A global example of this is the German Stock index, the DAX, up over 6% year to date compared to the tech-heavy NASDAQ index, trading flat for the year.

In a simplified world, this may lead to an expectation of support for the EUR/USD as investors need to purchase the Euro currency to allow them to buy into European stock indices, such as the DAX and the CAC.

Learn more about trading indices

Despite this and the overnight release of Eurozone flash PMI’s, which showed manufacturing rising to its highest level on record at 62.4 as well as the German Government walking back expectations of a five-day lockdown over Easter, the EUR/USD closed at its lowest level since November 2020.

Concerns remain over the slow vaccine roll out in Europe and a possible extension of lockdowns that delay the reopening. In contrast to the situation in the U.S of an ongoing reopening, stimulus checks and prospects of a large infrastructure package to keep the recovery on track.

Nonetheless, this isn’t a new story and it has been the driver of the EUR/USD’s decline during March. The question is how much more needs to be priced in?

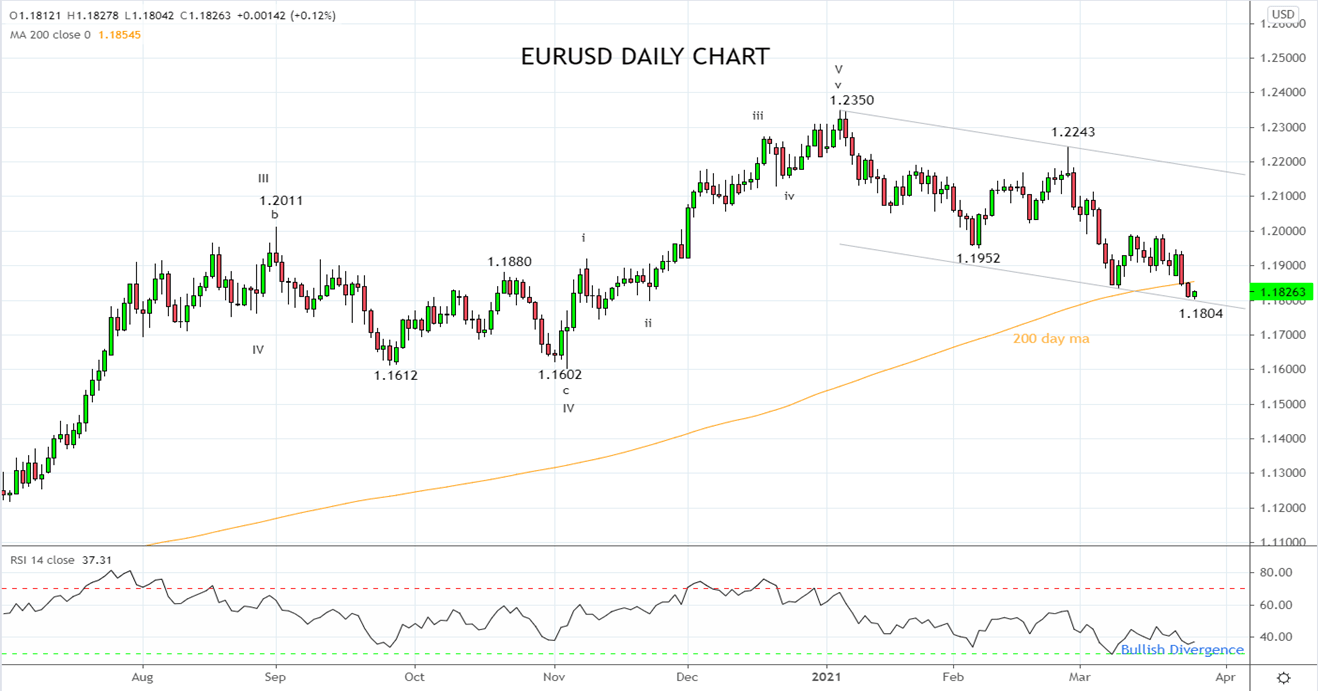

After breaking below the early March 1.1835 low this week, the EUR/USD is testing trend channel support currently around 1.1800ish. Interestingly, bullish divergence can be viewed via the RSI indicator that indicates a loss of momentum to the downside. Tentative reasons to look for a bounce, more so if the EURUSD could reclaim on a closing basis the 200day ma at 1.1855.

However, should the EURUSD fail to establish a base near current levels, and then slips through support at 1.1800/80, allow for a deeper pullback towards medium-term support at 1.1600.

Source Tradingview. The figures stated areas of the 25th of March 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation