It also provided a discussion of four additional options for the RBNZ to provide further monetary stimulus if needed, including expanding the LSAP program, reducing the OCR below zero, a term lending scheme to banks, and the purchase of foreign assets (such as foreign government bonds).

The purchase of foreign assets is viewed as the option of last resort, despite being highly effective.

How this would work is the RBNZ would create New Zealand dollars to fund the purchase of foreign assets. Thereby putting downward pressure on the exchange rate, via increased New Zealand dollar liquidity and via the direct effect of selling New Zealand dollars. This would result in lower interest rates as well as lower exchange rate, all of which would help the RBNZ to meet its objectives of higher economic activity, inflation, and employment.

While the interest rate market has embraced the idea of negative rates, pricing in almost 50bp of cuts, and taking the OCR to -25bp by the middle of 2021, the exchange rate remains on an upward trajectory, unperturbed by the prospect that the RBNZ may resort to buying foreign assets.

Should the New Zealand exchange rates appreciation accelerate the RBNZ may need to consider making good on its threat to purchase offshore bonds sooner than it may have hoped

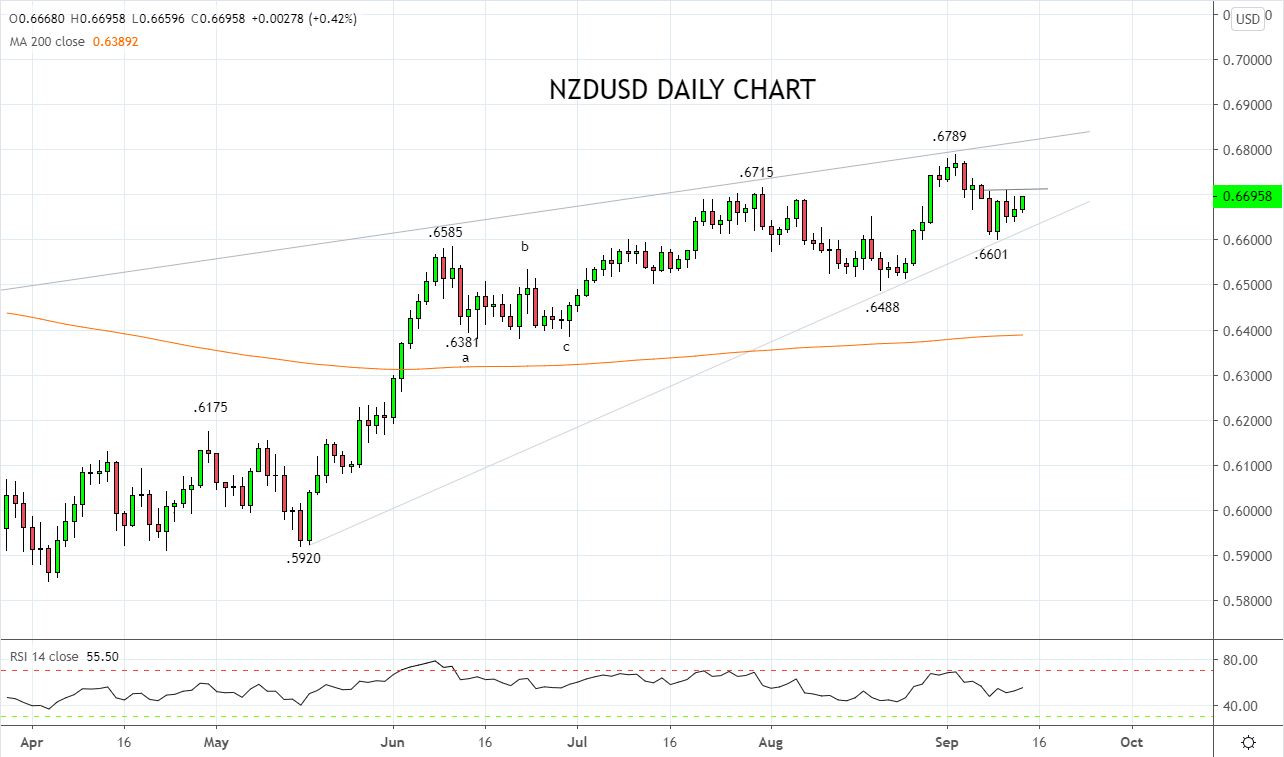

Technically the trend of a higher NZDUSD remains in place. After trading to the .6789 high on the 3rd of September, the NZDUSD retraced back to trend line support at .6600c before a rebound commenced, thereby keeping the bullish uptrend intact.

Providing the NZDUSD remains above the aforementioned trendline support and then trades above short term resistance at .6710ish it would be further confirmation the NZDUSD is set to retest .6800c, along with the resolve of the RBNZ.

Source Tradingview. The figures stated areas of the 14th of September 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation