The sports retailer reported 10% growth in like for like sales. Pre – tax profits increased 6.6% to £129.9 million whilst revenues increases an eye watering 47% to £2.72 billion.

JD Sports' performance has been nothing short of stellar whilst the rest of the UK high street struggles with lower consumer spending and changing shopping habits. So why is JD sports doing so well in such a tough retail environment?

1) JD is tapping into the booming “athleiseurewear” trend. By successfully targeting younger customers who are driving the trend for athleisure, wearing sports clothes have become more acceptable in school, work and socially.

2) A sound strategy has helped expansion across Europe. 23 stores have been opened including the first in Austria. Although still early days there is a growing sense that JD sports is developing the same “emotional resonance” with European customers as it has with its core UK and Irish customers.

Areas of concern?

Whilst JD said that it enjoyed an encouraging performance in the US following the takeover of US retailer The Finish Line, the figures are not quite so convincing. Lower margins on Finish Line products saw a 1.3% decline in the retailers’ gross margin. The US brand has also seen the closure of 10 stores. Whilst expansion into Europe and Asia is going well, the US is proving a little more challenging so this should be an area to keep an eye on.

More upside to come?

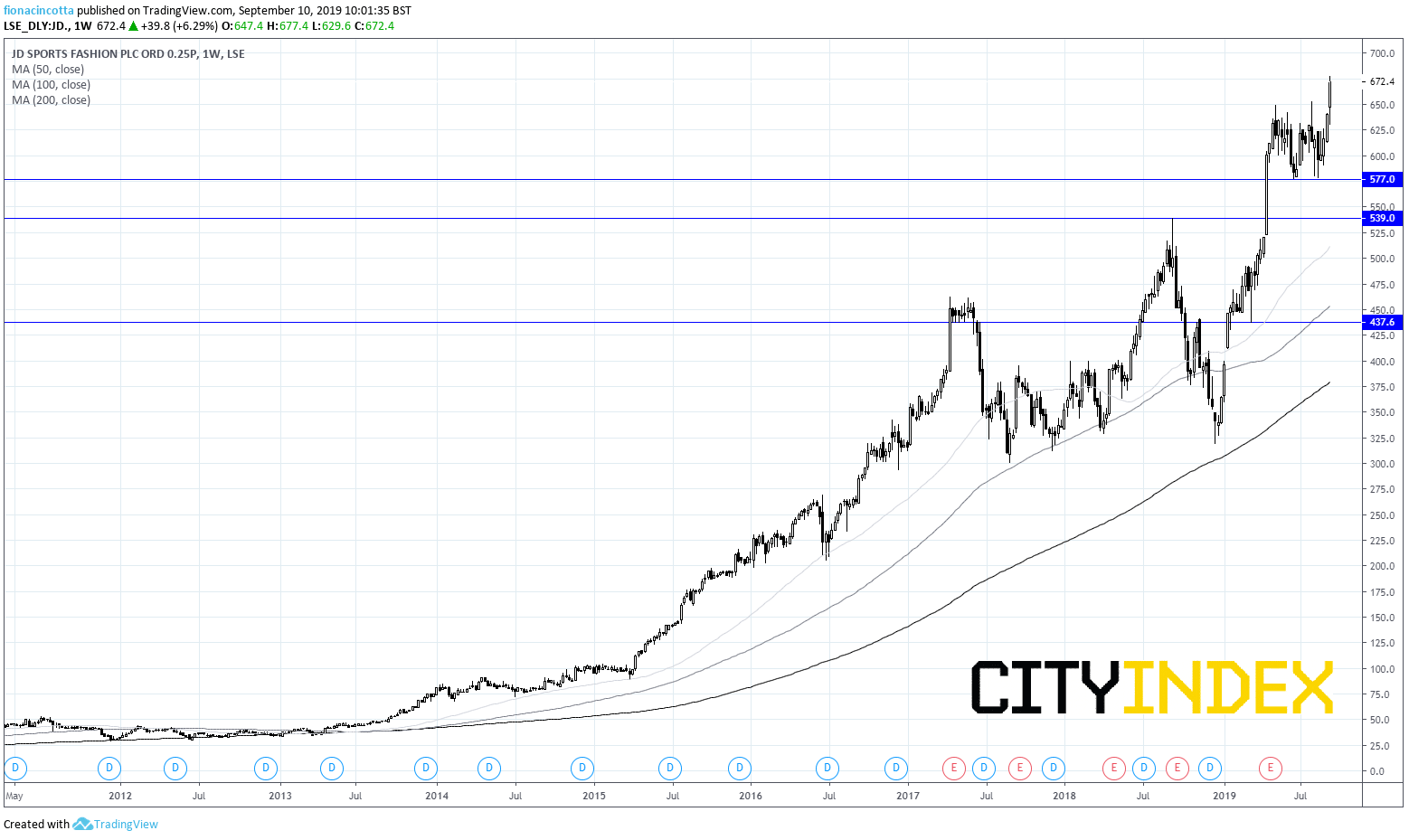

Despite a touch of weakness in the US, JD Sports has had a phenomenal run, lifting the share price by 5% in early trade and over 36% across the past 6 months. The strong growth shows no signs of slowing down.