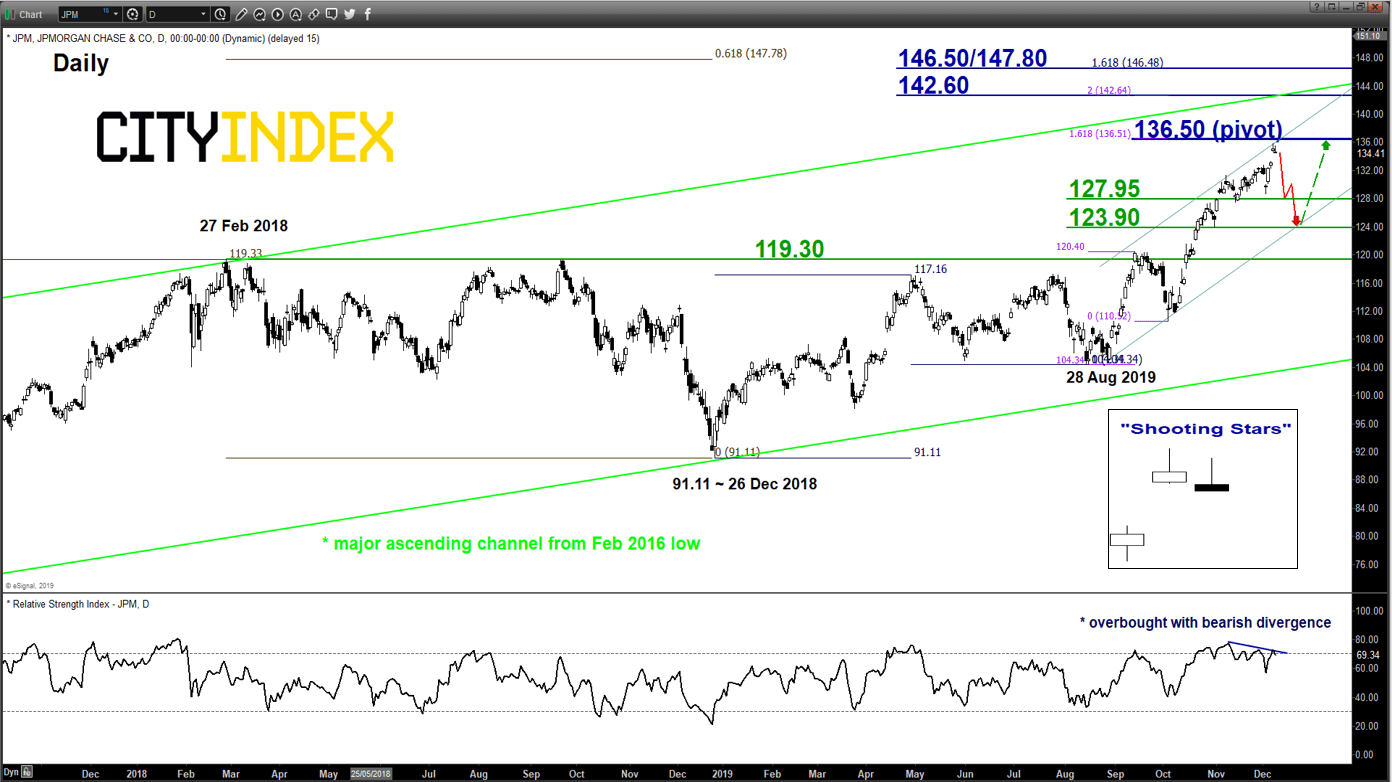

Medium-term technical outlook on JP Morgan Chase (JPM)

click to enlarge charts

Key Levels (1 to 3 weeks)

Pivot (key resistance): 136.50

Supports: 127.95 & 123.90

Next resistances: 142.60 & 146.50/147.80

Directional Bias (1 to 3 weeks)

JPM may see a corrective decline below 136.50 key medium-term pivotal resistance to target the supports at 127.95 and 123.90 before its impulsive up move sequence resumes within the major uptrend phase.

On the other hand, a clearance with a daily close above 136.50 invalidates the multi-week bearish scenario for the continuation of the rally to target the lower limit of the major resistance zone at 142.60 (Fibonacci expansion cluster & upper boundary of the major ascending channel from Feb 2016 low).

Key elements

- Price action of JPM has gapped up on last Fri, 06 Dec and ended with two consecutive daily “Shooting Star” candlestick patterns which indicates a potential bullish exhaustion where the odds of a bearish reversal increases at this juncture.

