Japan is considering state of emergency - JPY under pressure

The USD/JPY is rebounding as investors are considering riskier assets than the Japanese yen, usually considered as a safe haven. Otherwise, Japanese Prime Minister Shinzo Abe said his government will announce a state of emergency in seven regions amid the coronavirus outbreak, and is preparing a 108 trillion yen stimulus package to support the economy.

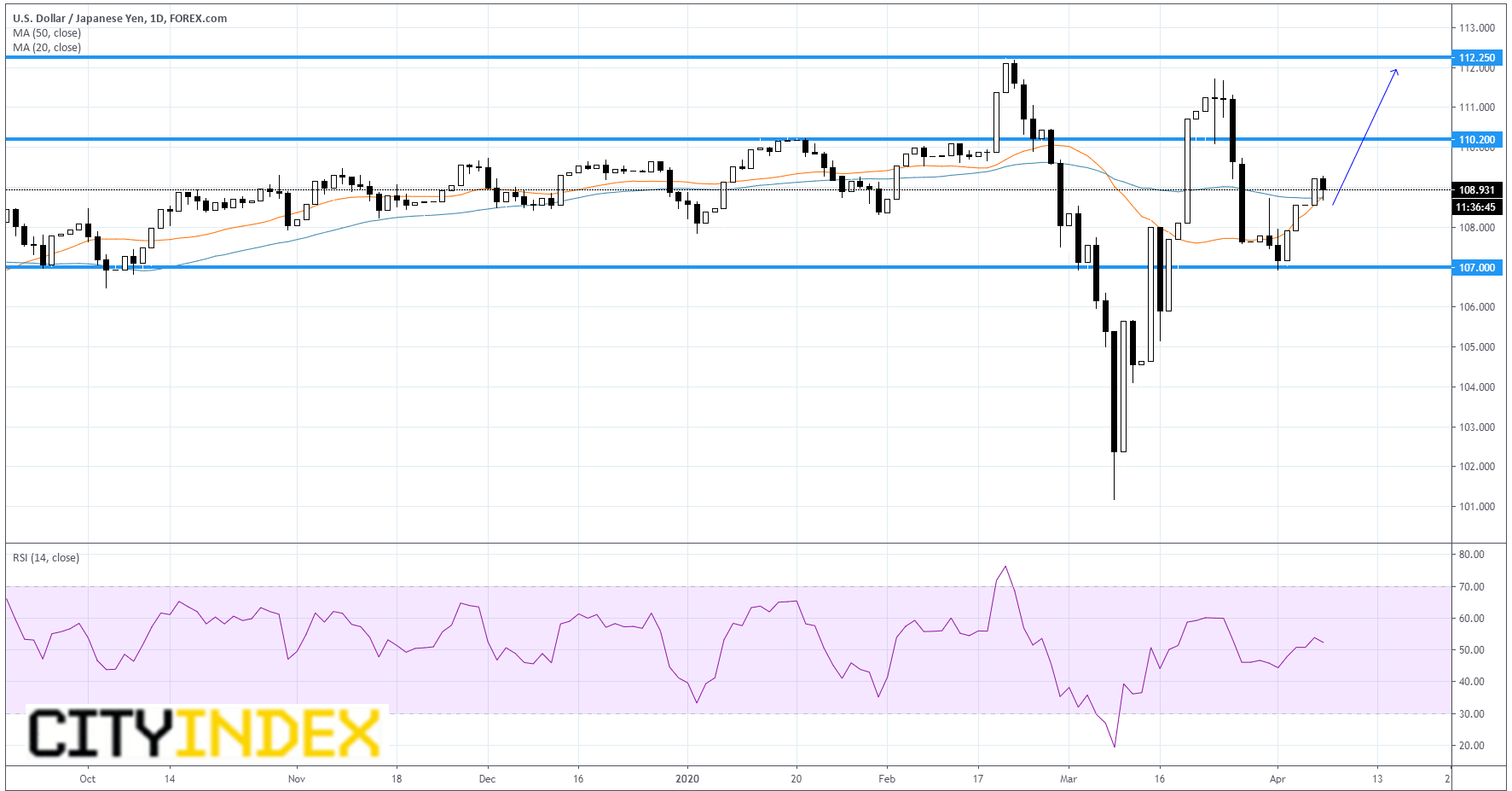

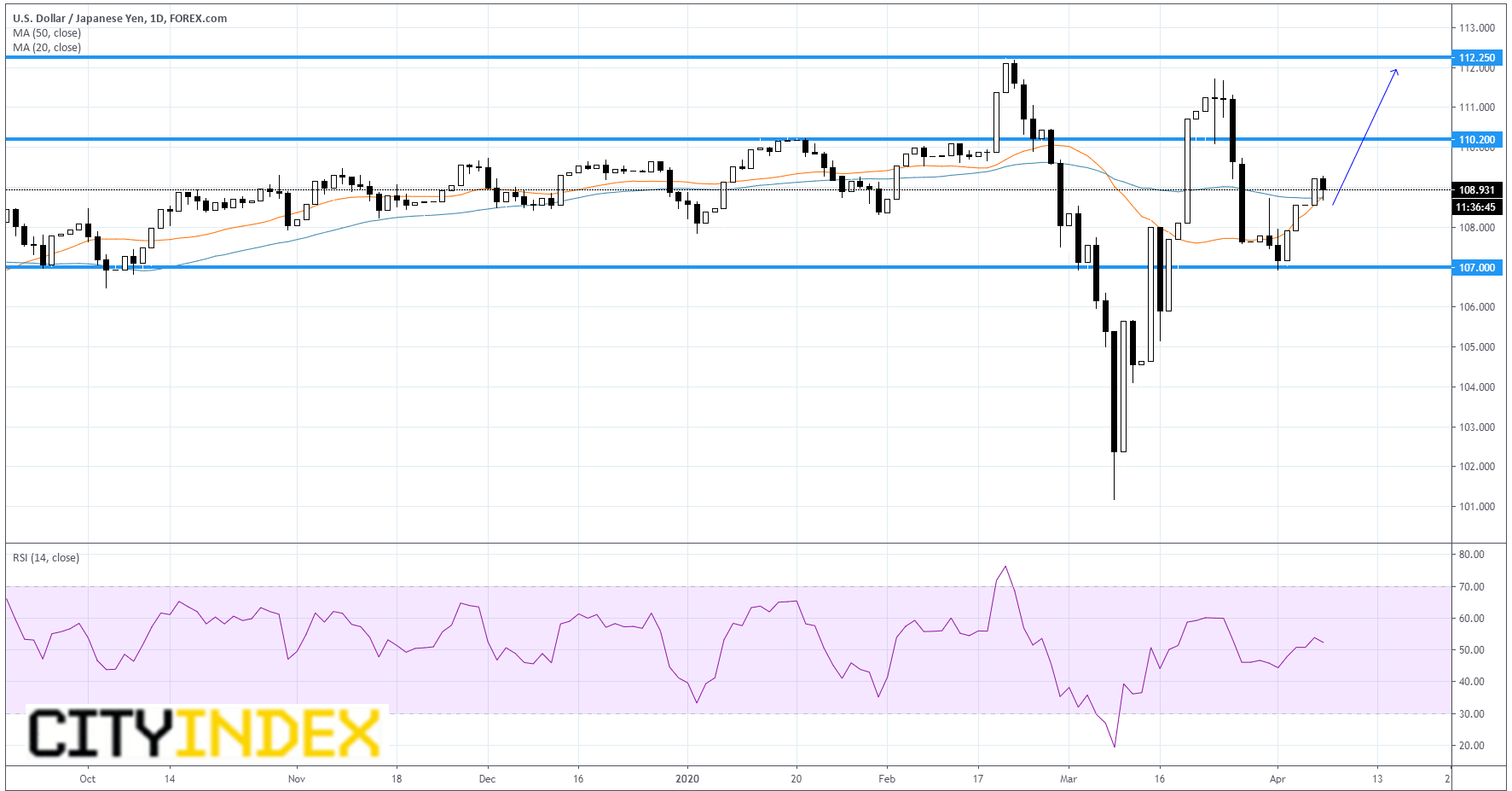

From a technical point of view, the pair has rebounded above its April bottom at 107.00 and stands above its 50-day moving average. The daily RSI also stands within its buying area between 50 and 70. Readers may therefore consider the potential for further advance towards horizontal resistance at 110.20 and towards Feb. 20 top at 112.25 as long as 107.70 holds on the downside.

From a technical point of view, the pair has rebounded above its April bottom at 107.00 and stands above its 50-day moving average. The daily RSI also stands within its buying area between 50 and 70. Readers may therefore consider the potential for further advance towards horizontal resistance at 110.20 and towards Feb. 20 top at 112.25 as long as 107.70 holds on the downside.

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM