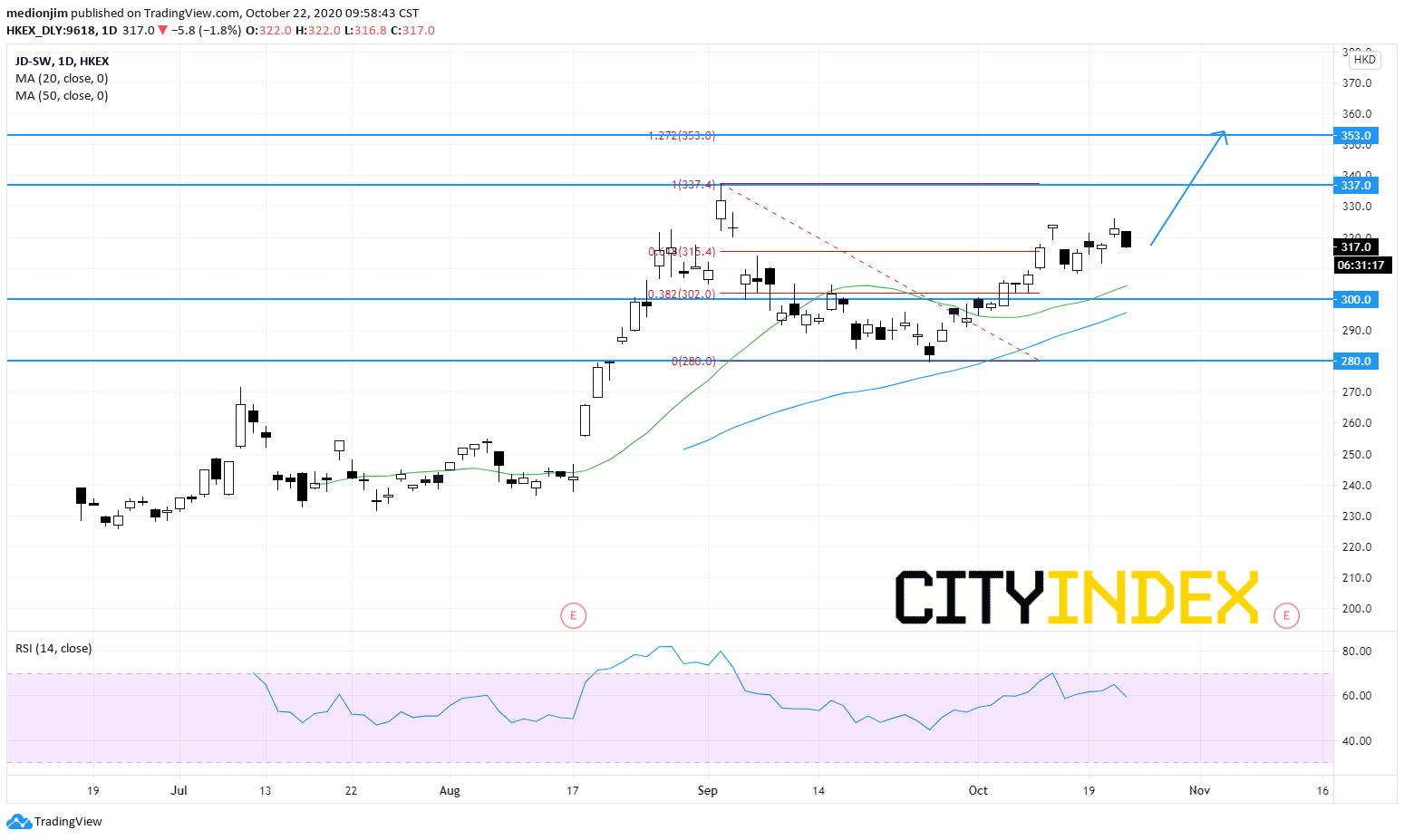

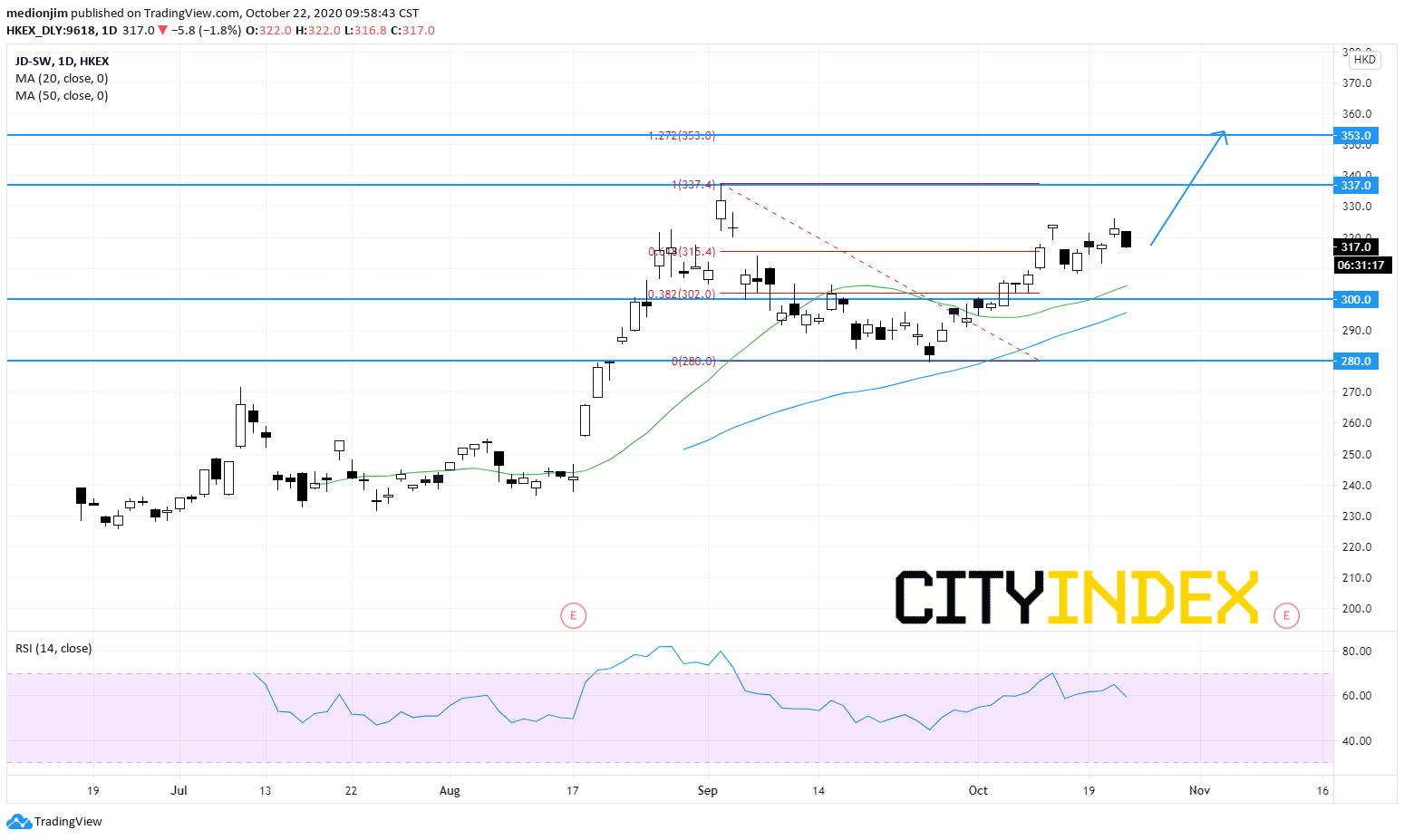

JD.com (9618.HK): Expecting to Challenge the High of August After the Consolidation

JD.com (9618), the second largest e-commerce company in China, rose from the IPO price at HK$226 to HK$322.8 as of October 21.

Recently, Credit Suisse raised the target price of JD.com to HK$380 from HK$311 and kept the rating at Outperform. The bank said that the company's 3Q 2020 revenue is expected to be solid (+25.8% on year), underpinned by healthy online consumption demand.

The company will release its 3Q result on November 11 with the expectation of EPS at HK$1.53.

From a technical point of view, the stock rebounded from HK$280 and returned the level above both 20-day and 50-day moving averages. Currently, the stock remains consolidating and standing above the 61.8% Fibonacci retracement level, which suggests that the stock has a chance to challenge the August's high.

The bullish readers could set the nearest support level at HK$300, while the resistance levels would be located at HK$337 and HK$353.

Source: GAIN Capital, TradingView

Recently, Credit Suisse raised the target price of JD.com to HK$380 from HK$311 and kept the rating at Outperform. The bank said that the company's 3Q 2020 revenue is expected to be solid (+25.8% on year), underpinned by healthy online consumption demand.

The company will release its 3Q result on November 11 with the expectation of EPS at HK$1.53.

From a technical point of view, the stock rebounded from HK$280 and returned the level above both 20-day and 50-day moving averages. Currently, the stock remains consolidating and standing above the 61.8% Fibonacci retracement level, which suggests that the stock has a chance to challenge the August's high.

The bullish readers could set the nearest support level at HK$300, while the resistance levels would be located at HK$337 and HK$353.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM