Italy is downgraded

Rating agency Fitch has downgraded Italy's rating to "BBB-" from "BBB+" with a stable outlook, saying "the downgrade reflects the significant impact of the global Covid-19 pandemic on Italy's economy and the sovereign's fiscal position." This decision puts more pressure on the single currency ahead of the ECB meeting tomorrow.

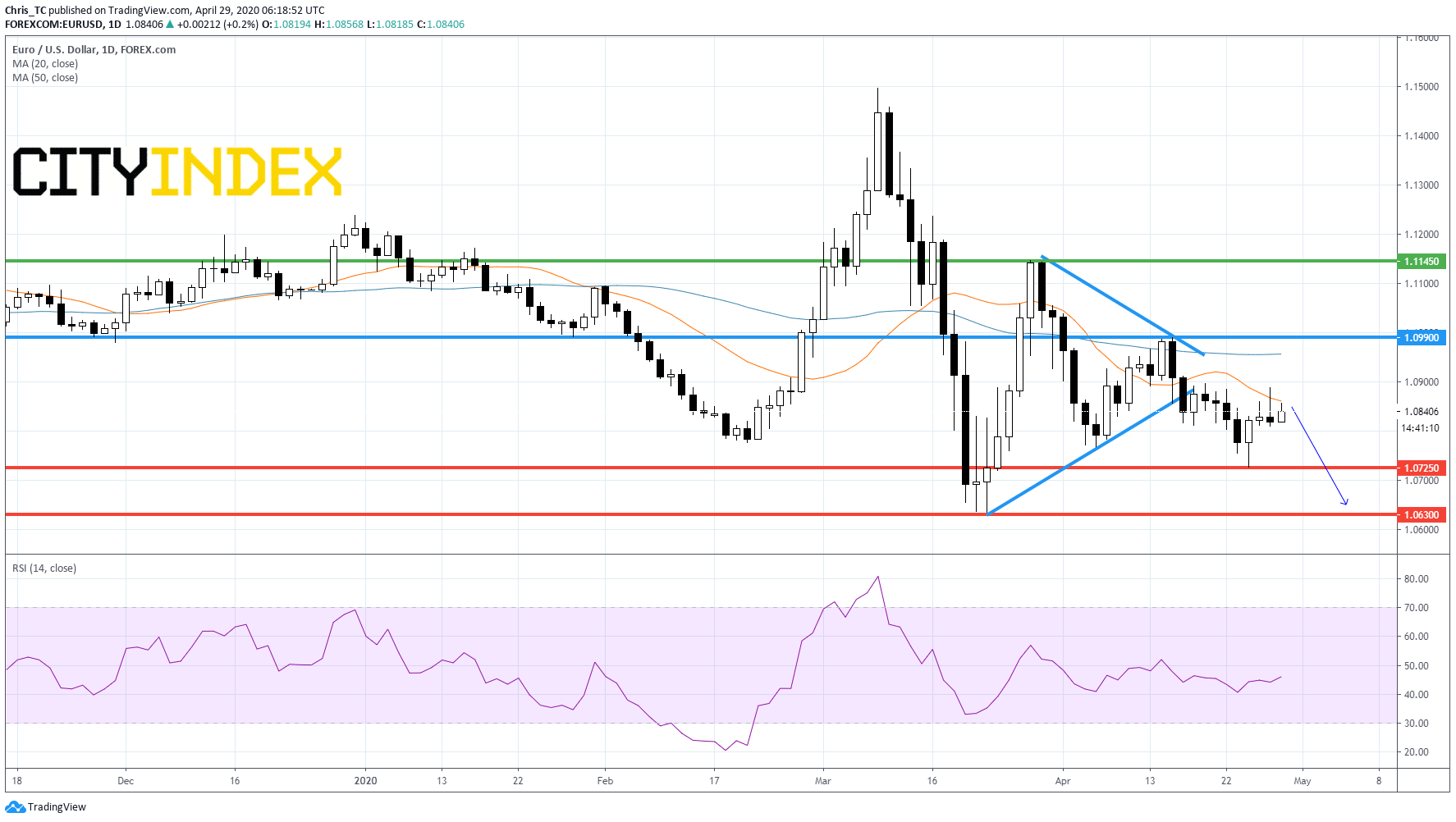

From a technical point of view, EUR/USD has escaped from triangle pattern in place since March and is capped by its 50-day moving average (in blue). The daily RSI stands within its selling area between 50 and 30. Readers may therefore consider the potential for further weakness below Apr. 14 top at 1.0990. The nearest support would be set at horizontal support at Apr. 23 low at 1.0725 and a second one would be set at set at March bottom at 1.0630 in extension.

Source: TradingView, GAIN Capital

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM