Is USD poised to break out

The Greenback has faltered on Thursday as markets remain in stasis as Greek debt negotiations remain ongoing and economic data is fairly thin on the […]

The Greenback has faltered on Thursday as markets remain in stasis as Greek debt negotiations remain ongoing and economic data is fairly thin on the […]

The Greenback has faltered on Thursday as markets remain in stasis as Greek debt negotiations remain ongoing and economic data is fairly thin on the ground. We remain optimistic about the dollar, which enjoyed a resurgence earlier this week, thus the dollar may not have faltered and instead may be on the verge of a breakout… if the stars align.

The Greenback has faltered on Thursday as markets remain in stasis as Greek debt negotiations remain ongoing and economic data is fairly thin on the ground. We remain optimistic about the dollar, which enjoyed a resurgence earlier this week, thus the dollar may not have faltered and instead may be on the verge of a breakout… if the stars align.

So, what needs to happen for a resumption of the dollar up-trend?

Even amongst all of this Greek uncertainty, the FX market is still focused on the future trajectory of US interest rates, in our view. In that vein, Thursday’s US data including personal income and spending, PCE data and initial jobless claims could be a bigger driver for EURUSD than the outcome of yet another Eurogroup meeting in Brussels later.

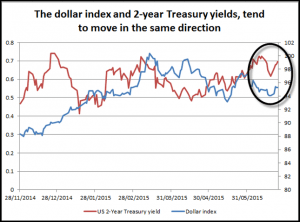

We may have to wait until next week to get a better grip on the future direction of the buck as we get the all-important start of the month data including ISM reports and NFP. That is what bond traders will be watching closely, and due to the importance of the 2-year Treasury yield to the US dollar right now, we will be watching it closely too.

The tech view: dollar index

The dollar remains in a tight range as stasis grips the market ahead of a resolution to the Greek crisis. The 50-day sma at 95.52 – approx. 30 pips from where we are right now – is capping the upside, if we can get above here then 96.20 – the 100-day sma – comes into view. We may need to wait for next week’s all-important data before we can think about dreams of 100.00 again in the dollar index. On the downside, 94.95 – the low from Wednesday – is key support, below that the low of the week so far – 93.80 – could act as a resting zone in the face of a sell off.

Figure 1: