Is Kweichow Moutai Better than Coca-Cola?

Kweichow Moutai (600519), a Chinese alcoholic beverages company, reported that 1Q net income increased 17% on year to 13.1 billion yuan on revenue of 25.3 billion yuan, up 13%. The improving 1Q result suggests that the demand of the company's product remains strong even Chinese economy faced a challenge of COVID-19. Besides, Citigroup raised its target price by 29% to 1,450 yuan on better earnings visibility and strong operating cash flow.

Meanwhile, Kweichow Moutai replaced Coca-Kola as the largest beverage company in the world. The market capacity of Kweichow Moutai reached around 226 billion dollars as of April 27, beyond Coca-Cola's market capacity around 200 billion dollars.

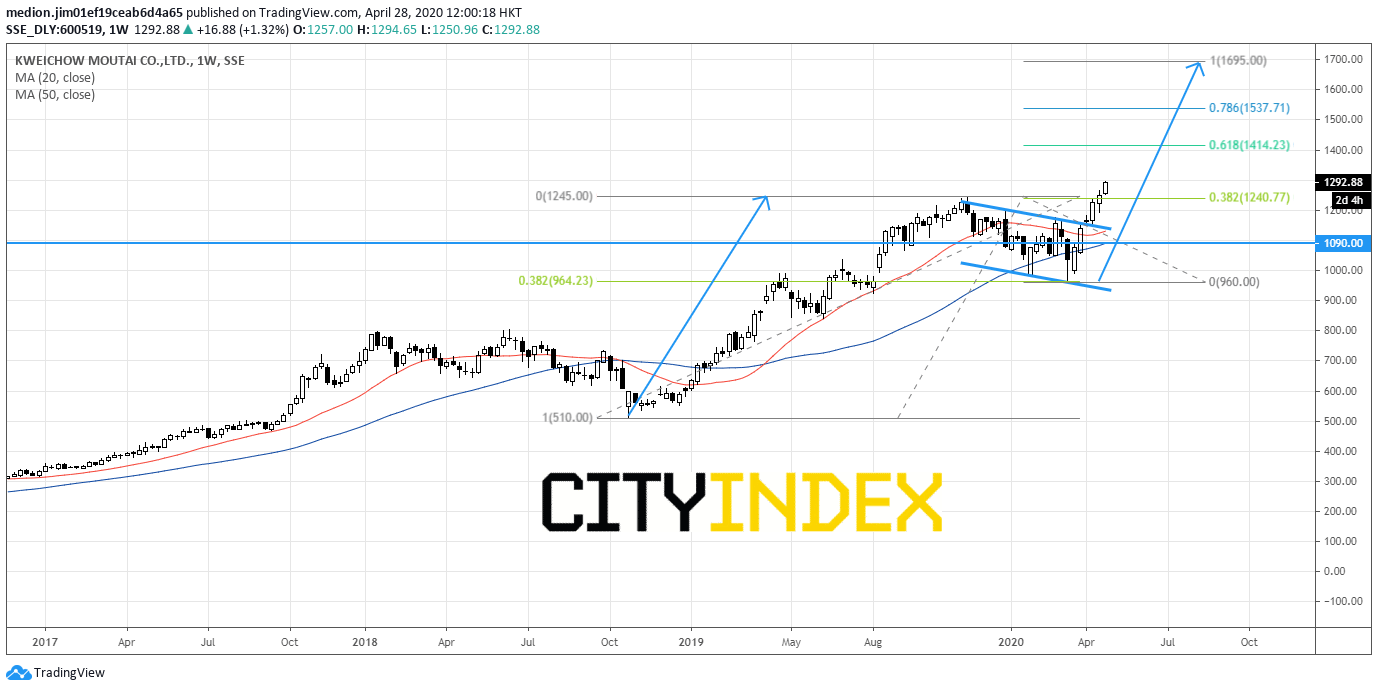

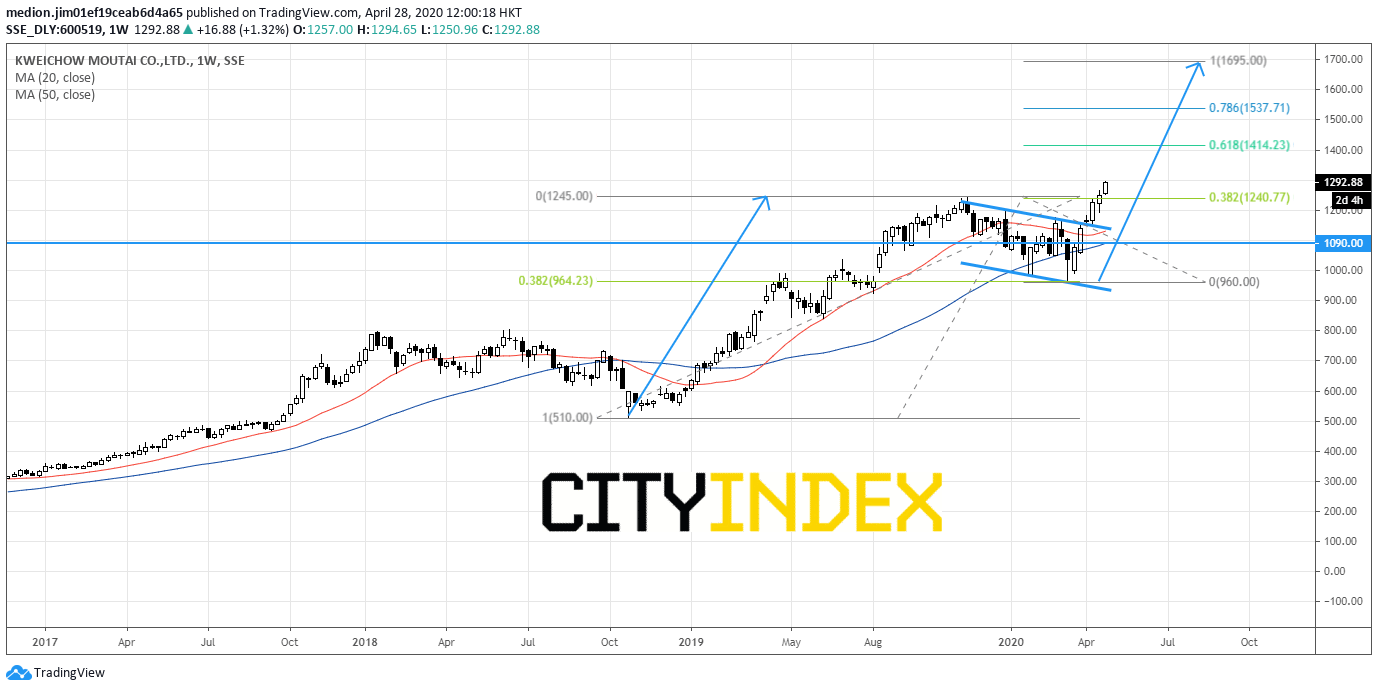

Let's take a look at the weekly chart of Kweichow Moutai. The stock retreated from October high at 1245 yuan and then was supported by 38.2% retracement between 2019 October high and 2018 October low. After that, the prices crossed above the declining channel from 2019 October high and made a new record high. The price action indicates that the trend would be bullish. The rising 50-week moving average at 1090 yuan should act as the key support level. Above this level, the prices should consider an advance to 1414 yuan, 1537 yuan and 1695 yuan, representing the 61.8%, 78.6.% and 100% measured move which projected from 2020 March low at 960 yuan.

Source: GAIN Capital, TradingView

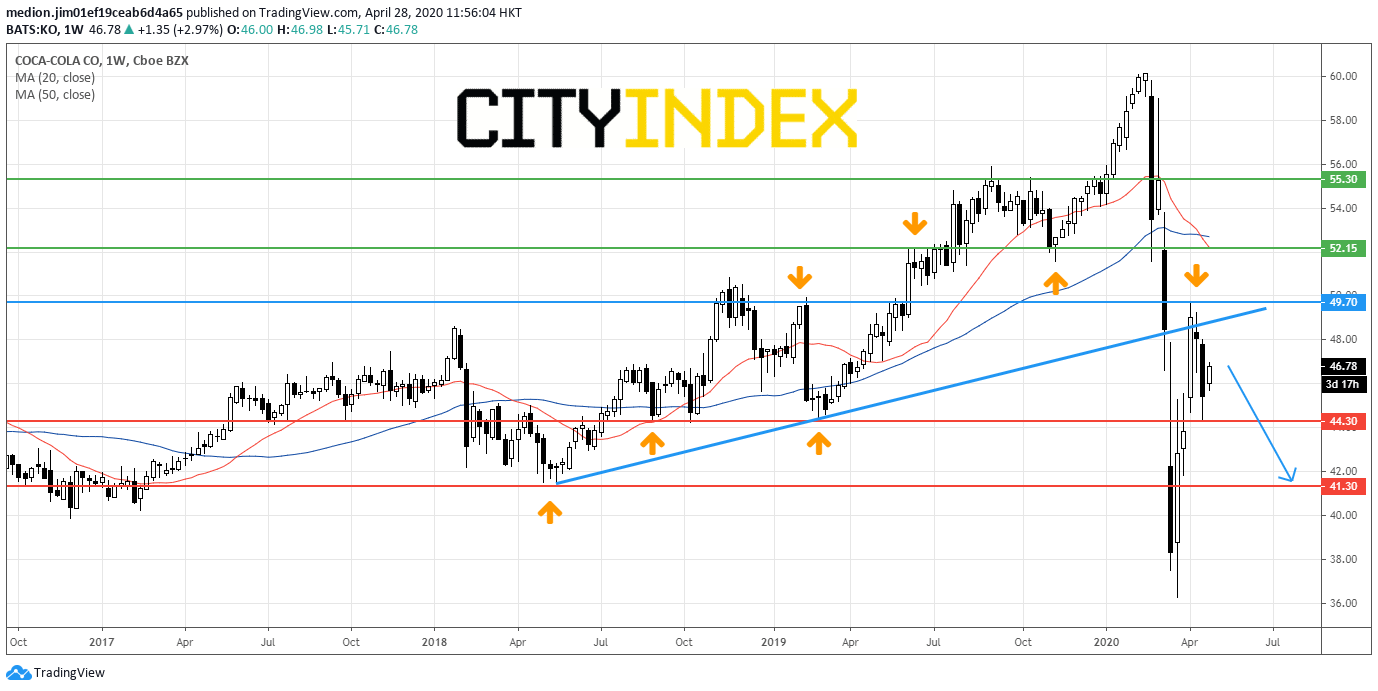

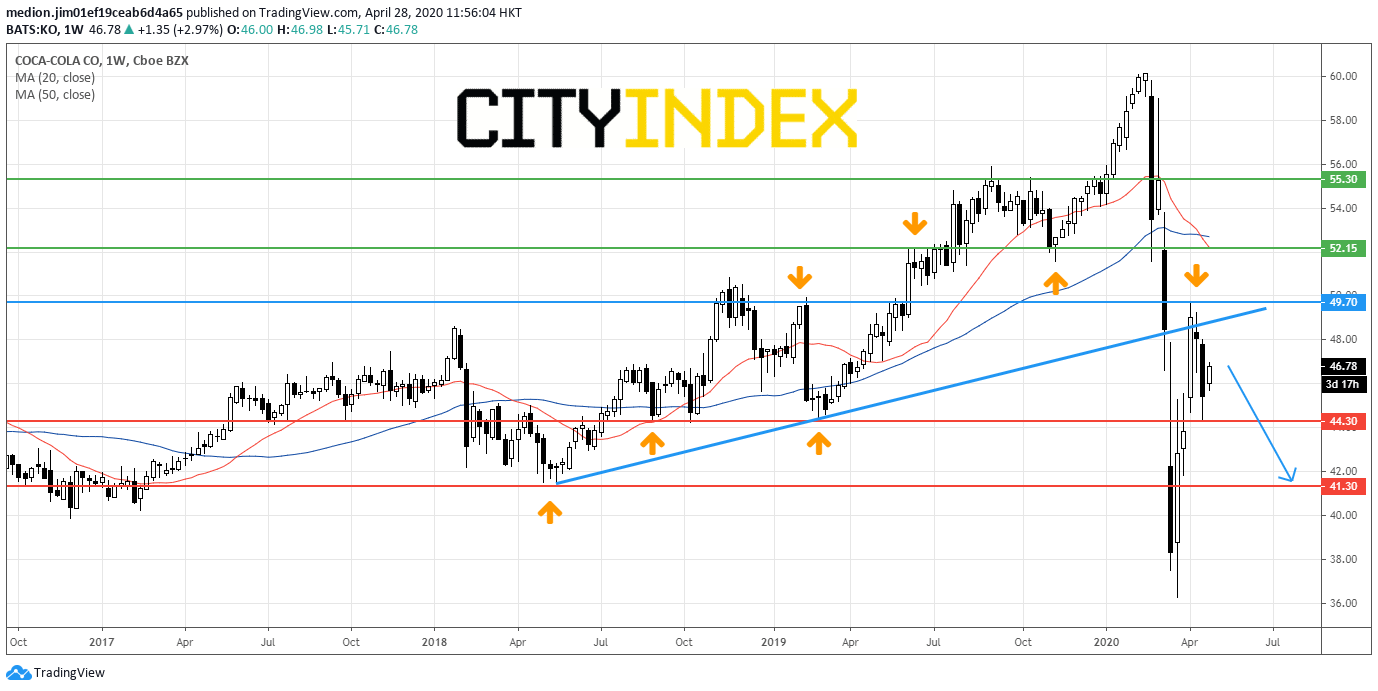

After that, let's check out the weekly chart of Coca-Cola. The stock posted a reversal signal after touching the former rising trend line drawn from 2018 low. Besides, the death cross between 20-week and 50-week moving averages has been identified. Therefore, unless the previous high at $49.7 is violated, the stock remains choppy and may return to the overlap support level at $44.3 and $41.3. Alternatively, only a break above $49.7 would trigger a stronger rebound to the next overlap resistance level at $52.15.

Source: GAIN Capital, TradingView

After comparing both charts, Kweichow Moutai would be technically better than Coca-Cola as the bullish trend is more obvious.

Meanwhile, Kweichow Moutai replaced Coca-Kola as the largest beverage company in the world. The market capacity of Kweichow Moutai reached around 226 billion dollars as of April 27, beyond Coca-Cola's market capacity around 200 billion dollars.

Let's take a look at the weekly chart of Kweichow Moutai. The stock retreated from October high at 1245 yuan and then was supported by 38.2% retracement between 2019 October high and 2018 October low. After that, the prices crossed above the declining channel from 2019 October high and made a new record high. The price action indicates that the trend would be bullish. The rising 50-week moving average at 1090 yuan should act as the key support level. Above this level, the prices should consider an advance to 1414 yuan, 1537 yuan and 1695 yuan, representing the 61.8%, 78.6.% and 100% measured move which projected from 2020 March low at 960 yuan.

Source: GAIN Capital, TradingView

After that, let's check out the weekly chart of Coca-Cola. The stock posted a reversal signal after touching the former rising trend line drawn from 2018 low. Besides, the death cross between 20-week and 50-week moving averages has been identified. Therefore, unless the previous high at $49.7 is violated, the stock remains choppy and may return to the overlap support level at $44.3 and $41.3. Alternatively, only a break above $49.7 would trigger a stronger rebound to the next overlap resistance level at $52.15.

Source: GAIN Capital, TradingView

After comparing both charts, Kweichow Moutai would be technically better than Coca-Cola as the bullish trend is more obvious.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM