Kingfisher reports strong 1H results

Kingfisher, the retailing company, announced that 1H adjusted EPS rose 28.0% on year to 15.1p on revenue of 5.92 billion pounds, down 1.3% (-1.6% like-for-like). The company decided not to declare an interim dividend, compared with 3.33p per share in the prior-year. The company added that "Q3 trends to date remain encouraging, but continued uncertainty and concerns over COVID and wider economic environment limit visibility".

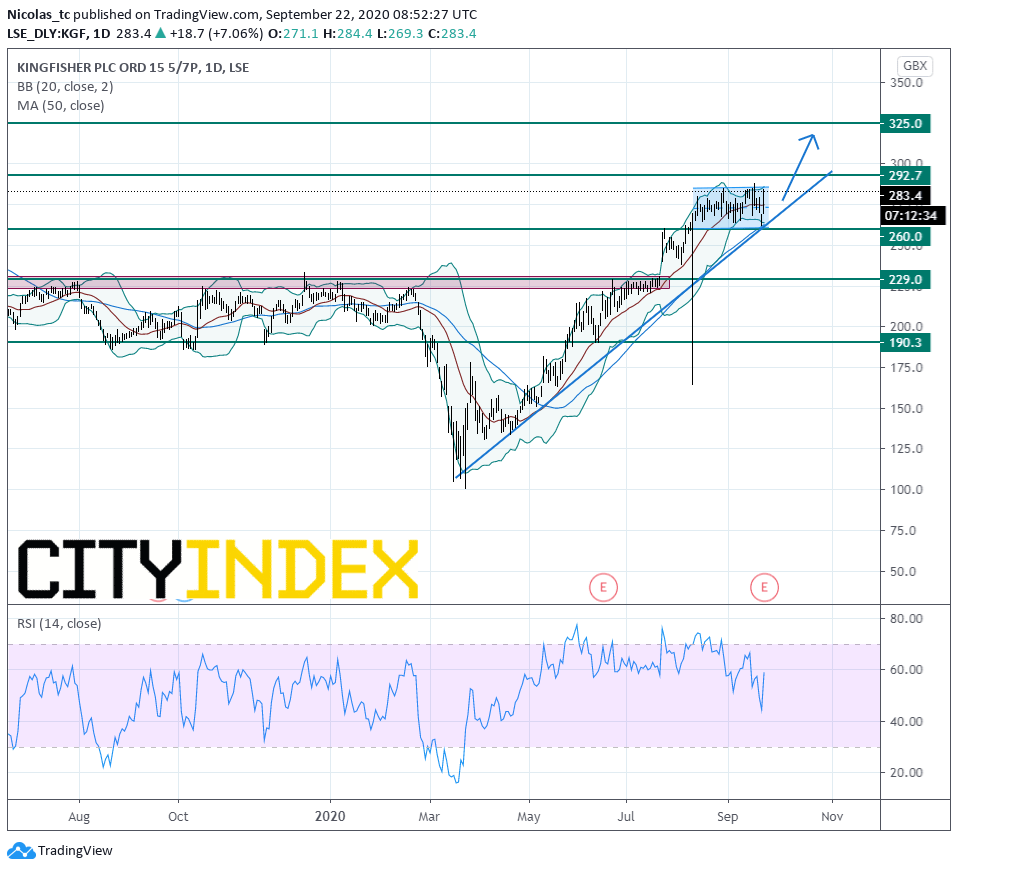

From a chartist’s point of view, the stock price is supported by a rising trend line and by the ascending 50DMA. However, the Daily Relative Strength Index (RSI, 14) is losing upward momentum. Prices need to stand above 260p to maintain the bullish bias. A break above 293p resistance zone would open a path to see 325p. Alternatively, a push below 260p would call for a reversal down trend towards 229p.

Source: GAIN Capital, tradingView

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM