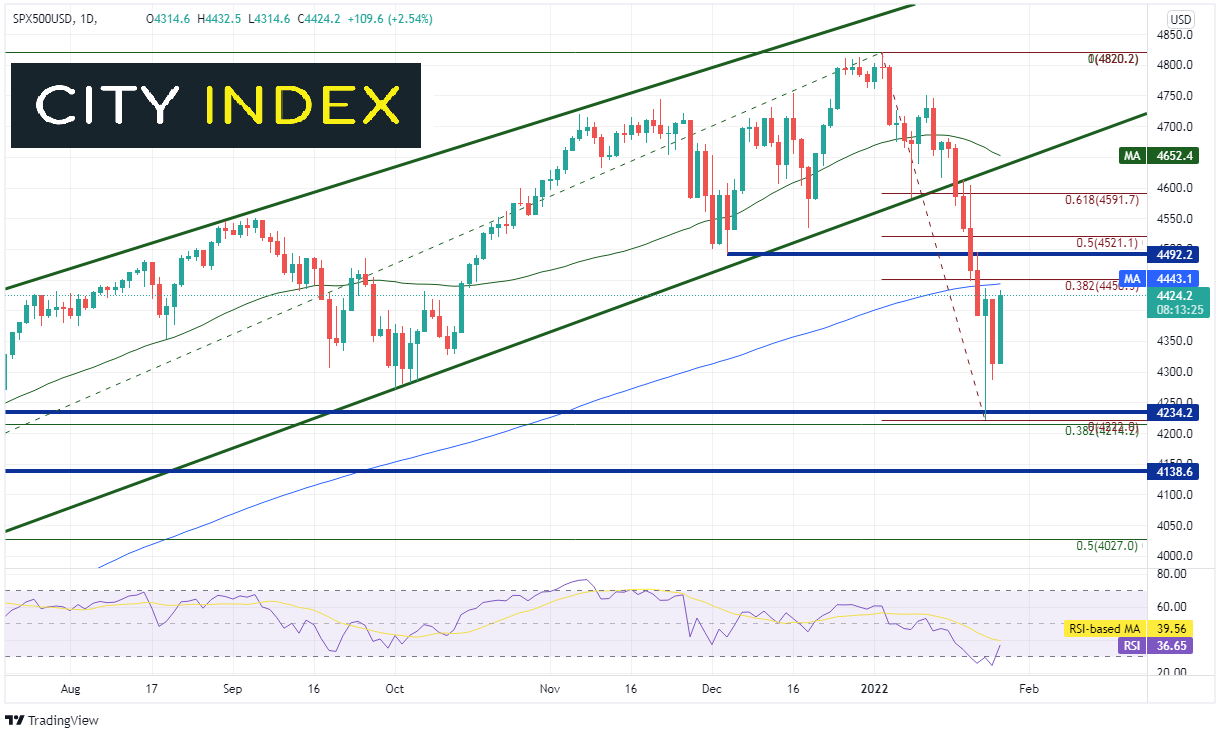

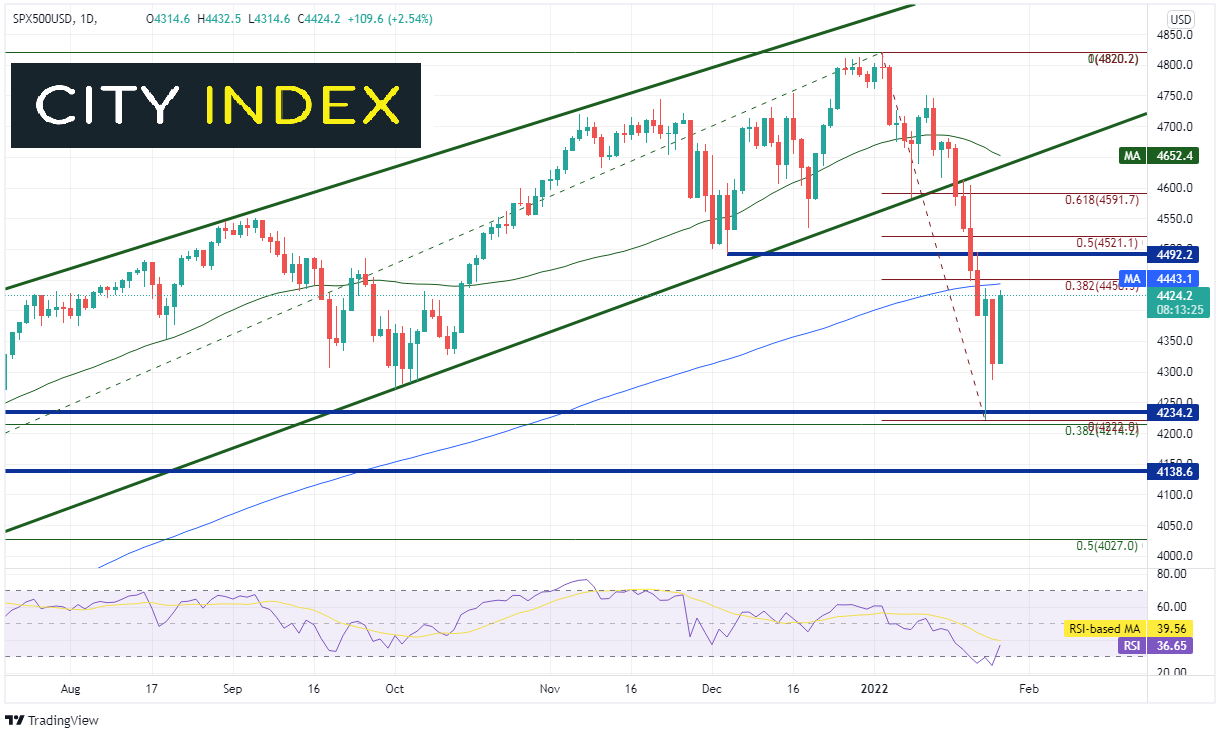

SPX 500

- Resistance:

- 4443/4450: 200-Day Moving Average and 38.2% Fibonacci retracement of the January 4th high to the January 24th low

- 4492: Horizontal Resistance

- 4521: 50% retracement from the high of January 4th to the low of January 24th

- Support:

- 4285: January 25th low

- 4222/4214: January 24th low and 38.2% Fibonacci retracement from the November 2nd, 2020 low to the January 4th high

