Is Acadia Realty Trust a Long-Term Buy and Hold?

Acadia Realty Trust is a real estate investment trust that focuses on the acquisition of shopping centers and mixed-use properties with retail components.

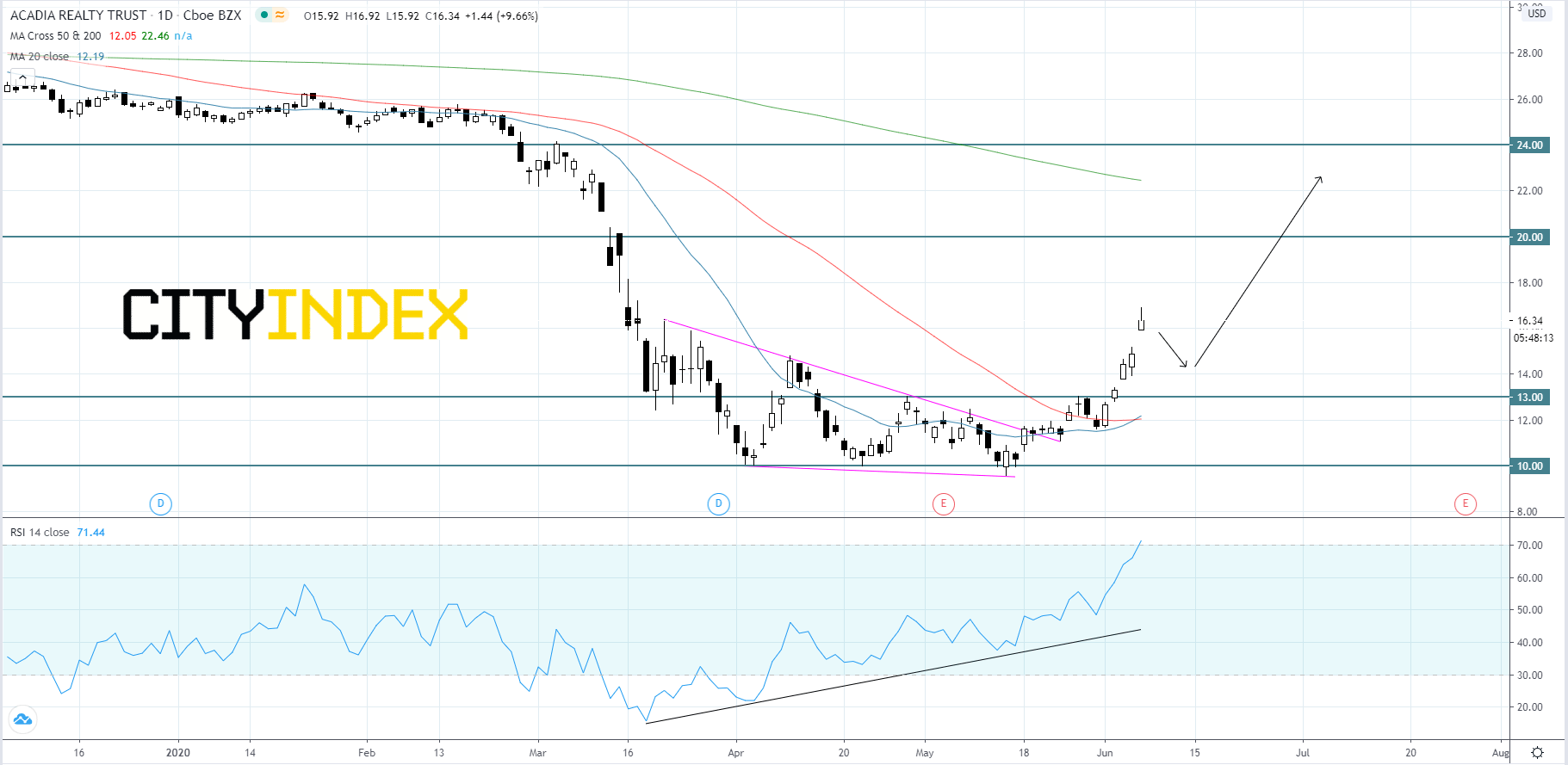

From a technical point of view, on a daily chart, Acadia's stock price recently broke to the upside of a falling wedge pattern and has extremely bullish momentum. Price has gapped up twice this week, making a higher high everyday. The 20-day moving average has just crossed above the 50-day moving average. The RSI has been rising on top of a bullish trend line and is over 70. Since price does not often go straight up, price will mostly likely pull back before regaining momentum and accelerating towards the $20.00 resistance level. Once price reaches the $20.00 level it will probably be a slower grind aimed at the $24.00 resistance level. If price cannot hold above the $13.00 level, then price may retrace to $10.00 support.

Source: GAIN Capital, TradingView

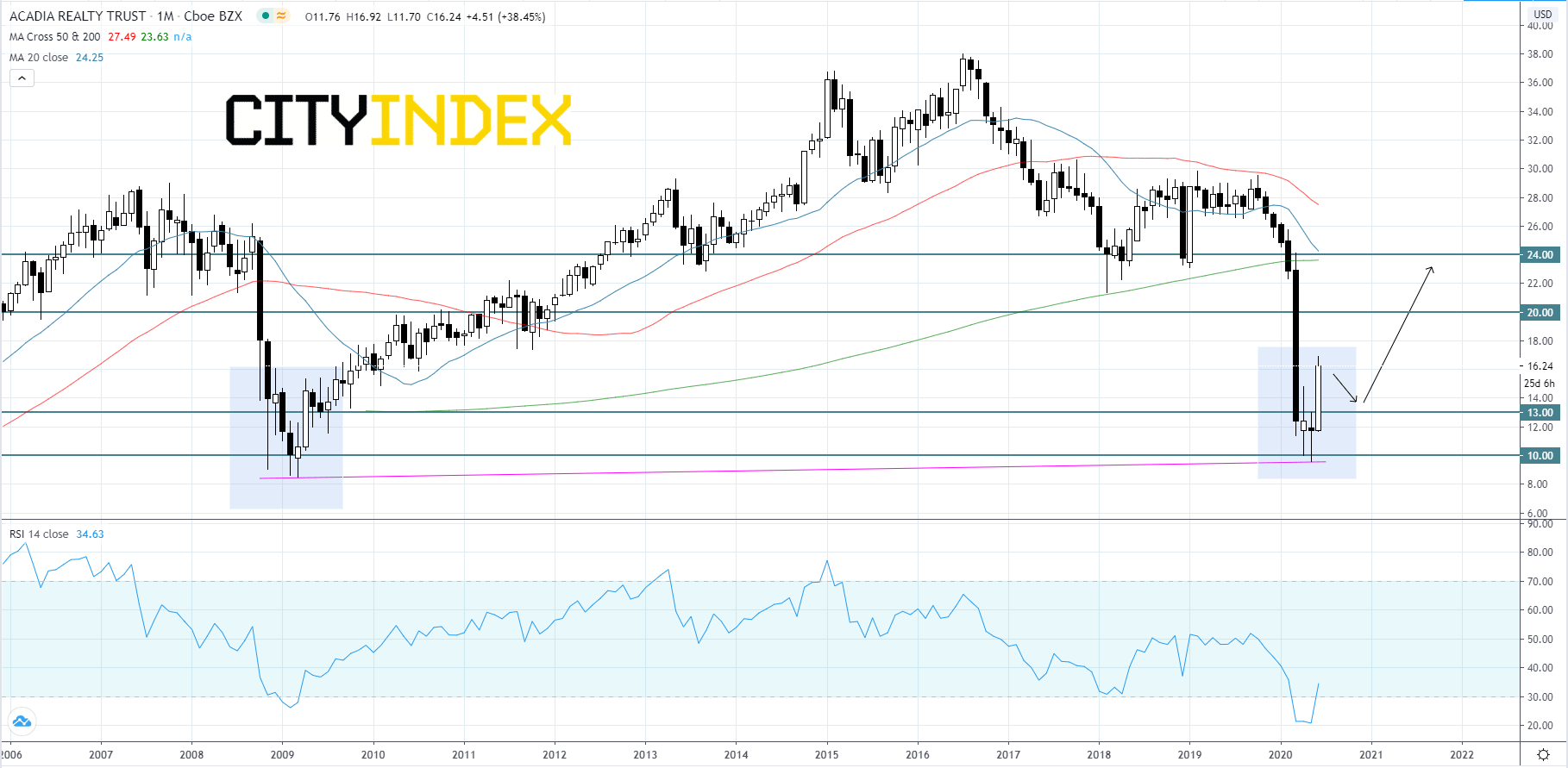

Looking at a monthly chart, we can see that price may have bottomed around the $10.00 level given the trend line. In 2009 price bottomed a little lower than $10.00 after confirming a hammer reversal candle just before a bullish engulfing candle started a new up trend. Looking at today's price movement we can see that something very similar may be occurring, which is why price may pull back slightly before continuing upwards.

Source: GAIN Capital, TradingView

From a technical point of view, on a daily chart, Acadia's stock price recently broke to the upside of a falling wedge pattern and has extremely bullish momentum. Price has gapped up twice this week, making a higher high everyday. The 20-day moving average has just crossed above the 50-day moving average. The RSI has been rising on top of a bullish trend line and is over 70. Since price does not often go straight up, price will mostly likely pull back before regaining momentum and accelerating towards the $20.00 resistance level. Once price reaches the $20.00 level it will probably be a slower grind aimed at the $24.00 resistance level. If price cannot hold above the $13.00 level, then price may retrace to $10.00 support.

Source: GAIN Capital, TradingView

Looking at a monthly chart, we can see that price may have bottomed around the $10.00 level given the trend line. In 2009 price bottomed a little lower than $10.00 after confirming a hammer reversal candle just before a bullish engulfing candle started a new up trend. Looking at today's price movement we can see that something very similar may be occurring, which is why price may pull back slightly before continuing upwards.

Source: GAIN Capital, TradingView

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM