It may be Time to Buy Yen

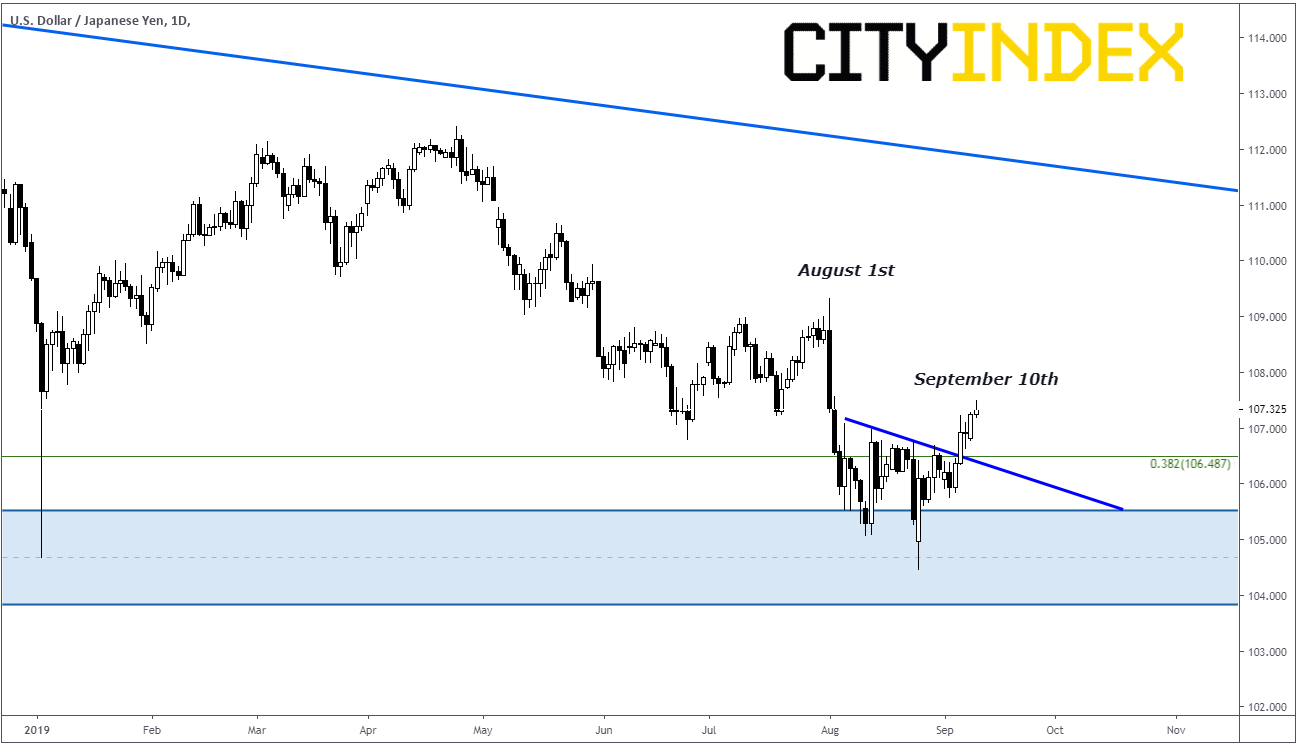

Many of the Yen pairs have a had a nice rally off their lows from August 26th. On that date, we discussed how a false breakdown in many of the Yen pairs could lead to a 60 handles rally in S&Ps! The false breakdown was confirmed with the recent 5 day move higher in many of the Yen pairs, which helped to catapult XXX/JPY through triangle resistance to new highs, not seen in many pairs in over a month.

Source: Tradingview, City Index

Here is the question now:

Is it time to sell Yen pairs (or buy Yen)? And if so, in which pair?

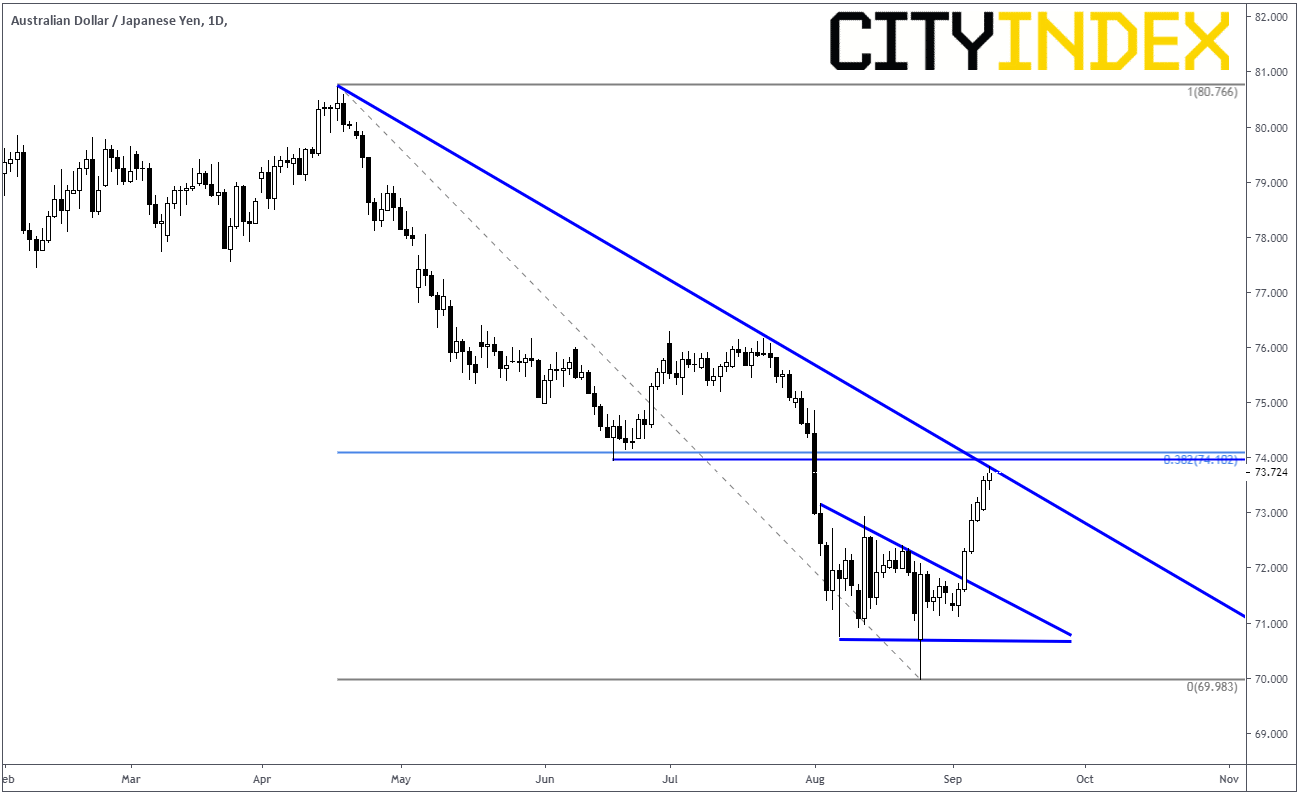

AUD/JPY looks like it may be a good candidate to go short if one wants to take a shot at buying Yen, which is currently trading at 73.74.

Source: Tradingview, City Index

- The pair is currently up against downward sloping trendline resistance which goes back to April 19th near 73.80.

- AUD/JPY is running into horizontal resistance from the low on June 18th near 74.00

- The pair is near the 38.2% retracement level from the April 19th highs to the August 26th lows at 74.10.

Because of the potential strong resistance above, one may consider shorting AUD/JPY and placing a stop above the resistance area.