Japan 8217 s Tankan amp China 8217 s PMI Preview

Before previewing tonight’s key market-moving date from Asia, namely Japan’s quarterly tankan survey and China’s PMI readings, it’s worth mentioning the unexpectedly upward revision in […]

Before previewing tonight’s key market-moving date from Asia, namely Japan’s quarterly tankan survey and China’s PMI readings, it’s worth mentioning the unexpectedly upward revision in […]

Before previewing tonight’s key market-moving date from Asia, namely Japan’s quarterly tankan survey and China’s PMI readings, it’s worth mentioning the unexpectedly upward revision in UK Q4 GDP and the continued (but slow) improvement in Eurozone CPI. Sterling powered ahead to the top of currency performers for the day, followed by the yen as stocks erased most of Monday’s gains.

The preliminary estimates for Eurozone March inflation showed an improvement to -0.1% y/y from -0.3% in February, in line with most market estimates. The figure improved for two consecutive months following a record low of -0.6% in January.

When excluding volatile energy and food items, inflation slowed to 0.6% y/y from 0.7%.

The report suggests the euro’s 12% and 8% decline against USD and GBP so far this year may be starting to help import some inflation, while price expectations are moving in the right direction as the ECB embarks in its asset purchase program of €60 bn per month.

And as long as the Fed is expected to raise interest rates later this year, the policy divergences will keep euro under pressure to the benefit of the ECB’s “reflationary” policy.

PM Cameron could not have wished for a better headline figure to deliver during his campaigning for next month’s general elections.

The final reading on UK Q4 GDP was revised upwards to 3.0% y/y, from the earlier reading of 2.7%, matching the rate of Q3 2007. We’d have to go back to Q2 2006 when growth last rose above 3.0% at 3.5%.

Overall 2014 GDP was revised to 2.8% from prior estimate of 2.6%. The major contributions emerged from net exports, up 0.9%. While Q4 current account deficit eased to 5.6% GDP from 6.1% of GDP in Q3, the overall figure for 2014 rose to a new record high of 5.5% GD, highlighting the growing twin imbalances in the economy.

Oil markets remain on hold as Iran and the world’s major powers negotiate the OPEC nation’s nuclear program. Oil was had initially extended selling in early European session on speculation that a deal would lead Tehran to increase oil exports and bring an additional 1 million barrels per day once existing sanctions are lifted.

Wednesday’s busy Asia/Pacific schedule starts with the release of the Japan’s Q1 Tankan survey (due at 00:50 London time), with the large manufacturers survey seen at +16 from +9 in Q4. The survey on large non-manufacturers’ outlook is seen at +18 from +15. Make sure you watch the tankan “outlook”, not the “index”.

Traders will also scrutinize the outlook for capital expenditure, which is expected to have slowed to +0.5% from +8.9% in 4Q. The capex component of the tankan survey has frequently been the most market-moving component of the survey.

Bank of Japan governor Kuroda reiterated earlier today his prediction for price gains to pick up considerably later this year. Borrowing a page from most central banker’ book, Kuroda said a decline in CPI would be temporarily due to effects of oil, before likely reaching 2% in or around in FY 2015.

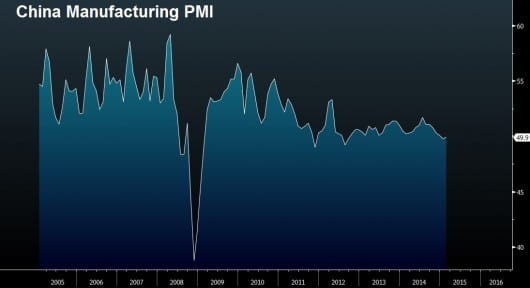

Two days after Chinese officials offered the strongest hint of further policy easing, the PMI figures are due for March at 01:00 GMT (02:00 BST) . Manufacturing PMI is expected to slow to 49.7 from 49.9, while services PMI is seen also weakening from 53.9. Markets will also watch the HSBC version of the PMI figures due 45 mins later.

Earlier this week, China’s central bank chief said “inflation is also declining, so we need to be vigilant to see if the disinflation trend will continue, and if deflation will happen or not”, allowing for the possibility of interest rates and “quantitative” measures.

Beware that the prevailing market reaction of each disappointment in Chinese figures has been USD-positive. A deeper contraction in the official manufacturing PMI could sway most analysts to call for an April RBA rate cut, rather than wait until May. AUDUSD could resume downside near 0.7300. Although USDJPY has broken above 120, it remains dragged by intermittent yen strength, which could way resurface from further Chinese weakness.