Kingfisher : bullish gap

Kingfisher, the retailer, posted a 2Q trading update: "As announced on 17 June 2020, Kingfisher's Q2 20/21 Group LFL sales (to 13 June) were up 21.8% reflecting strong e-commerce growth and the phased reopening of stores in the UK and France from mid-April. Based on the strong sales seen to date in Q2, combined with cost reductions benefiting H1 (some of which are non-recurring), the Company anticipates its half year adjusted pre-tax profit to be ahead of prior year."

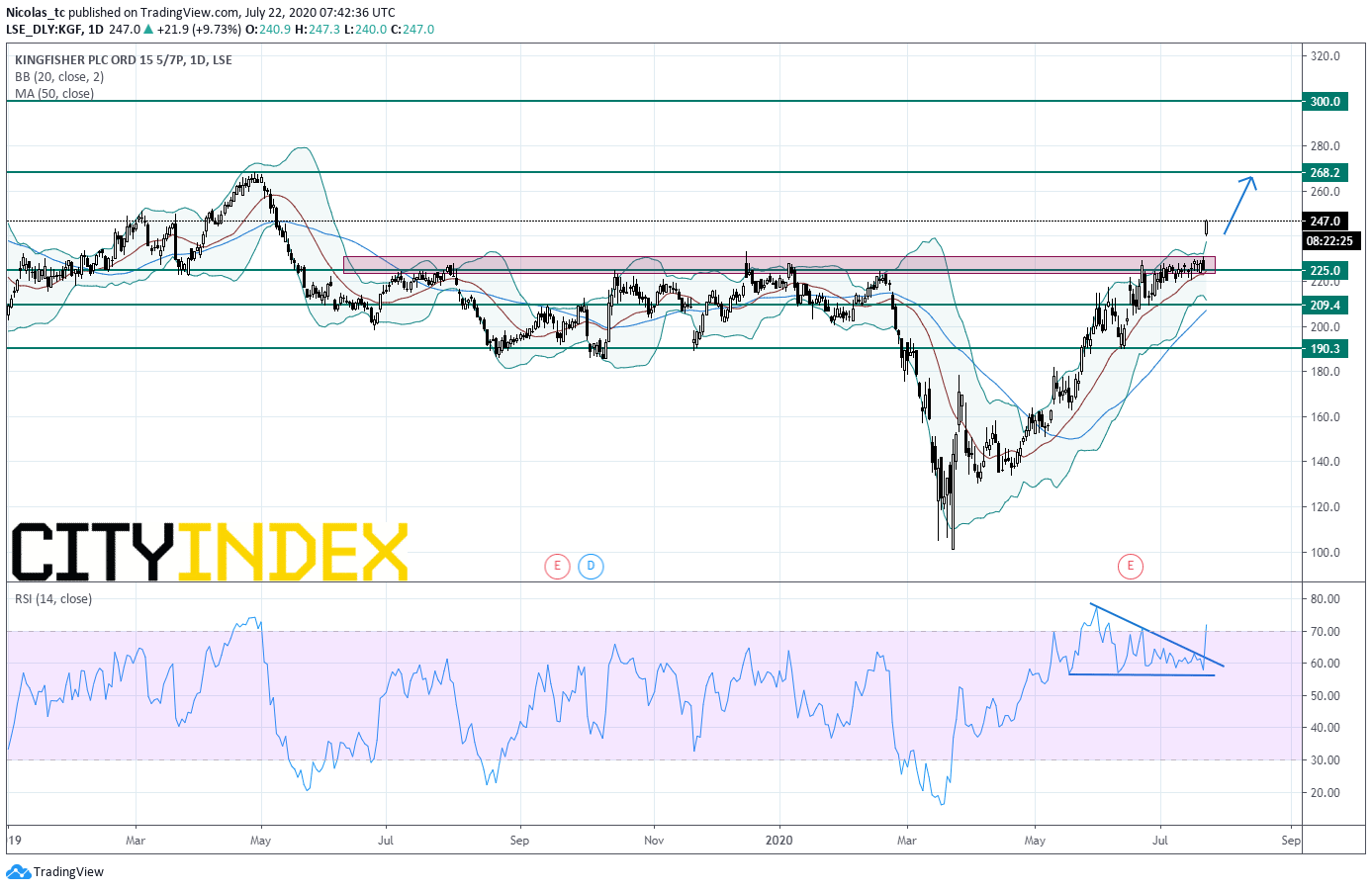

From a chartist's point of view, the stock price remains in a bullish trend supported by the rising 20DMA currently at 225p and is trading above the upper Bollinger band thanks to the bullish gap opened this morning. The daily Relative Strength Index (RSI, 14) escaped from a triangle pattern. As long as 225p is support, the bias remains bullish. Next resistance threshold is set at 268.2p. Alternatively, a break below 225p would call for a reversal down trend with 209.4p and 190.3p as targets.

Source: GAIN Capital, TradingView