In the first full trading week of 2020, a cautious mood looms over markets after the assassination of powerful Iranian commander Qassem Soleiman who once called President Trump a “gambler”.

While most analysts don’t think the latest escalation in tensions between the U.S. and Iran will result in an actual military confrontation, reprisal attacks on American interests commenced this morning with an Iranian missile attack on a military base in Iraq hosting American troops. S&P 500 futures are currently down -1.2% at the time of writing, trading at 3197.50.

Last week’s drone attack is destined to have a more lingering impact than when he last rattled markets in early December. Back then, President Trump issued a barrage of tariff threats against Argentina, