Is USD/CNH about to Reverse and Head towards New Highs?

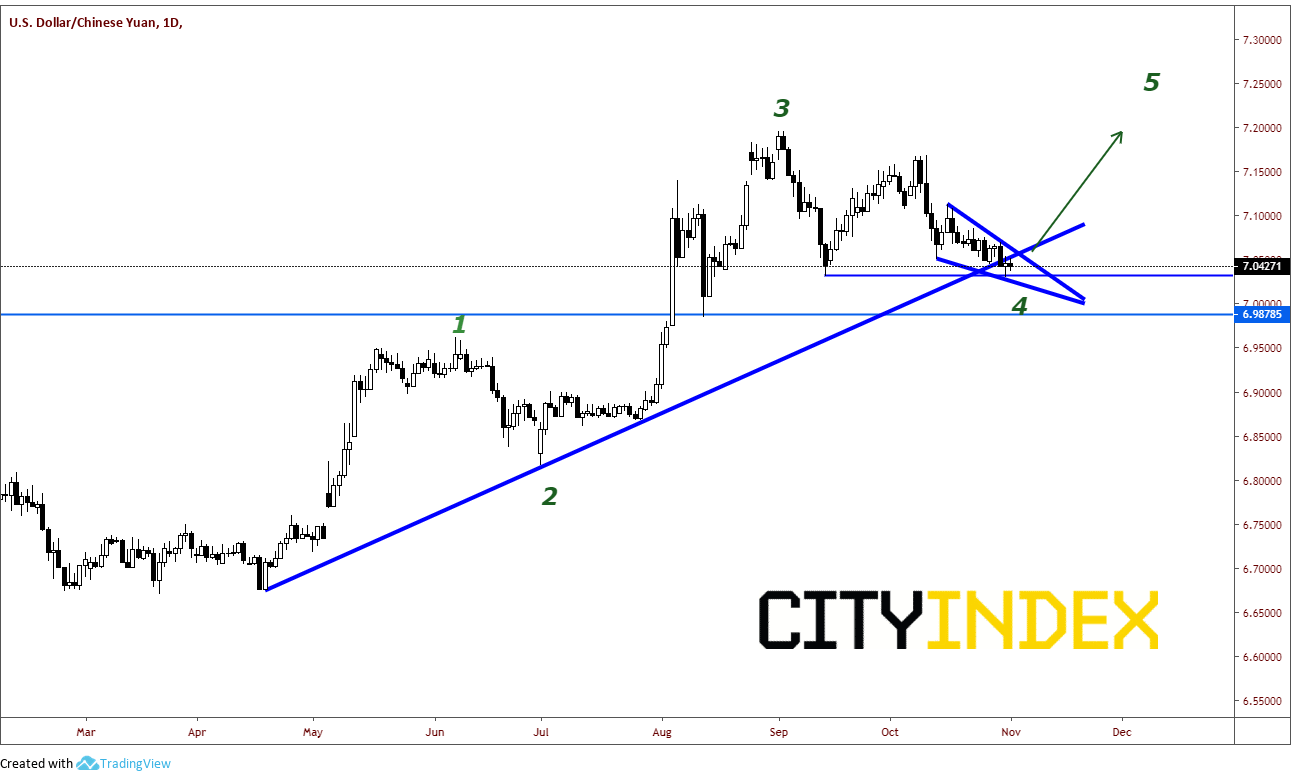

According to Wikipedia, “The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, high and lows in prices, and other collective factors”. To put it simply, the Elliott wave principal involves 5 impulse waves and 3 corrective waves, with each wave having its own rules and personality. For purposes of looking at USD/CNH, it appears current price structure is in Wave 4 and may have one more wave higher to complete the 5-wave impulsive pattern before putting in the 3 corrective waves. One thing to note about the “rules” of wave 4 is that it cannot move back into the area of wave 1. If so, the pattern is negated. Price is currently trading at 7.0436. The wave 1 high is 6.9430….so price still has room to work with.

Source: Tradingview, City Index

Other technical tools show that USD/CNH has just broken the upward sloping trendline from April 18th yesterday. However, price has not moved lower and is putting forming its 2nd straight daily candlestick doji, a sign of indecision. This may indicate price could move higher, posting a false breakdown.

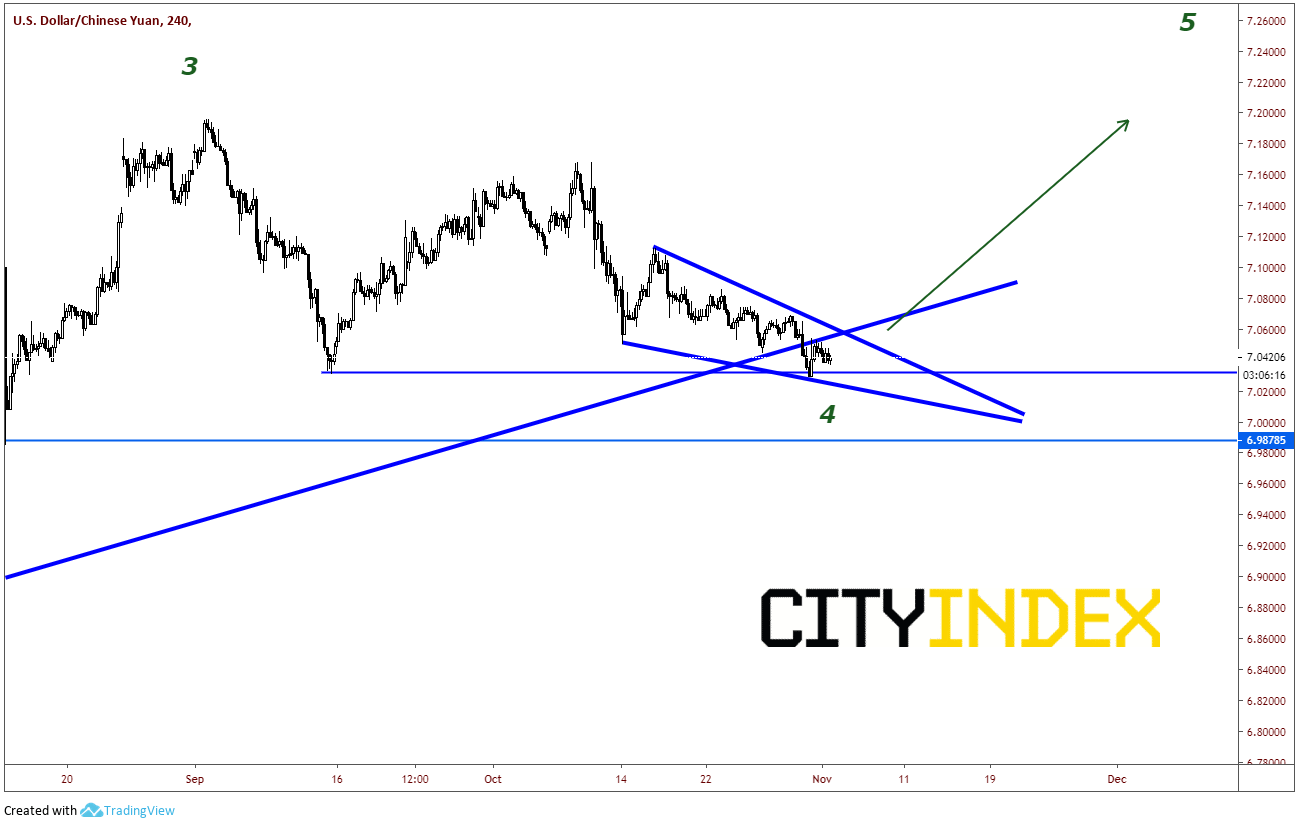

On a 240-minute chart, USD/CNH is holding horizonal support from the lows on September 13th. Within wave 4, price is currently trading in a descending wedge pattern, which theoretically should break to the upside and target the top of the wedge, which is 7.1125.

Source: Tradingview, City Index

If price does break higher and reach the target of the wedge, there is also horizontal resistance in the area. Above there, resistance comes in at the wave 3 highs of 7.1913, which will put price well on its way towards completion of wave 5. If price breaks and fails to hold the falling trendline from the descending wedge near 7.0236, the wedge pattern will be negated. Below that is long-term horizonal support at 6.9879, and then ultimately the top of wave 1 at 6.9430.

As we have seen lately, USD/CNH has been very fickle when it comes to headlines regarding the US-China trade war. Elliott wave theory is just another way to give structure to the underlying psychology of price movement. Watch for more headlines over the weekend as President Trump and President Xi try to find a date and location to sign Phase One of the ongoing negotiations.