Large Bounce in AUD/USD, But is it Enough?

Earlier this week, The Reserve Bank of Australia (RBA) had an emergency monetary policy meeting, in which they cut interest rates a record low of 25bps. In addition, the RBA announced the start of their own quantitative easing program. The government also put together a fiscal stimulus plan of nearly $10 billion dollars. However, that may not be enough as the Australian government is in the process of putting together an additional fiscal package which could be larger than the first fiscal package! Australia has also closed it’s borders to permanent residents and citizens.

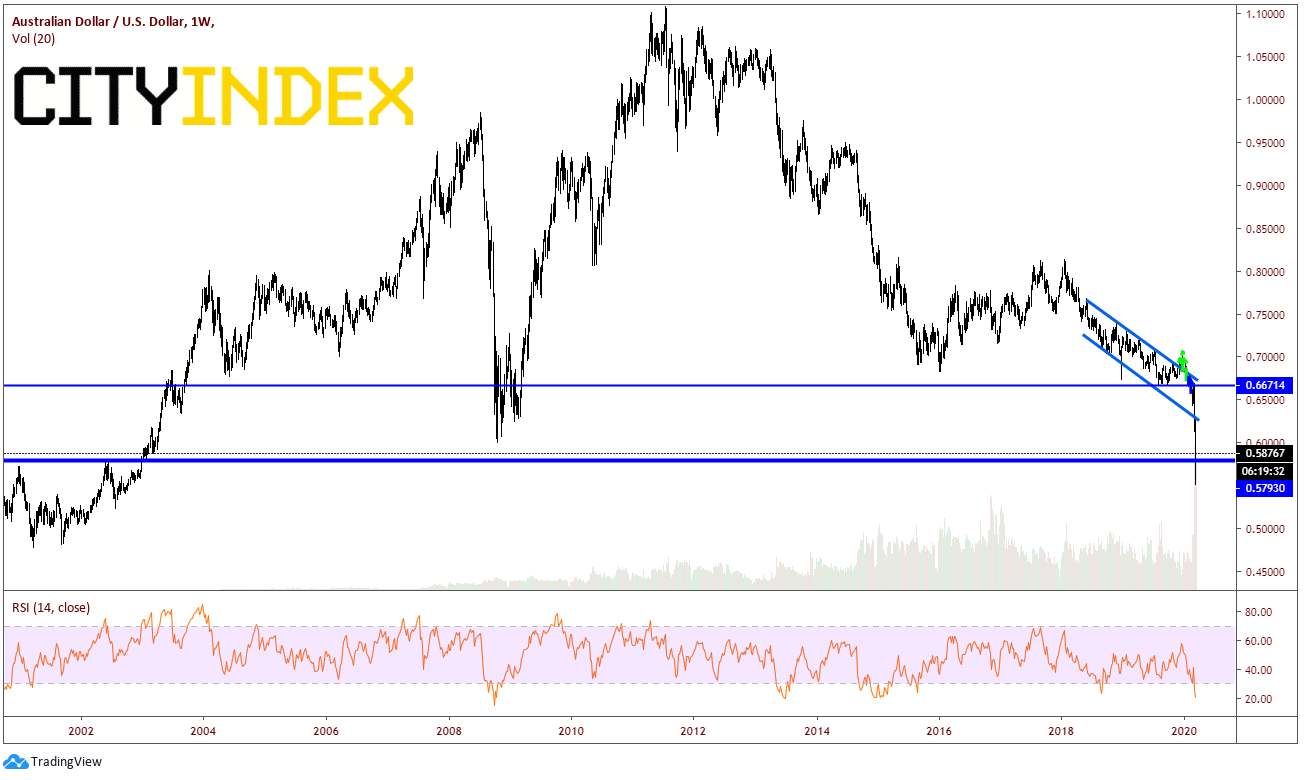

What does this mean to the value of the AUD/USD? In the day before the RBA announcement, AUD/USD had moved lower from roughly .6000 to .5800. In early trading on Thursday morning before the announcement, price broke from roughly .5800 to .5500, a low not seen since 2002!

Source: Tradingview, City Index

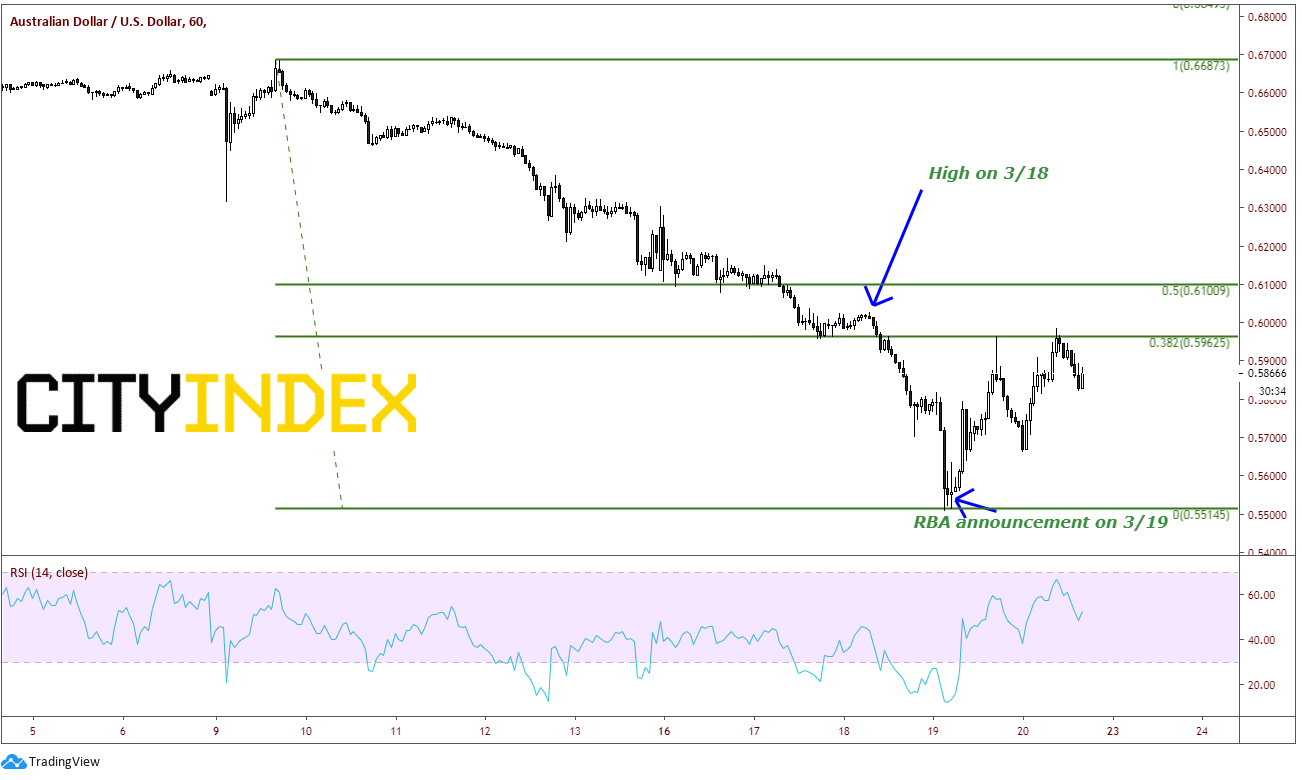

AFTER the announcement on Thursday from the RBA, AUD/USD went bid. Over the last 2 days price moved from .5509 to a high of .5963, a move of 454 pips! However, if we look at the high to low from March 6th at .6687 to the lows on March 19th at .5504, price has only retraced to the 38.2% Fibonacci retracement level, which is considered a shallow correction.

Source: Tradingview, City Index

To a large degree, the move lower in AUD/USD is due to both the unprecedented actions of the Australian Government and the RBA, as well as, the strong demand for US Dollars. Today the US Dollar (DXY) has pulled back a bit, after traded to a high earlier of 103. However, that has not provided much of an incentive for AUD/USD to go bid. If AUD/USD can not take out .6000, and to a larger extent the 50% retracement level at .6100, than the AUD/USD should continue to move lower!

Here we make a case that if the AUD/USD cannot move higher through key, strategic levels, price would resume its move lower. As a result of the strong demand for US Dollars, the same case can be made for many other USD pairs. Watching both the DXY AND bold moves by governments and central banks will help give a better sense of direction for AUD/USD and USD pairs in general.