- 4138: Horizontal support

Source: Tradingview, Stone X

Trade SPX 500 now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

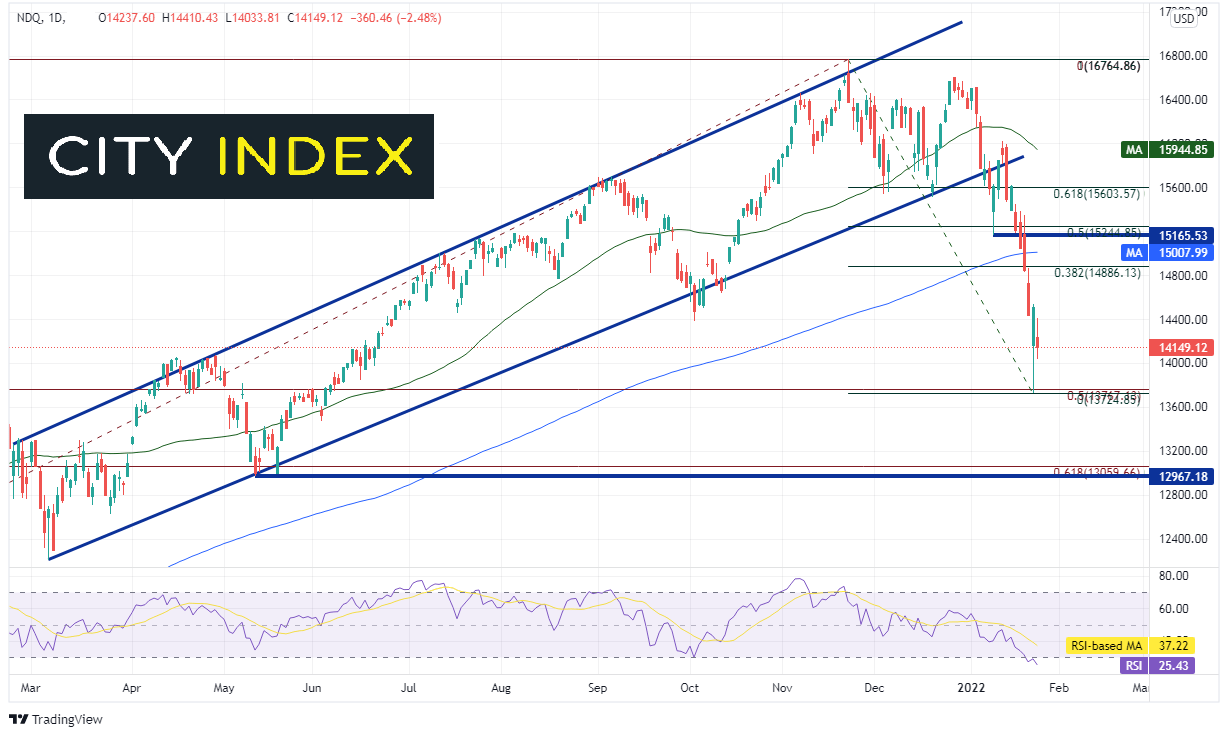

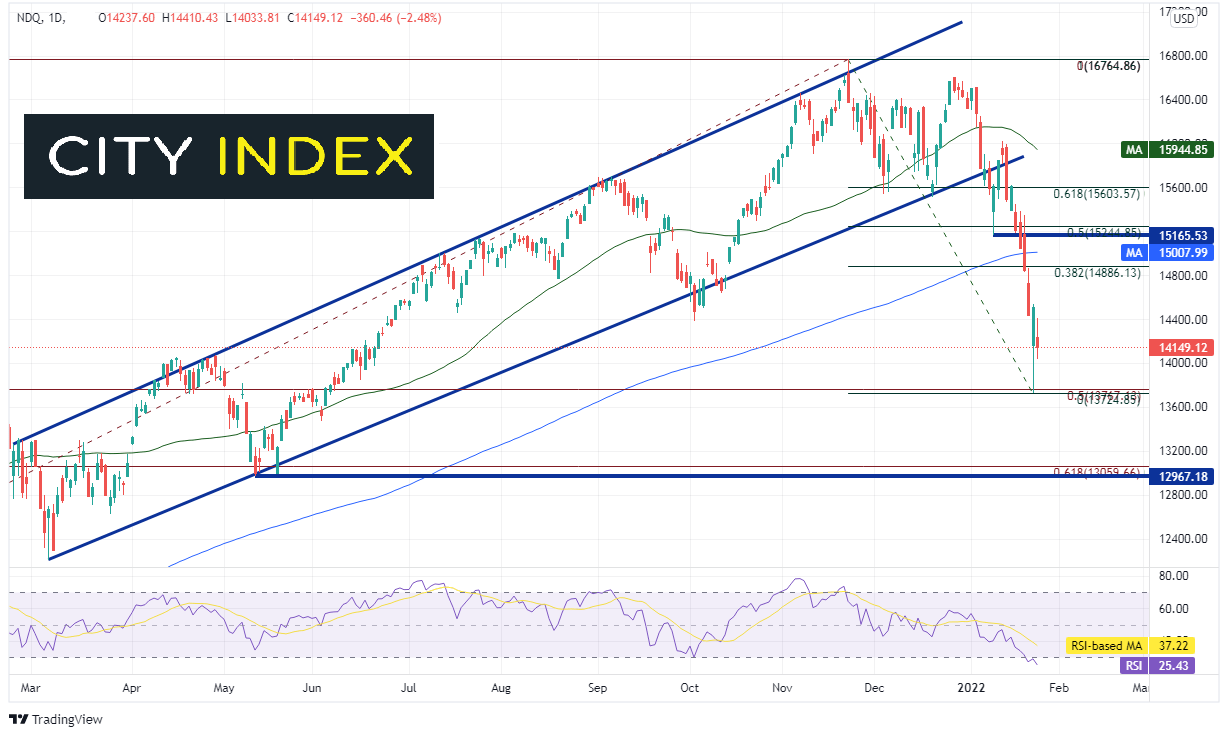

NDQ 100

- Resistance:

- 14886/15508: 38.2% Fibonacci retracement from the high of November 22nd, 2021 to the low of January 24th and 200 Day Moving Average

- 15165: Horizontal Resistance

- 15245: 50% Fibonacci retracement from the high of November 22nd, 2021 to the low of January 24th

- Support:

- 14033: January 25th low

- 13725: January 24th low at the 50% retracement from the low of September 21st, 2020 to the high of November 22nd, 2021

- 13960/12968: 61.8% Fibonacci retracement from the low of September 21st, 2020 to the high of November 22nd, 2021 and horizontal support

Source: Tradingview, Stone X

Trade NDQ 100 now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM