Polls are neck and neck between the three primary candidates, Taro Kono, Sanae Takaichi, and Fumio Kishida. All three have promised to put together a stimulus package to help regain the growth momentum in an economy struck by the third wave of Covid during July and August.

Taro Kono is the favorite contender amongst the Japanese public. However, his left-leaning views on social issues and his opposition to nuclear power put him offside with the party's conservative elders.

If elected, hard-line conservative Sanae Takaichi would become Japan's first female Prime Minister. Her policies around fiscal expansion and monetary easing are the most aggressive of the three leading contenders and would be the most beneficial for USDJPY and the Nikkei.

The third genuine contender is Fumio Kishida. Kishida is a moderate, and although he has received only modest support in the polls, he is viewed as the safest choice by party members.

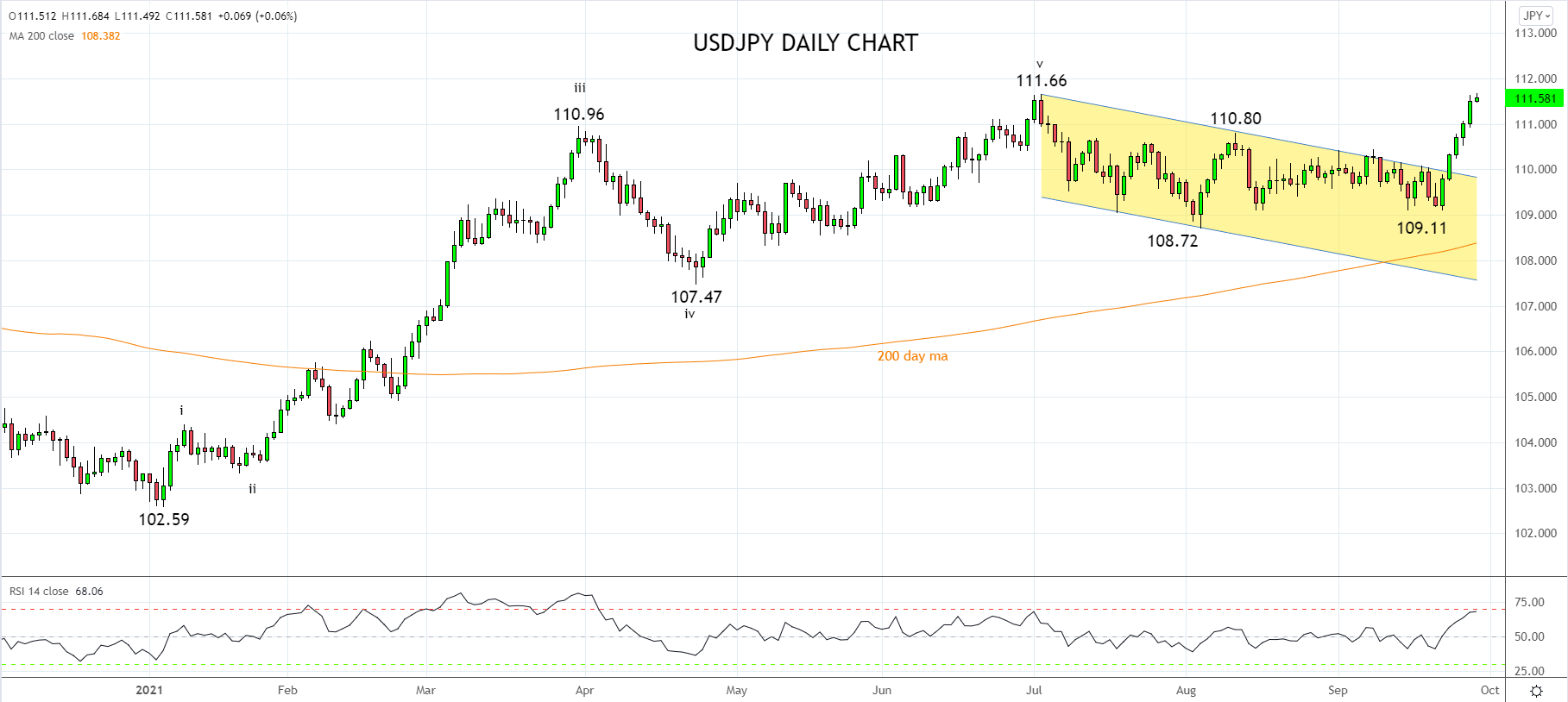

After breaking above trend channel resistance at 110.10 noted last week, USDJPY has since rallied strongly to make a new cycle high this morning at 111.68.

Aside from the technical drivers mentioned above, the rally has been aided by higher U.S. yields and rising energy prices as Japan is totally reliant on energy imports.

From here, a break and daily close above 111.66ish would open the way for USDJPY to test the next resistance zone at 112.20/40 before a move towards medium-term resistance 114.50ish. Stops on long positions should be raised to 110.70.

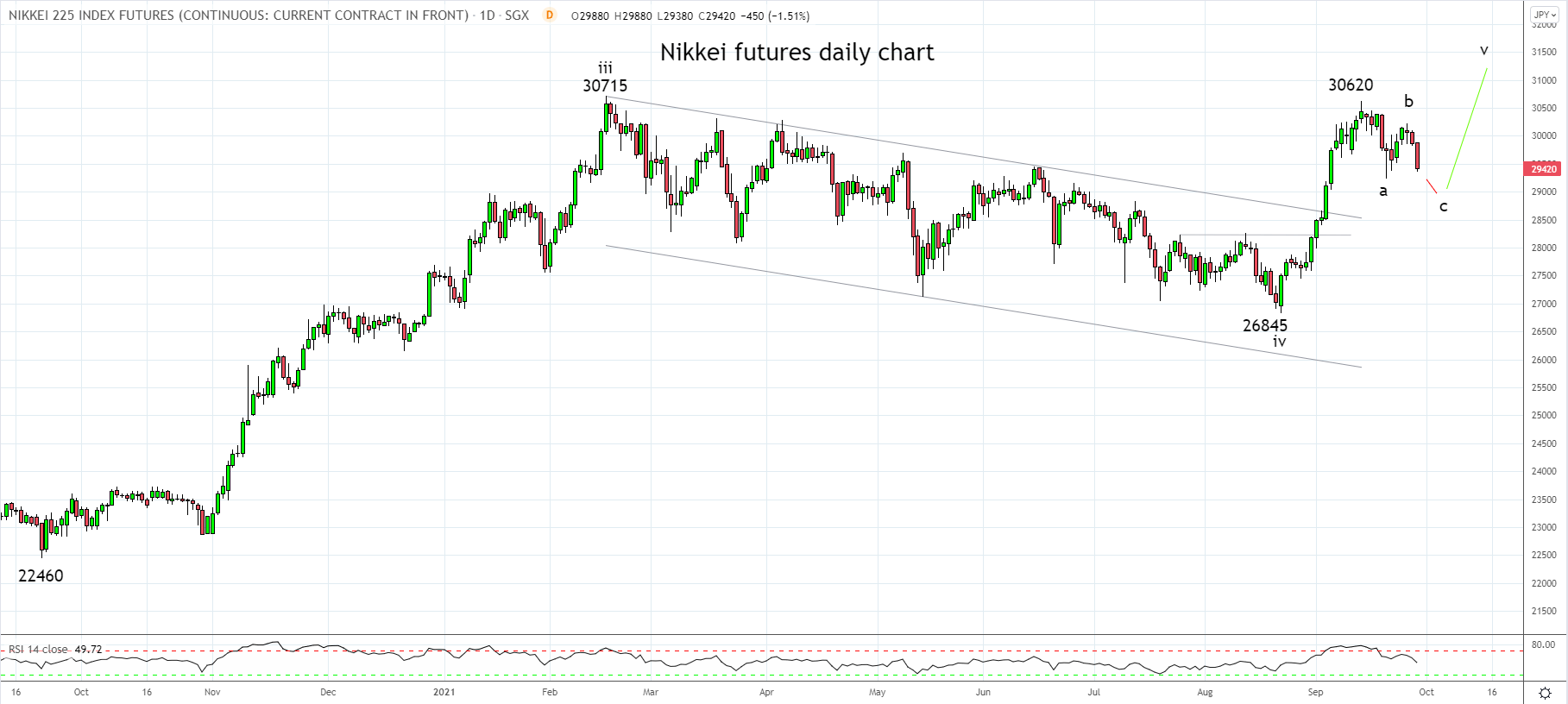

In our last article on the Nikkei, after a good surge higher it was suggested to take profit on Nikkei long positions and look to rebuy dips. "After the Nikkei futures almost reached the 30715 high/target yesterday, the market is displaying signs of being overbought in the short term. As such, we would consider closing longs here and look to rebuy the Nikkei into weakness in coming weeks."

The Nikkei appears to be tracing out Wave c of a three-wave pullback that targets a move back into the 30,000/28,000 support region. Should signs of basing emerge within this support region, long Nikkei positions should again be considered.

Source Tradingview. The figures stated areas of September 29, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation