A wild ride for cryptocurrencies and their headline act, Bitcoin last week. After opening near $8,500, Bitcoin plummeted below $7000 for the first time since May. The overall market cap of the top 100 cryptocurrencies has dropped from more than $350bn in late June to $195bn at the time of writing.

The catalyst for the fall appears to be China-related as the Peoples Bank of China (PBOC) released a statement late last week announcing new steps to uphold its ban of cryptocurrencies and said that “Investors should be careful not to mix blockchain technology with virtual currency,”. The clarification comes following a Bitcoin rally in late October after Chinese President Xi Jinping said China should “seize the opportunity” of blockchain technology.

Fuelling the price decline last week rumours that Chinese police had raided the offices of cryptocurrency exchanges Binance and Bithumb. Both exchanges have subsequently denied the claims and a spokesman for Binance has since confirmed the exchange doesn’t have “fixed offices in Shanghai or China.”

While it would have been nice to have kept our excellent track record in place in Bitcoin, it wasn’t to be. Bitcoin has gone through the $7,200 stop loss in the long Bitcoin trade recommendation in this article https://www.cityindex.com.au/market-analysis/china-spurs-bitcoin-revival/.

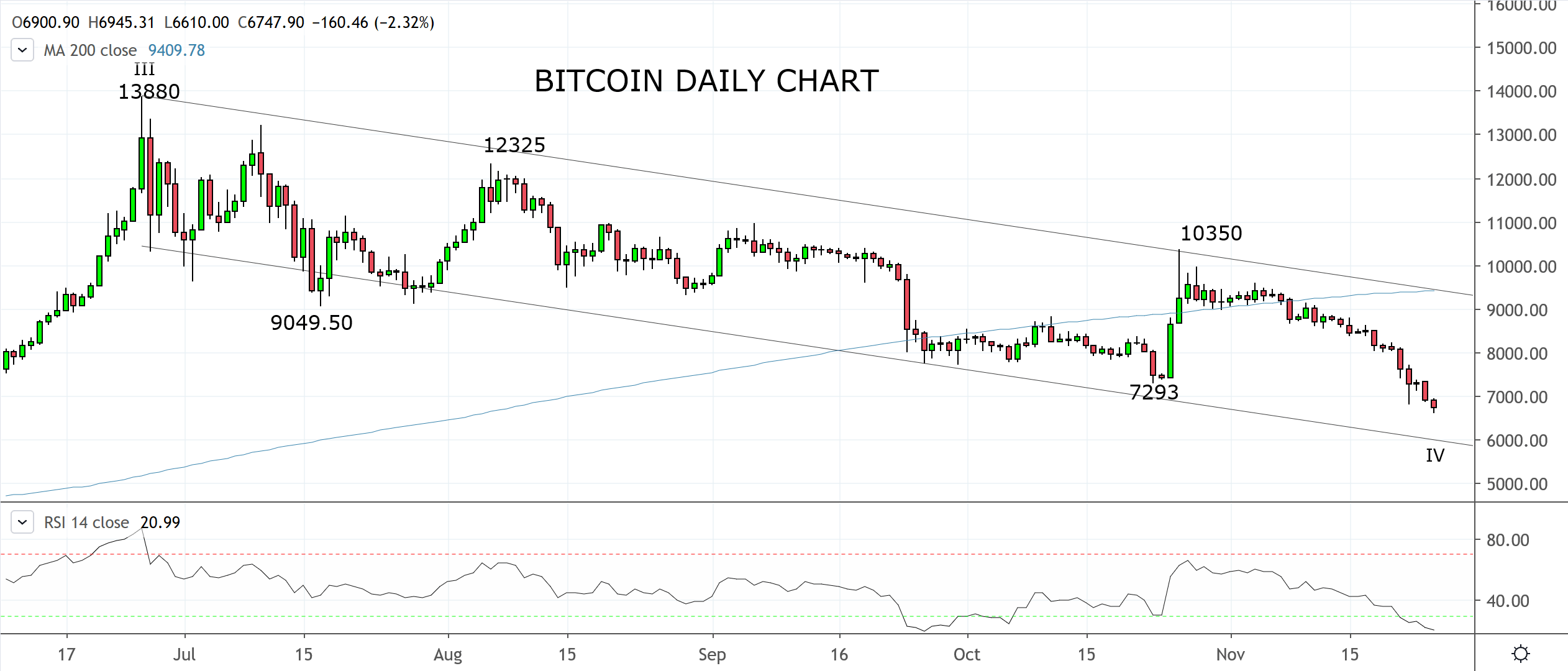

Technically, we continue to view the sell-off from the 13880 high as corrective pullback and this suggests at some point in time the Bitcoin uptrend will resume. A possible clue as to the timing of the rally, Bitcoin has made medium term highs and lows in December the past two years. Firstly falling from the 19666 high in December 2017 before rallying from the 3122 low in December 2018.

As such, we would allow for the current sell off to continue before looking for some signs of stabilization in December. Potentially this will involve a test of trend channel support $6000 area and should a rally back above the 200-day moving average $9,400 occur, it would suggest the uptrend has returned. Conversely, should Bitcoin fall much below the 200 week moving average at $5000, it would severely jeopardize prospects for a recovery.

Source Tradingview. The figures stated areas of the 25th of November 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation