Is Universal Health Services Headed Up?

On Monday, after market, Universal Health Services (UHS) is expected to report first quarter EPS of $2.61 compared to $2.45 a year ago on revenue of appx. $2.9B vs. $2.8B last year. The company's current analyst consensus rating is 9 buys, 8 holds and 0 sells, according to Bloomberg.

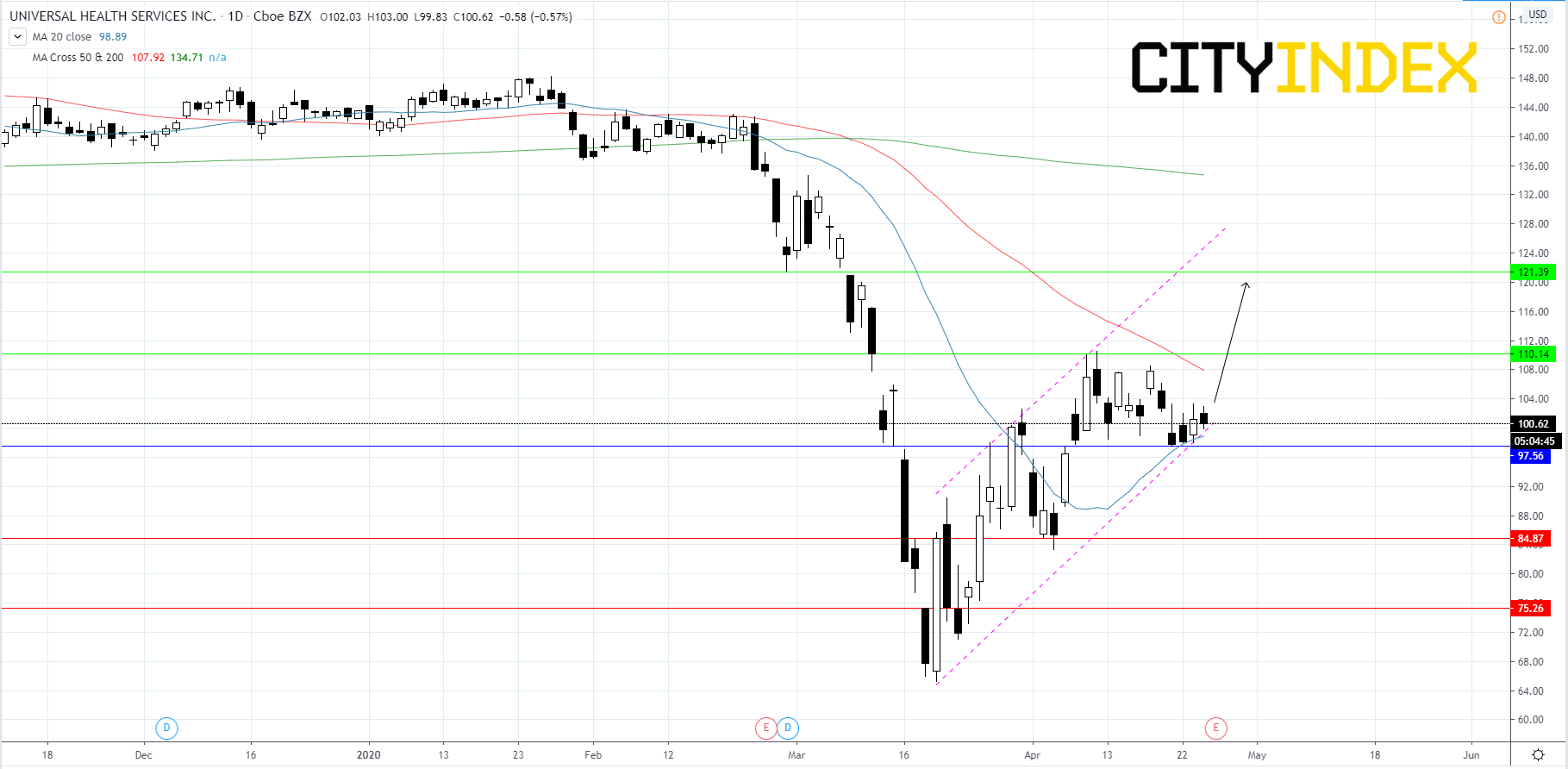

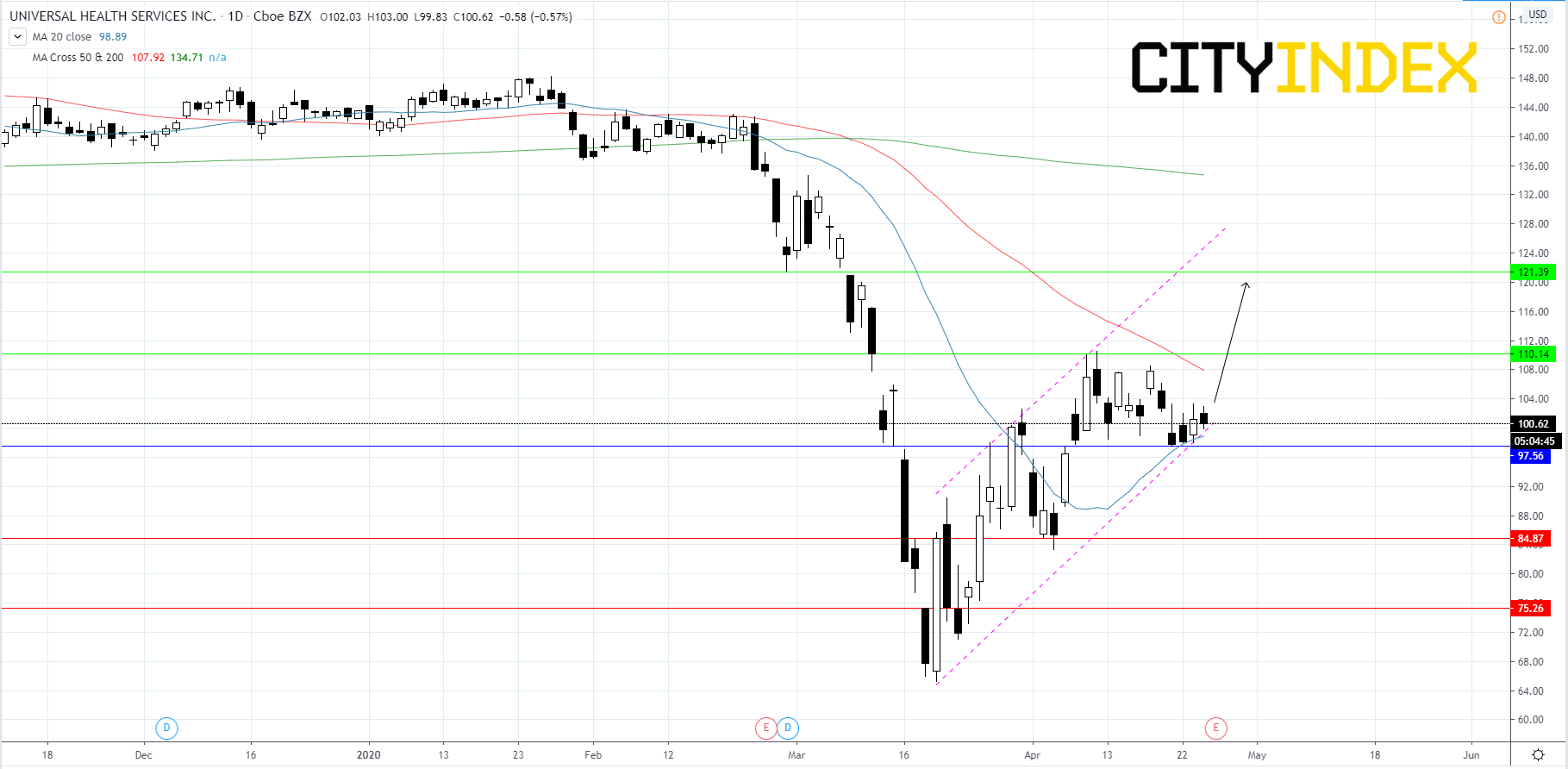

From a chartist's point of view, Universal Health Services's stock price is roughly $100.62 and holding above the $97.56 key support level, also on the 20 day moving average, and on a rising trend line that began in mid-March. If price can continue to hold the 20 day moving average we may see a retest of $110.14. If price can manage to get above $110.14 it could be headed up to $121.39 to reach a high in the up trend channel that price has been in for about 25 trading days. We have a tight stop at $97.56 because earnings and current market conditions make it possible for price to have a very volatile move.

Source: GAIN Capital, TradingView

From a chartist's point of view, Universal Health Services's stock price is roughly $100.62 and holding above the $97.56 key support level, also on the 20 day moving average, and on a rising trend line that began in mid-March. If price can continue to hold the 20 day moving average we may see a retest of $110.14. If price can manage to get above $110.14 it could be headed up to $121.39 to reach a high in the up trend channel that price has been in for about 25 trading days. We have a tight stop at $97.56 because earnings and current market conditions make it possible for price to have a very volatile move.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM