January rally could lift markets higher in the short term

The January effect, where stock markets could move higher for the first five trading days, may provide Bullish momentum at the start of this New […]

The January effect, where stock markets could move higher for the first five trading days, may provide Bullish momentum at the start of this New […]

The January effect, where stock markets could move higher for the first five trading days, may provide Bullish momentum at the start of this New Year. So far the markets have held above support levels and continue to show strength which is indicating that more upside is likely heading into the end of this week but traders should be aware of the support levels which will need to be respected if the Bulls are going to remain in control. The UK market seems to show more strength compared to the US, which is a Divergence that may cause concern over the coming weeks. See key levels below:

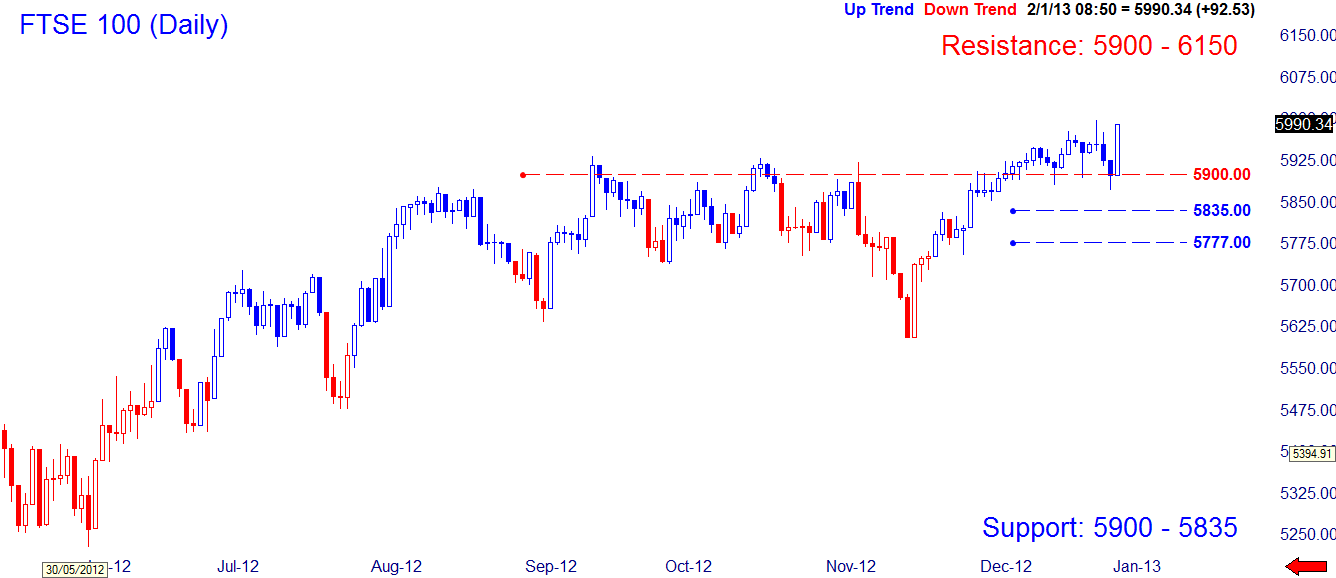

FTSE 100 targeting 6150 level

Last year closed on a positive note and the UK FTSE 100 index has managed to hold firmly above the 5900 resistance level which has now become support. The index continues to enjoy its bullish momentum which started in November and this looks set to continue as long as the resistance targets are cleared. Over the next few weeks the FTSE 100 will need to hold 5900 but if a pullback occurs we may see 5835 being tested. As long as we do not see a change in momentum this should not be a major concern. From a pattern perspective we see the classic higher highs and higher lows supporting a Bullish case for January – February.

Dow Jones reaches 12900 support

As expected the US Dow Jones index reached and has held support level at 12900. As long as we see this level holding, the cushion may provide an opportunity to launch a move towards the 13338 level. This has already proved to be a barrier during December and once surpassed the index may seek to reach 13550 over the coming weeks. However, the Dow Jones has not turned Bullish from a momentum basis and this may hold back the index unless we see a sharp thrust over the next few days. Failing this scenario could place the Dow Jones back into a weak state and drag the index lower below 12900.

Crude Oil reaching for $100.00

December saw Crude Oil hold above key support at $89.00 and has so far shown signs of strength for this commodity. If Oil continues higher in January then the $100.00 level may be cleared, paving the way for $125.00 per barrel by the first half of this year. But the push higher may not be a smooth ride and Crude Oil will likely face hurdles along the way. An alternative scenario may arise where we see a range bound environment ranging from $90.00 – $100.00 before a breakout occurs. Currently Oil has turned Bullish on a momentum basis and next week will provide further clue.