Virtual or not, the markets will be watching regardless, the US Dollar, the Dow and Gold often experience heightened volatility around the event.

All eyes are on Federal Reserve Chair Jerome Powell’s keynote address due 2:10pm (UK time). The Fed Chair is expected to pre-announce the findings of the Monetary Policy Framework review, a review of the Fed’s policies and practices to deal with the “new normal” which is slow global growth, low inflation and low interest rates.

ATI Chatter

If Jerome Powell were to talk about average inflation and the adoption of Average Inflation Targeting (ATI) traders will be sure to take note.

ATI is important because it will mean a change in policy from a firm inflation target to one which permits an overshoot over time. This would be a hint to the market that the US central bank would allow inflation to stay above 2% for a while, essentially meaning that interest rates will stay lower for longer.

EUR/USD

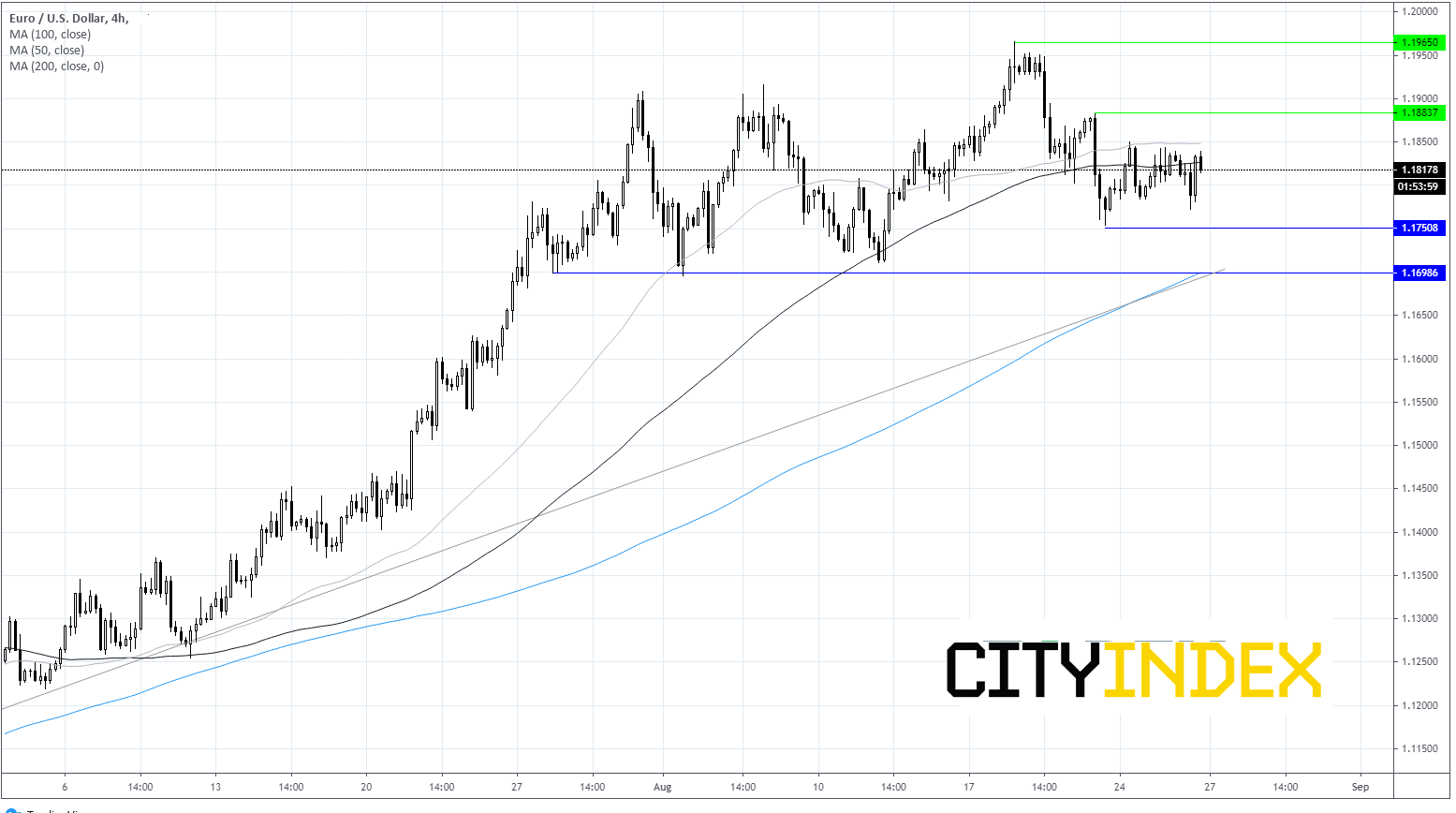

The EUR/USD trades -0.15% on Wednesday, with little change ahead of Jerome Powell’s speech at Jackson Hole. The pair is trading at 1.1815, towards the upper end of the daily traded range of $1.1772 - $1.1839.

On the four-hour chart, the price trades below the 50 sma and 100 sma suggesting more weakness could be on the cards. Although it trades above its ascending trendline and 200 sma.

Immediate support can be seen at $1.1750, a break through here could open the door to $1.17. Resistance can be seen at $1.1825 &$1.1850 (50 & 100 SMA) and $1.1885.