In response to the US airstrike which killed two senior pro-Iranian officials, the Iraqi parliament voted to dispel foreign troops, in a move which would make US presence in Iraq an occupation (an invasion). There are currently around 5000 US troops Iraq.

There had been speculation that Iran were planning to retaliate via cyberattacks or targeting US bases and civilians. And by Saturday, the homepage of the US government library’s website had been altered to show a picture of Trump being punched in the face alongside a pro-Iranian message. In a bid to fend off attacks against US civilians or bases, President Trump tweeted a stern warning against such move.

“The United States just spent Two Trillion Dollars on Military Equipment. We are the biggest and by far the BEST in the World! If Iran attacks an American Base, or any American, we will be sending some of that brand new beautiful equipment their way...and without hesitation!”.

Well, not everyone appeared to have read the tweet, or it was simply ignored. Hours ago it’s been reported that one an attack on a military base in Kenya resulted in the death of a US military service member and two US contractors. Oh, and that Donald Trump has an $80 million bounty for ‘his head’. So, tensions are unlikely to recede any time soon.

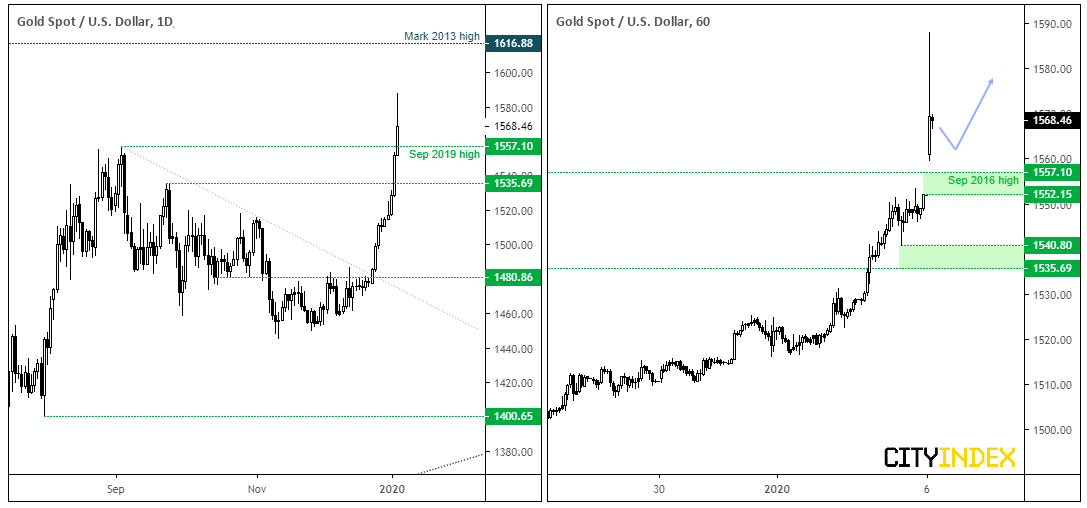

XAU/USD: Gold prices were already soaring ahead of the weekend but developments since Friday’s close have resulted in an explosive move higher. Between Fridays close and today’s high, it’s appreciated an impressive $36, bringing its current 2-day total to over $61.

When events of this magnitude unfold, traditional technical analysis techniques such as overbought/oversold and sometimes key levels bare little relevance. As just one example, net-long exposure to gold has been signalling a sentiment extreme since August yet that hasn’t stopped speculators pushing the yellow metal materially higher. So, whilst tensions remain elevated, the bullish bias on gold remain despite many signs of overextension on a technical basis. Of course, if we somehow see these tensions fully recede, gold could find itself vulnerable to a heavy sell-off.

For now, the September high and Friday’s close suggest a zone of support around 1552. Given we’ve seen such a large spike on the hourly, traders may want to see prices consolidate further before entering unless we see fresh developments supporting gold further.

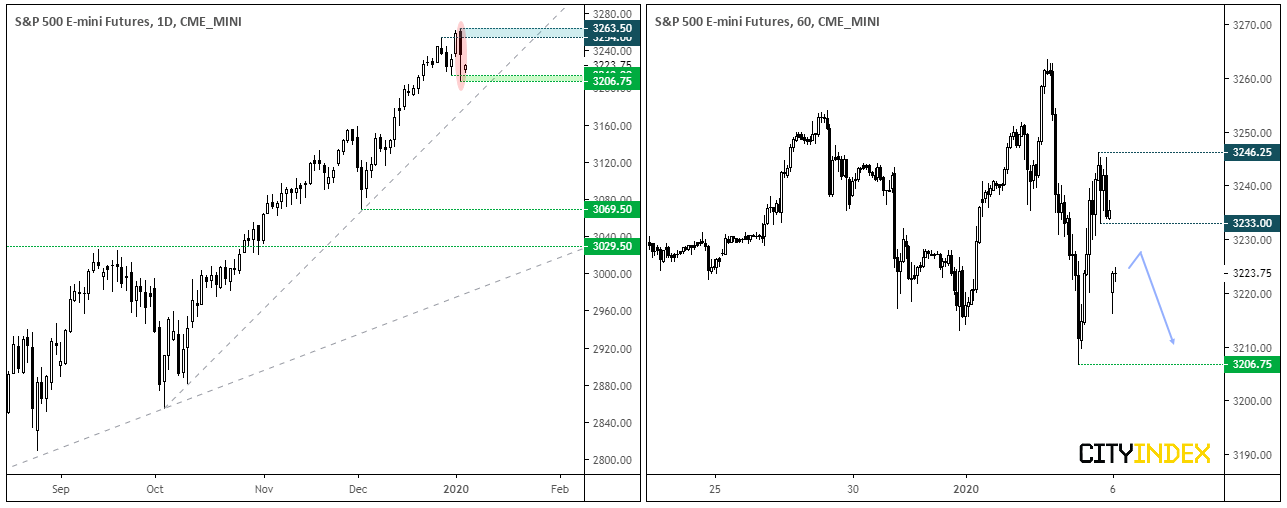

S&P 500 E-mini Future: The index closed the week with a bearish engulfing, outside week (both the open-close and high-low engulfed their respective prior session). Whilst this may or may not prove to be the beginning of a larger correction, bears are in control over the near-term and the bullish trendline from the October low make a viable target.

- The hourly chart is consolidating after gapping lower, making 3233 a level for bears to consider fading into.

- 3026 is the initial bearish target, whereas a break beneath it brings the October trendline into focus.

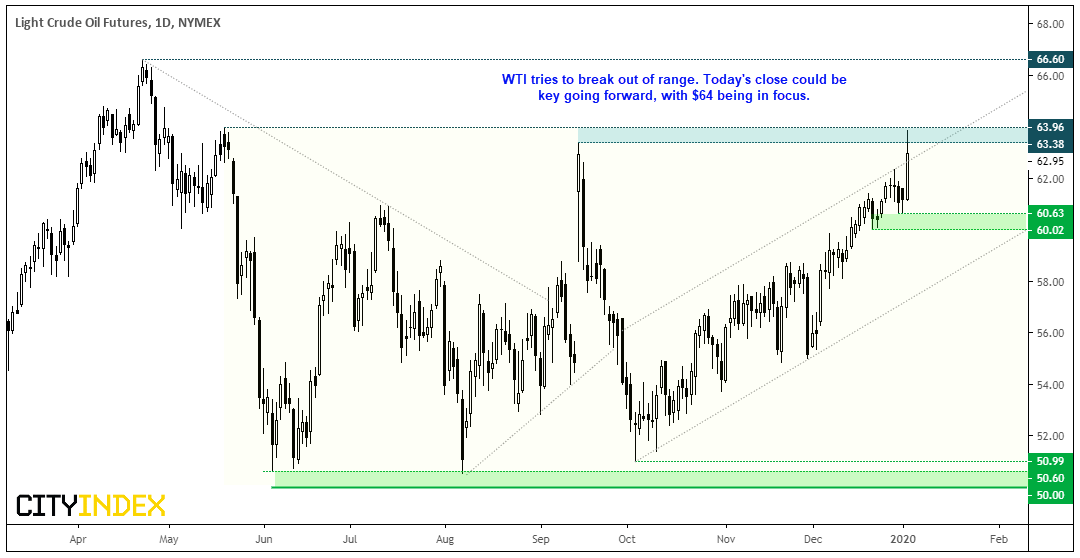

WTI: As outlined on Friday, $64 is a pivotal level and despite gapping higher over the weekend, continues to cap as resistance. In similar vein to gold and S&P futures, traders would be wise to wait for a retracement and / or volatility to subside before committing although the direction for WTI is less clear given it remains below key support. SO around current levels, WTI could better serve as a sentiment tool to use alongside gold and S&P, or simply wait for a break above $64 to assume bullish trend continuation.

Related Analysis:

Gold – A Thing of Beauty

OIL MARKET WEEK AHEAD: Iran’s Possible Scenarios