Ken Odeluga FTSE at risk of significant correction as global equities weaken

Whilst most major stock market investors were, eventually, gifted with a Christmas rally in 2014, it’s clear the year will not go down as among […]

Whilst most major stock market investors were, eventually, gifted with a Christmas rally in 2014, it’s clear the year will not go down as among […]

Whilst most major stock market investors were, eventually, gifted with a Christmas rally in 2014, it’s clear the year will not go down as among the best vintages for investing, with only modest single-digit performances in the largest equity markets.

Only the US’s broad S&P 500 index added more than 10%, with a 13% rise.

FTSE 100’s loss was approaching 3%, the Euro Stoxx 50 of top stocks in the bloc lost 1%, whilst Japan’s Nikkei 225 benchmark was about 8% better off than at the start of the year.

Following the annus horribilis global stock markets were subjected to, there are few surprises for stocks’ lacklustre performance.

The wider picture, of course, is the bearish trajectory these macroeconomic scenarios – and a few others – have set for much broader stock markets, namely the US’s S&P 500.

The FTSE itself faces similar challenges as it heads into a new year.

2014 was the year the FTSE 100 made its strongest attempt yet to reclaim the all-time closing high reached on the last day of the last century.

It was also a year in which the UK’s flagship stock index once again failed to touch its former zenith, with the subsequent loss of hundreds of points in the weeks that followed.

In technical analysis terms, these failures seem to have a behavioural charge behind them.

The frequent loss of momentum exhibited by UK-listed stocks on such occasions implies the market is re-basing expectations of future gains back down to lower levels.

Additionally, all chartists know that such repeated failures increase the likelihood of a significant correction.

Furthermore, the FTSE is getting tardy just as UK markets reach the cusp of a year of uncertainty.

FTSE 100 investors polled by Thomson Reuters singled out the UK’s general election – likely to be held in May 2015 – as another major factor contributing to concerns about the market outlook.

The Reuters poll of 49 traders, fund managers and strategists gave a median forecast for the FTSE 100 of 6800 points by the middle of 2015 and 7000 points – a record high – by the end of 2015.

Reuters polled the investors during the week beginning Monday 15th December and the results were published on Wednesday 17th.

The level of the FTSE 100 foreseen by the end of 2015, implied modest gains of slightly less than 7% above the index’s close on Friday 19th December, at 6545.27.

The FTSE 100 market participants on a median basis saw the index at 6331.83 by July 2015, and over 10% higher than that before 2016 begins. That still suggested only a moderate net gain for the entire year of 2015.

With the FTSE 100’s shaky year in perspective and the likelihood of an uncertain 2015 in mind, together with a broadly ‘top-down’ Modern Portfolio approach that has rotational leanings, we may be able to seek out tentative UK equity opportunities for the year ahead.

This leads us, quite logically, to the UK-listed market sectors that have weakened the most during the course of the year.

For a wider perspective of the UK market’s performance in the year up till Monday 22nd December, I’ve used constituents of the broad FTSE 350 index.

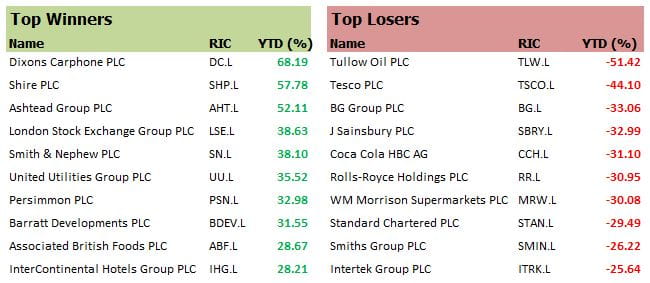

For a narrower, FTSE 100-focused perspective here is an excellent table.

Even without the broader table below, no rocket science was required to identify which groups were the year’s biggest losers, as they were often the ones that suffered the most public of collapses.

The broad energy sector was possibly the highest-profile loser, tracking a historic 50% fall in the price of Brent crude oil futures prices, from a high of $107.73 on 26th June to current prices around $49.49.

Much debate has ensued since this rout, about the upstream impact (Exploration & Production companies and their minions) and downstream (us, the consumers and our global economies).

On the one hand, there are arguments about how much more pain oil producers can take as cheaper oil squeezes margins further.

On the other hand, whilst the least well-off consumers may experience some benefit from the implied decrease of their expenditure on fuel, the benefits might be largely marginal for the majority.

Furthermore, many economists warned that rather than lower pump prices being a reason for cheer, they might instead be a symptom of slowing global growth that could tip the world into an outright economic slump.

These factors have made almost all firms in the global listed Exploration & Production sector (most of which will be small-to-medium-sized companies) riskier bets, based on profitability.

Financial risk management data provider, companywatch.net reported in December that according to its calculations, oil prices had fallen so deeply that 70% of all E&P firms were now unprofitable.

One aspect of the conundrum that had not been widely explored outside of highly-specialised circles until recently, is that the precipitous oil price drop is raising energy companies’ borrowing costs, reducing the amount they can borrow or pricing them out of the market altogether.

The price situation could also make it difficult for some companies to meet covenants on existing loans and prompt lead banks to ask for extra protection on future deals.

Average secondary loan prices for US oil and gas companies have dropped to 94.53% of face value by early December, down from a high of 100.01% in late January 2014, according to Thomson Reuters data.

The most obvious concern for investors in the UK’s ‘Big Oils’ is whether or not such companies will be able to increase or sustain dividend payments.

With the UK’s oil and gas sector typically paying close to the highest dividends in the London Stock Market, investors have tried to determine the level below which oil prices would have to dip before the ability of giants like Royal Dutch Shell and BP to increase dividends is jeopardised.

Estimates seem to currently range between $75 and $85 per barrel of oil equivalent as prices that crude would have to fall under for a sustained period (say two years or more) before BP and Shell would consider pulling dividends.

Well, the main Nymex-listed oil futures contract lost the $80 handle at the end of October 2014, whilst the more European-facing Brent Crude future listed on Intercontinental Exchange has traded under $85 since the beginning of November last year.

Outside of the OPEC production, regions such as China and Russia were calculated to have costs per barrel of as little $38 and under $15 respectively, according to a Bank of America Merrill Lynch report earlier this month. The investment bank estimated it costs almost $50 per barrel to produce oil from the North Sea. Obviously, each global oil major will have a greater or lesser concentration in all of these regions.

If you found this article useful, you might also want to read Kelvin Wong’s notes on US stocks to watch next year, James Chen’s technical analysis of indices, currencies and commodities for 2015, Ashraf Laidi’s 2015 FX outlook and his article on the dangers of underestimating deflation.