- The formation of the ‘Shooting Star” candlestick patterns has taken place right below the upper boundary of a medium-term ascending channel from 28 Aug 2019 low and a Fibonacci expansion cluster level at 136.50.

- The daily RSI oscillator has formed a bearish divergence signal at its overbought region which suggests that medium-term upside momentum has started to wane.

- The significant medium-term supports rest at 127.95 and 123.90 which are defined by the lower boundary of the medium-term ascending channel and the 23.6%/38.2% Fibonacci retracement of the recent rally from 03 Oct low to 06 Dec 2019 high.

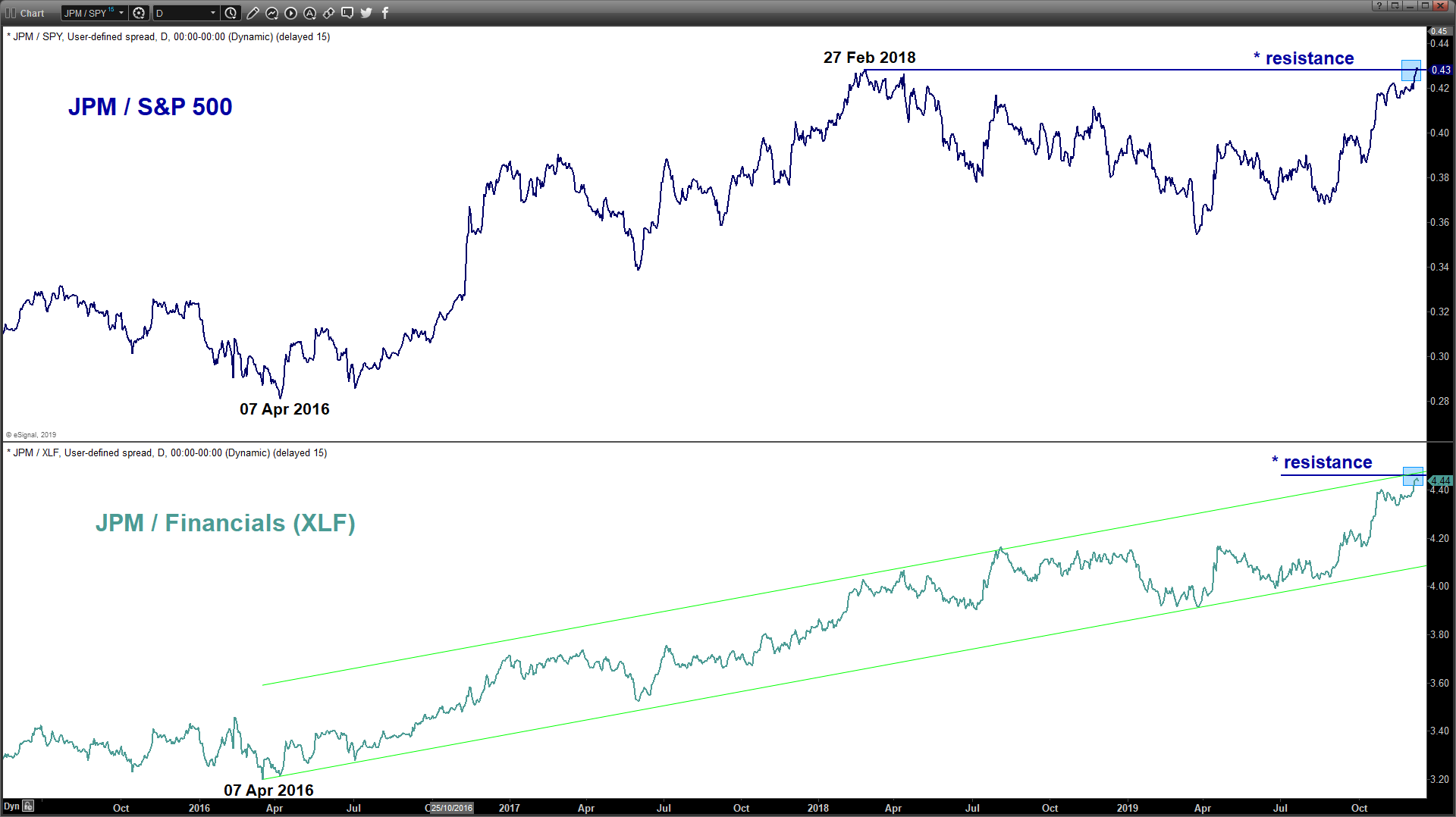

- The ratio charts of JPM against the market (S&P 500) and its sector (Financials) are indicating an “overstretched outperformance” condition for JPM.

Charts are from eSignal