternative scenario, a break above the previous high at $71.25 would suggest the bullish breakout of the declining trend line and trigger a rebound to next resistance level at $75.25.

Source: GAIN Capital, TradingView

Besides, Hong Kong's 1Q GDP sank 8.9% on year (-6.5% expected), the largest decline in record, according to the government. The gloomy economic activity could affect Link REIT as the portfolio of Link REIT focuses on the Hong Kong market.

From a technical point of view, the stock remains capped by a declining trend line drawn from January top on a daily chart. The declining 50-day moving average is also acting as resistance. The RSI also failed to penetrate the previous high at 54, suggesting the lack of upward momentum for the prices. As long as the previous high at $71.25 is not surpassed, the stock could consider another down leg to the previous bottom at $62.65 and the 127.2 retracement level at $60.30.

In an alternative scenario, a break above the previous high at $71.25 would suggest the bullish breakout of the declining trend line and trigger a rebound to next resistance level at $75.25.

Source: GAIN Capital, TradingView

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM