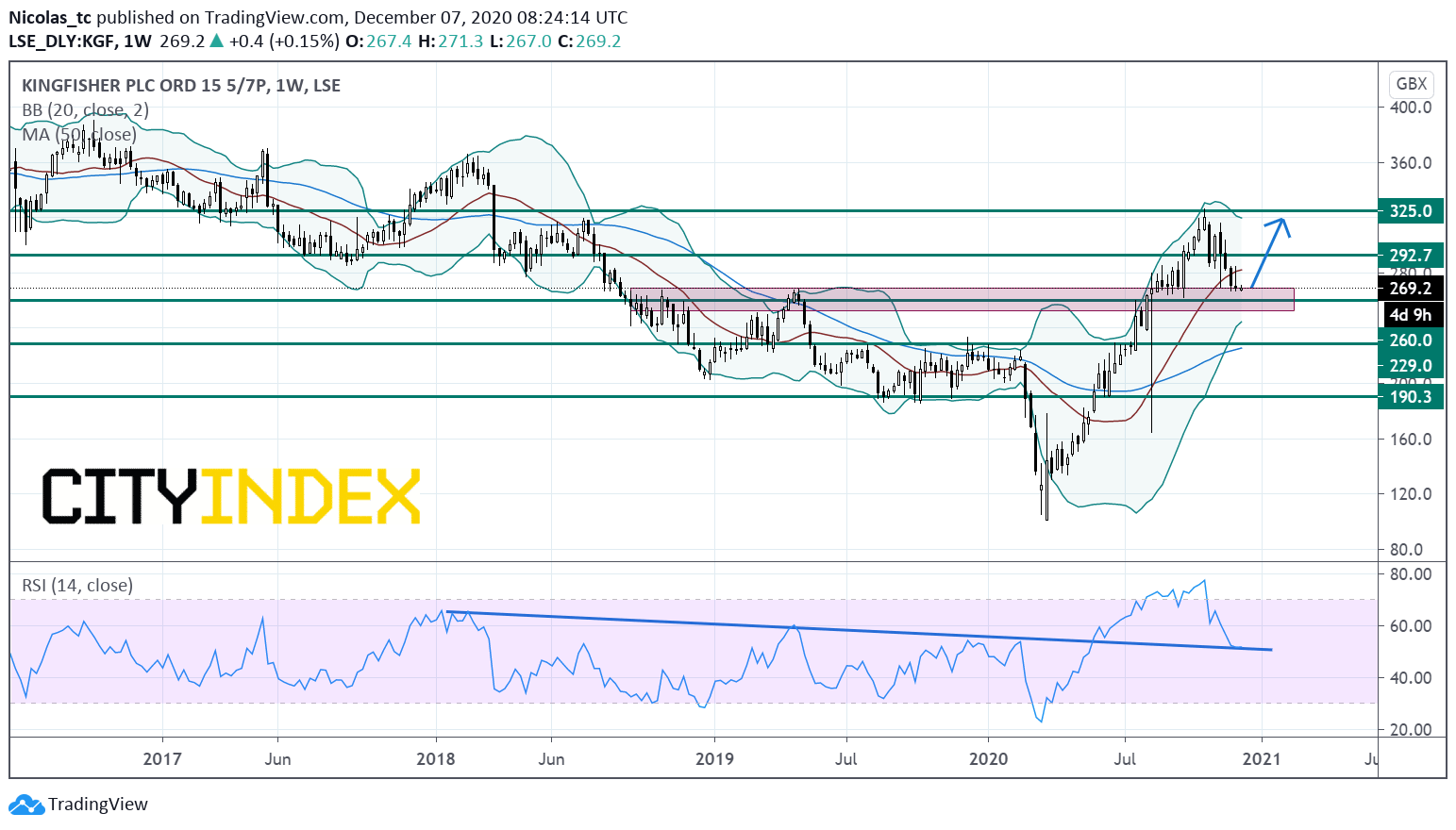

Kingfisher’s shares near technical support level

Kingfisher, the retailing company, said it intends to return in full the U.K. and Republic of Ireland business rates relief received as a result of the COVID-19 crisis. The company stated: "Kingfisher's total annual business rates bill eligible for this relief is approximately £130 million, of which c.£110 million falls in FY 20/21 and the balance in FY 21/22. Following this decision, we now anticipate that FY 20/21 adjusted profit before tax will include c.£85 million of non-recurring cost savings (previous guidance: c.£175 million), net of any one-off COVID-related costs."

From a chartist point of view, the stock price remains in consolidation mode but is now approaching from a key support zone around 260p (overlap). The weekly RSI (14) is nearing a former declining trend line which will now play a support role. Readers may want to consider the potential for opening Long positions above the technical support level at 260p with 292.7 and 325 as targets. Caution: a break below 260 would trigger a bearish acceleration towards the next support threshold at 260p.

Source: TradingView, Gain Capital

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM