Key Levels To Watch for on The S&P 500

On Tuesday, Netflix (NFLX) is awaited to post third quarter EPS of $2.11 compared to $1.47 a year ago on revenue of $6.4 billion vs $5.2 billion last year. The Co operates a video streaming service and on October 7th, the Financial Times disclosed that Netflix India won the right to stream some episodes of its documentary series called 'Bad Boy Billionaires: India' in an Indian court. In unrelated news, traders are anticipating a move around 10.8%. The stock dropped 6.5% after last earnings were reported. Technically speaking, the RSI is above 50. The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at $513.66 and $504.61). We are looking at the final target of $625.00 with a stop-loss set at $506.00.

On Wednesday, Tesla (TSLA) is likely to unveil third quarter EPS of $0.57 vs $0.37 last year on sales of $8.3 billion compared to 6.3 billion a year ago. The Co manufactures electric-vehicles and on October 14th, the Co lowered the price of both versions of it's Model S. In other news, on October 12th, Chief Executive Officer Elon Musk tweeted that on October 20th, the Co will be releasing a limited full self driving beta to a small number of people. From a chartist's point of view, the RSI is above its neutrality area at 50. The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at $427.76 and $405.84). We are looking at the final target of $595.00 with a stop-loss set at $384.00.

On Thursday, Intel (INTC) is expected to announce third quarter EPS of $1.10 compared to $1.42 a year ago on revenue of $18.2 billion vs $19.2 billion last year. The Co designs and manufactures microprocessors, and on October 2nd, The U.S. Department of Defense awarded Intel Federal LLC, a subsidiary of the Co, the second phase of its State-of-the-Art Heterogeneous Integration Prototype (SHIP) program. From a technical point of view, the RSI is above 50. The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is above its 20 and 50 day MA (respectively at $51.84 and $50.45). We are looking at the final target of $58.10 with a stop-loss set at $52.40.

On Friday, American Express (AXP) is anticipated to release third quarter EPS of $1.33 vs $2.08 last year on revenue of $8.6 billion compared to $11.0 billion a year ago. American Express operates a globally integrated payments company and on October 13, the Co revealed a partnership with GlobalGiving, a non-profit crowd funding platform for charitable projects. The goal of the partnership is to enable colleagues of the Co to make donations submitted through GlobalGiving and the American Express Foundation will match the contribution. Looking at a daily chart, the RSI is above its neutrality area at 50. The MACD is above its signal line and positive. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at $102.26 and $100.13). We are looking at the final target of $116.80 with a stop-loss set at $99.40.

