On Friday, CME Copper Futures climbed 2.8% to a 1-year high at $3.291, as market sentiment was boosted by coronavirus vaccines development. Over the weekend, Regeneron Pharmaceuticals (REGN) reported that its REGEN-COV2, an antibody cocktail for Covid-19, has received Emergency Use Authorization from the U.S. Food and Drug Administration. The company said it "now expects to have REGEN-COV2 treatment doses ready for approximately 80,000 patients by the end of November, approximately 200,000 patients by the first week of January, and approximately 300,000 patients in total by the end of January 2021".

In fact, Goldman Sachs sees copper having the best potential among the metals and expects Chinese copper producer JiangXi Copper (358.hk) to benefit from rising copper prices.

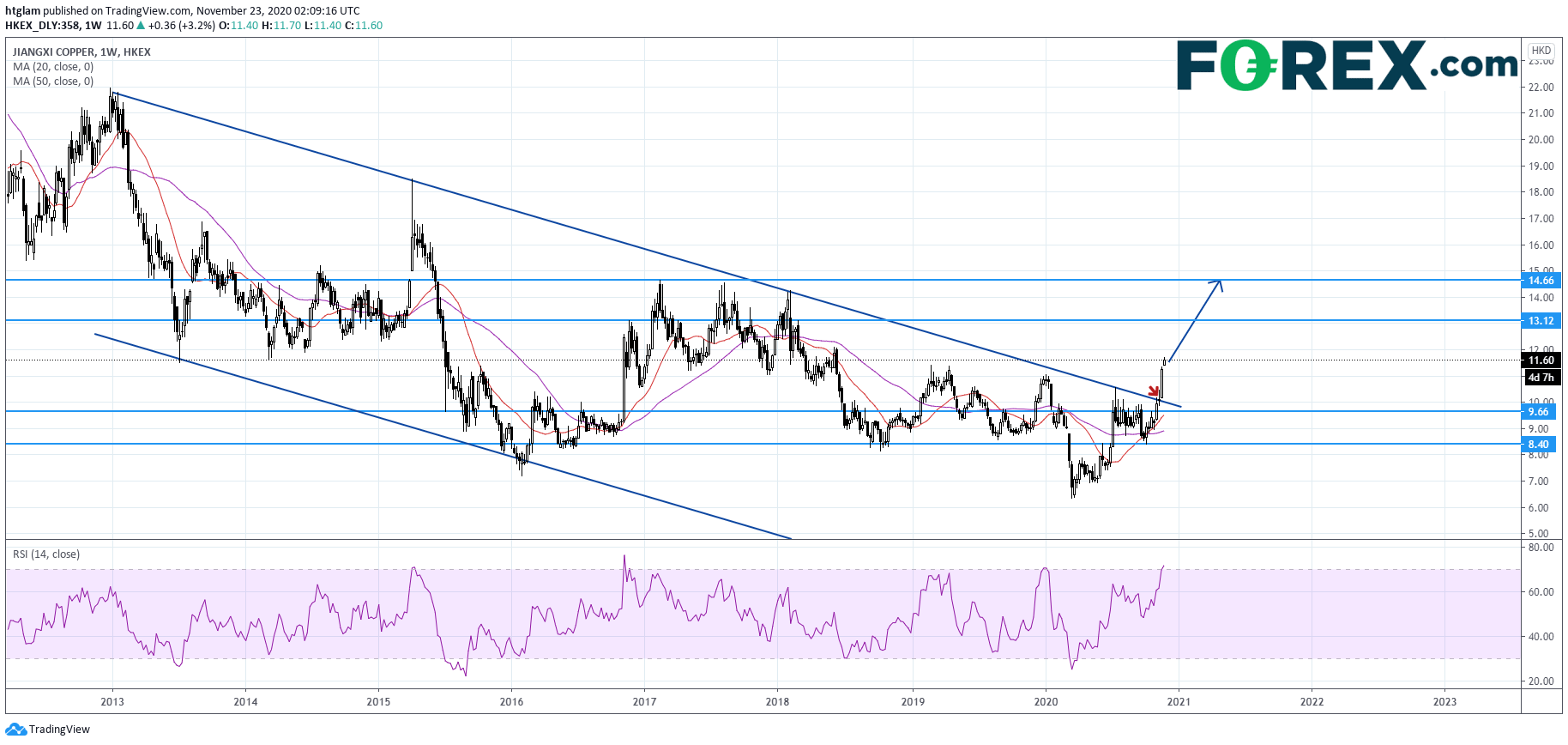

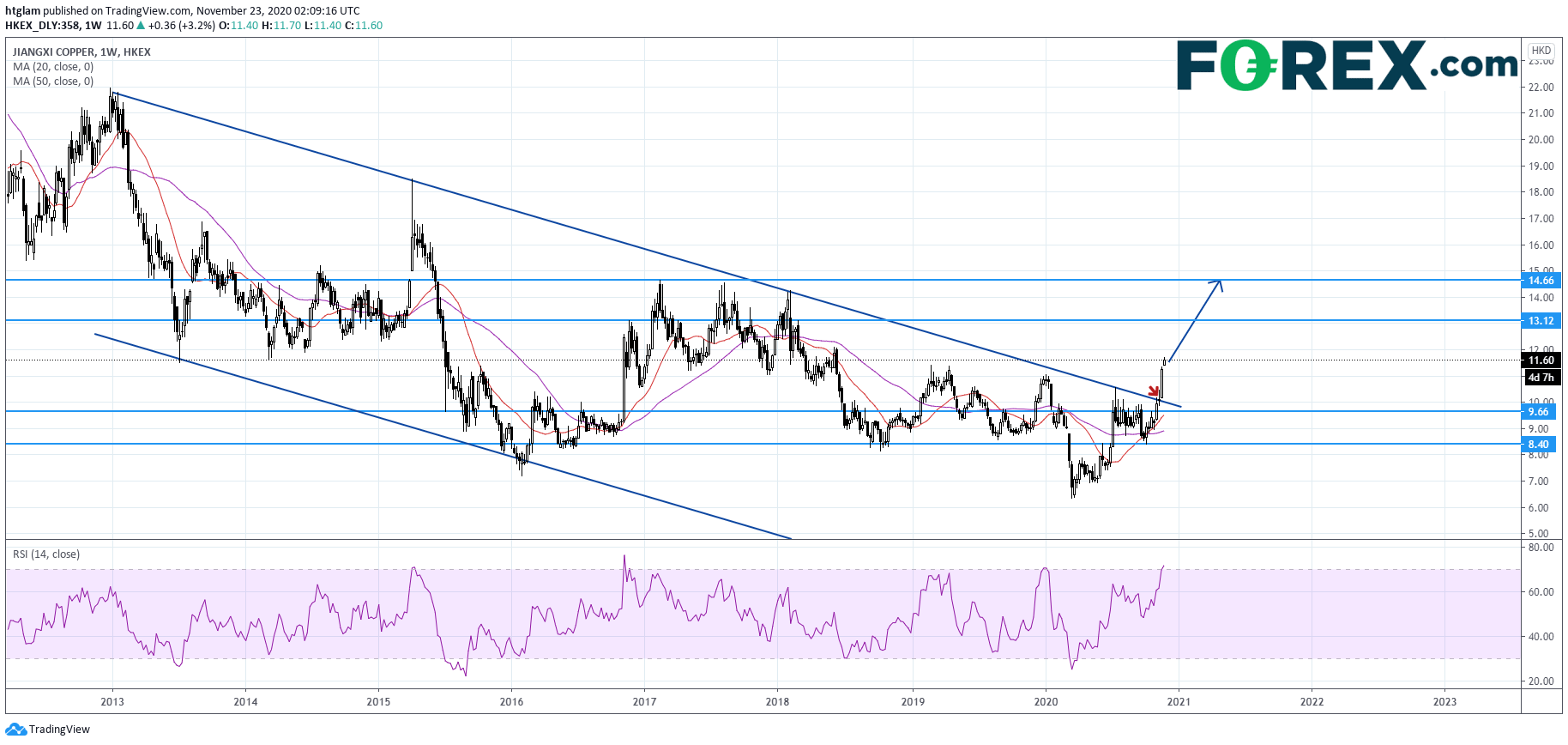

On a weekly chart, JiangXi Copper (358.hk) has broken above a long-term bearish trend line drawn from 2013, signaling a critical upturn. The level at $9.66 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $13.12 and $14.66 respectively.

Source: GAIN Capital, TradingView

In fact, Goldman Sachs sees copper having the best potential among the metals and expects Chinese copper producer JiangXi Copper (358.hk) to benefit from rising copper prices.

On a weekly chart, JiangXi Copper (358.hk) has broken above a long-term bearish trend line drawn from 2013, signaling a critical upturn. The level at $9.66 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $13.12 and $14.66 respectively.

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM