Jiangxi Copper (358-hk): Upside Break-through Awaited

Copper prices have rallied to the highest level in more than a year in July. Chile's, the largest copper producer in the world, government agency Cochilco said the country's copper output is expected to drop 1.2%, or 69,400 tons, this year.

Citigroup pointed out that the base metal is recovering from the depths of the demand shocks that accompanied the Covid-19 pandemic, and expects a deficit in global copper market next year.

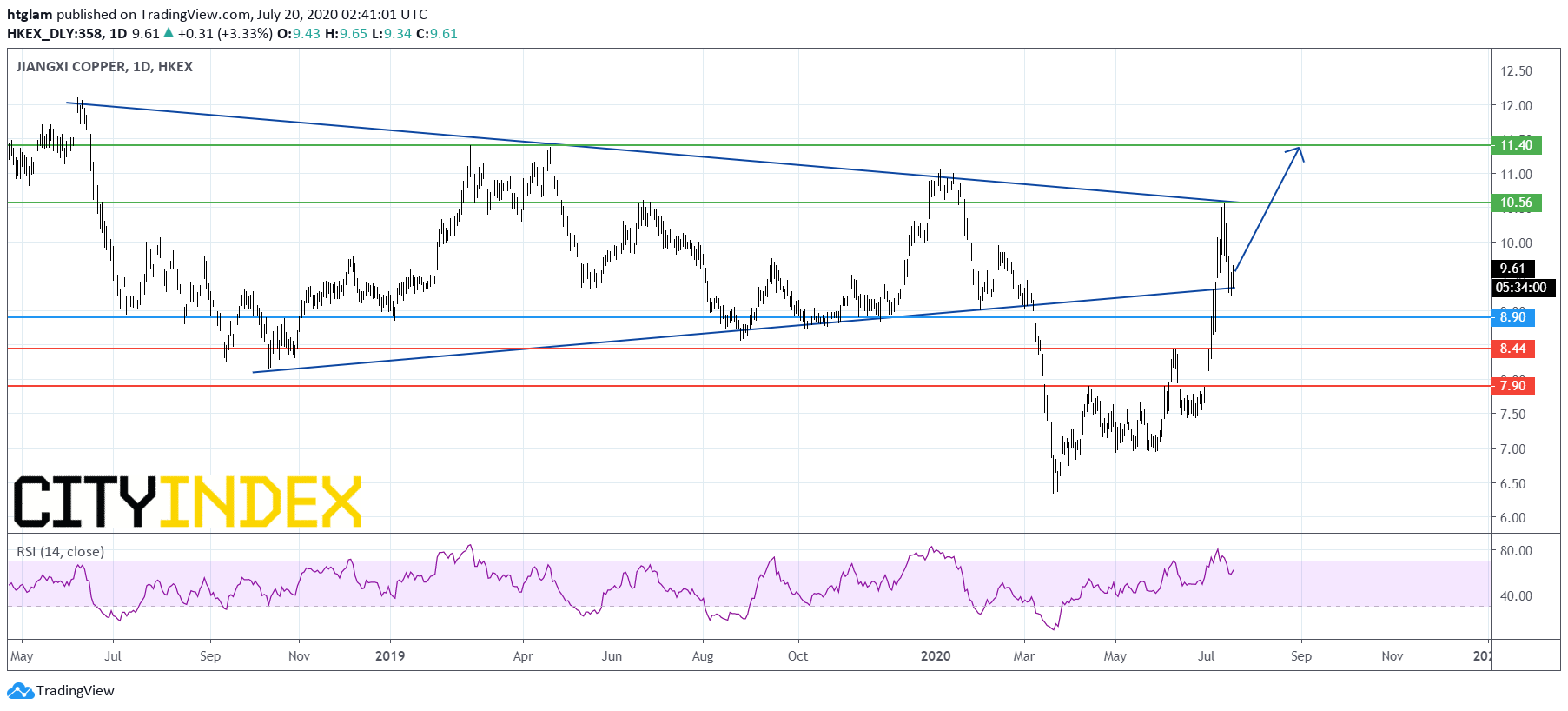

From a technical point of view, Chinese major copper miner Jiangxi Copper (358-hk) is gathering more upside momentum as shown on the daily chart. It has rebounded more than 50% from March's low and has broken above last year's low (which acted as a resistance). Bullish investors might consider $8.90 as the nearest support, while a break above the nearest resistance at $10.56 would open a path to the next resistance at $11.40. Alternatively, losing $8.90 would suggest a deeper price correction and may trigger a pull-back to the next support at $8.44.