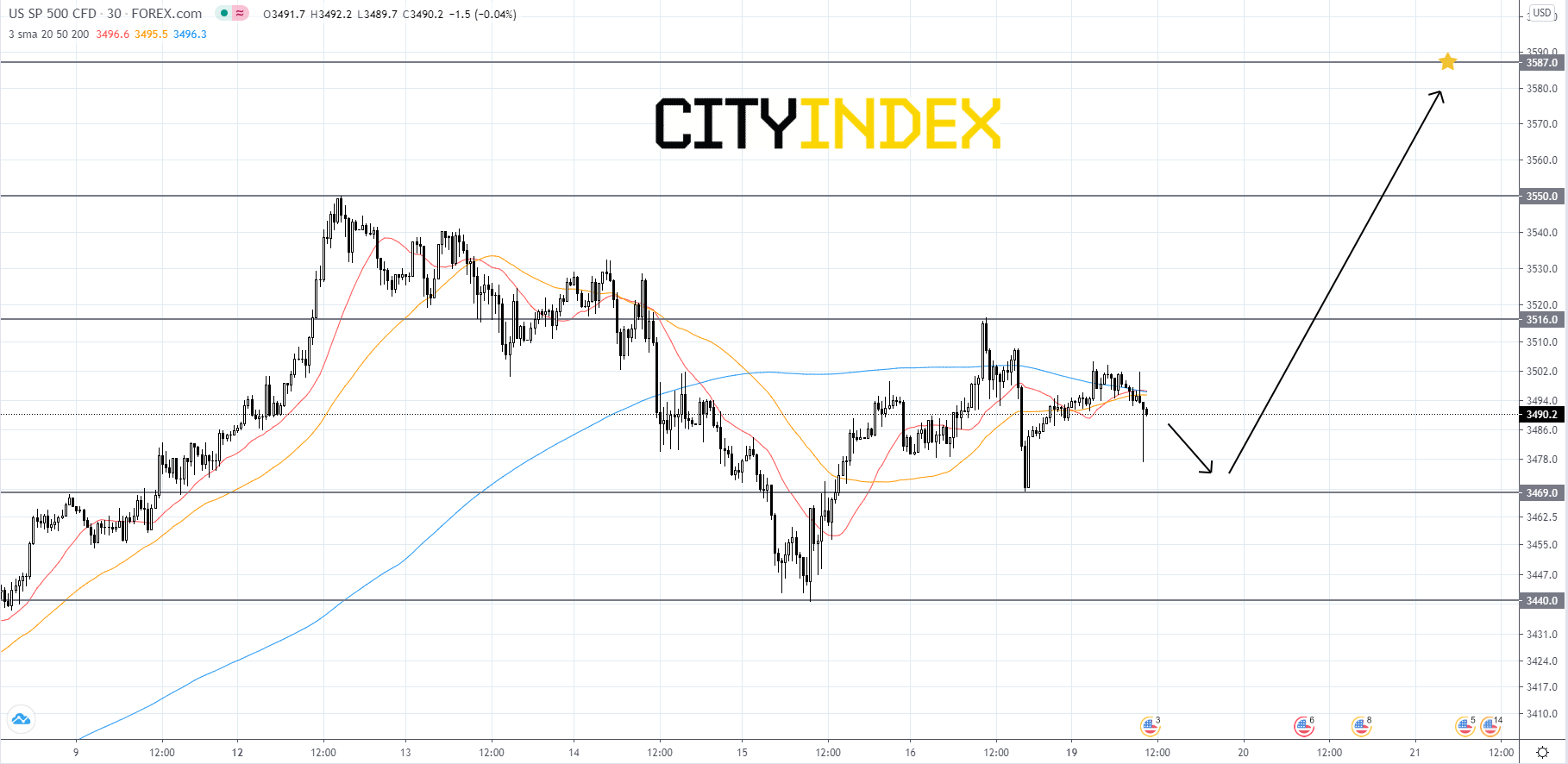

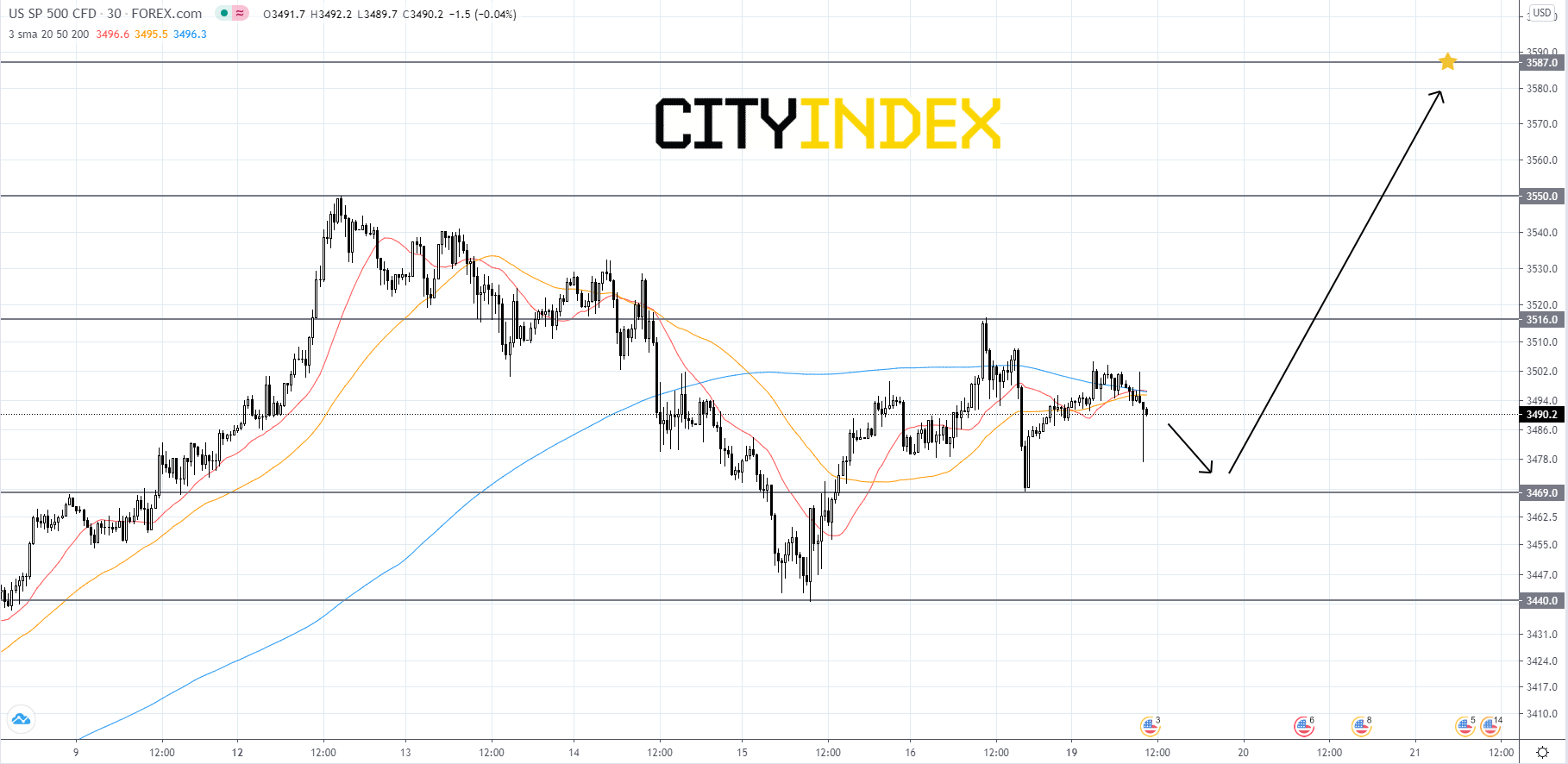

Looking at the S&P 500 CFD on a 30 minute chart, the index's advance was halted last week at 3550.00. Since then the index pulled back and found support at 3440.00 where it rebounded on Thursday, October 15th. If price can get above its 3516.00 resistance level, then it should allow for a retest of last weeks high at 3550.00. If price manages to break above 3550.00, it would be a bullish signal and the next target would be the all-time high of 3587.00. If price slips again then traders should look to the 3469.00 level for a bounce. If price does not find support at 3469.00, then it could find support at 3440.00. If price breaks below 3440.00, it would be a bearish signal that could send the index tumbling downward.

Source: GAIN Capital, TradingView

On Wednesday, Tesla (TSLA) is likely to unveil third quarter EPS of $0.57 vs $0.37 last year on sales of $8.3 billion compared to 6.3 billion a year ago. The Co manufactures electric-vehicles and on October 14th, the Co lowered the price of both versions of it's Model S. In other news, on October 12th, Chief Executive Officer Elon Musk tweeted that on October 20th, the Co will be releasing a limited full self driving beta to a small number of people. From a chartist's point of view, the RSI is above its neutrality area at 50. The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at $427.76 and $405.84). We are looking at the final target of $595.00 with a stop-loss set at $384.00.

On Thursday, Intel (INTC) is expected to announce third quarter EPS of $1.10 compared to $1.42 a year ago on revenue of $18.2 billion vs $19.2 billion last year. The Co designs and manufactures microprocessors, and on October 2nd, The U.S. Department of Defense awarded Intel Federal LLC, a subsidiary of the Co, the second phase of its State-of-the-Art Heterogeneous Integration Prototype (SHIP) program. From a technical point of view, the RSI is above 50. The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is above its 20 and 50 day MA (respectively at $51.84 and $50.45). We are looking at the final target of $58.10 with a stop-loss set at $52.40.

On Friday, American Express (AXP) is anticipated to release third quarter EPS of $1.33 vs $2.08 last year on revenue of $8.6 billion compared to $11.0 billion a year ago. American Express operates a globally integrated payments company and on October 13, the Co revealed a partnership with GlobalGiving, a non-profit crowd funding platform for charitable projects. The goal of the partnership is to enable colleagues of the Co to make donations submitted through GlobalGiving and the American Express Foundation will match the contribution. Looking at a daily chart, the RSI is above its neutrality area at 50. The MACD is above its signal line and positive. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at $102.26 and $100.13). We are looking at the final target of $116.80 with a stop-loss set at $99.40.

Looking at the S&P 500 CFD on a 30 minute chart, the index's advance was halted last week at 3550.00. Since then the index pulled back and found support at 3440.00 where it rebounded on Thursday, October 15th. If price can get above its 3516.00 resistance level, then it should allow for a retest of last weeks high at 3550.00. If price manages to break above 3550.00, it would be a bullish signal and the next target would be the all-time high of 3587.00. If price slips again then traders should look to the 3469.00 level for a bounce. If price does not find support at 3469.00, then it could find support at 3440.00. If price breaks below 3440.00, it would be a bearish signal that could send the index tumbling downward.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 08:33 AM