Lenovo Group (992): Upside Breakout

Lenovo Group (992), the global personal computers and hardware manufacturer, rallied 56% from March low, meanwhile, Hang Seng Index was able to rebound 23% only. It would suggest that the stock is outperforming the market.

In the early of November, the company reported that 3Q net income rose 53% on year to $310 million on revenue of $14.52 billion, up 7%. UBS raised the target price of the company from HK$6.50 to HK$7.00. The bank said the company will keep outpacing the worldwide PC sector in the short term, with share gain opportunity underpinned by its robust after-sales service.

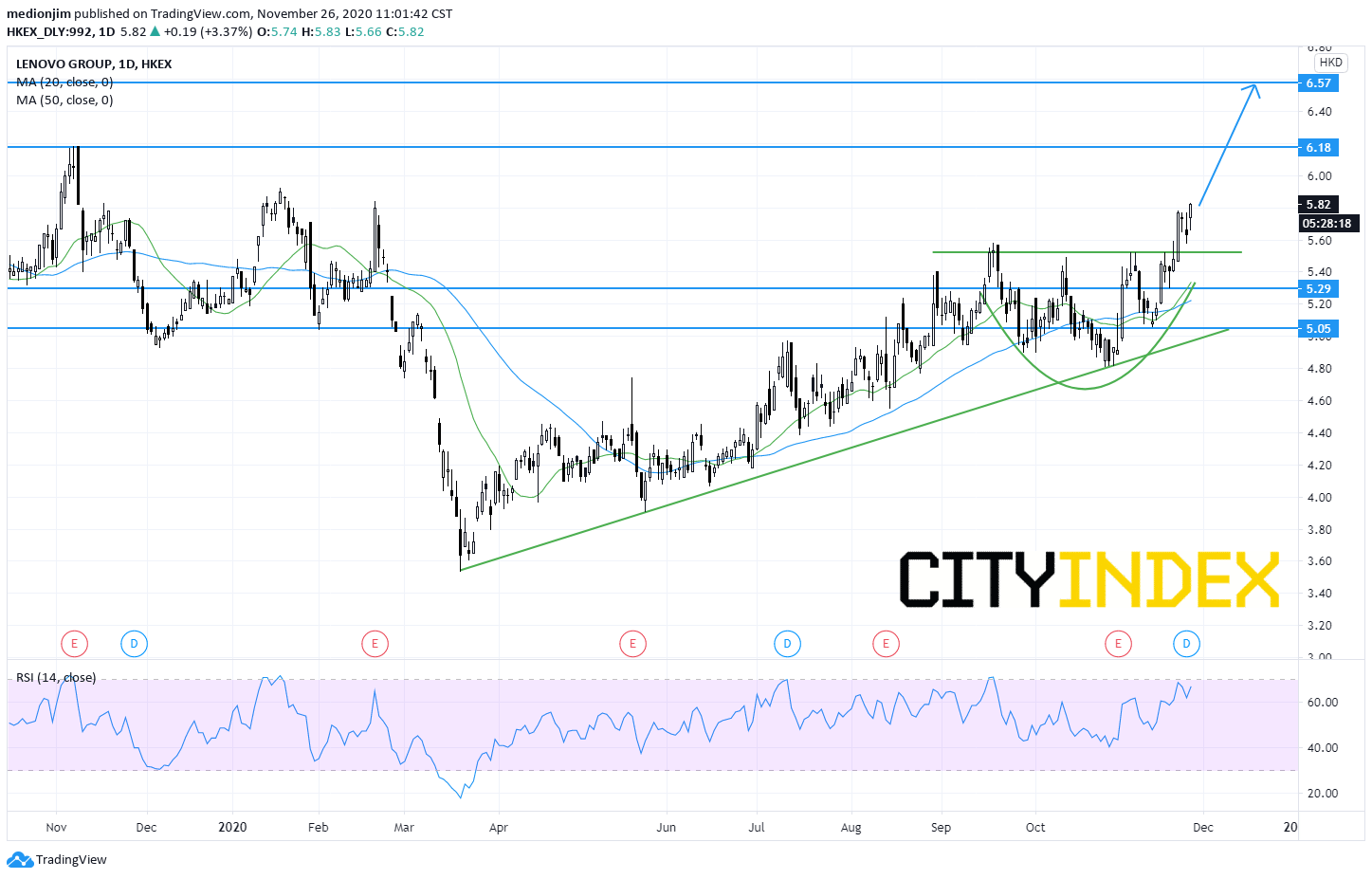

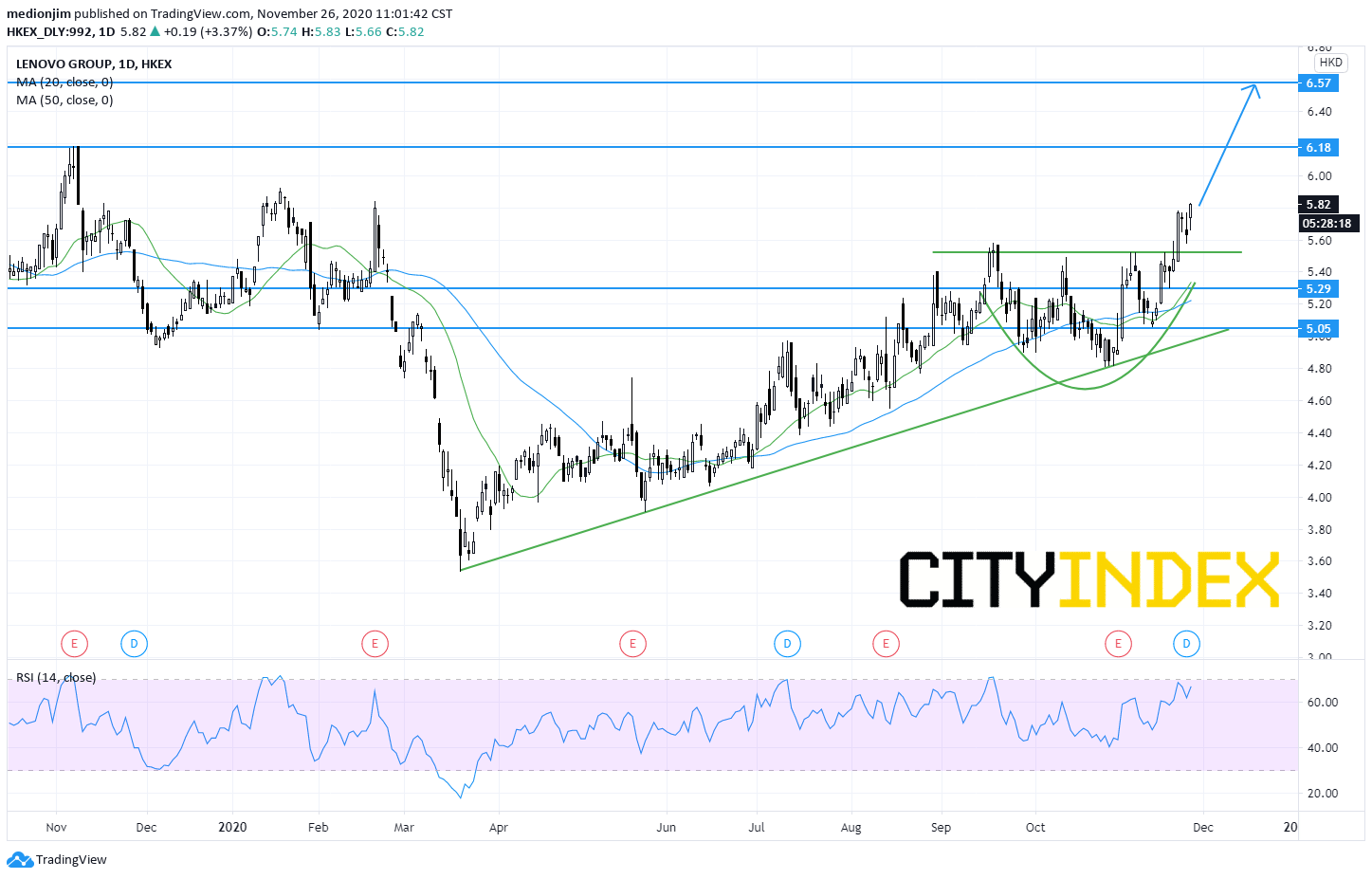

From a technical point of view, the stock prices have broken above the consolidation zone and challenges the 52-week high. The upward momentum is further reinforced by both rising 20-period and 50-period moving averages. Unless the support level at HK$5.29 is violated, the stock could consider a further upside to the resistance levels at HK$6.18 and HK$6.57.

Source: GAIN Capital, TradingView

In the early of November, the company reported that 3Q net income rose 53% on year to $310 million on revenue of $14.52 billion, up 7%. UBS raised the target price of the company from HK$6.50 to HK$7.00. The bank said the company will keep outpacing the worldwide PC sector in the short term, with share gain opportunity underpinned by its robust after-sales service.

From a technical point of view, the stock prices have broken above the consolidation zone and challenges the 52-week high. The upward momentum is further reinforced by both rising 20-period and 50-period moving averages. Unless the support level at HK$5.29 is violated, the stock could consider a further upside to the resistance levels at HK$6.18 and HK$6.57.

Source: GAIN Capital, TradingView

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM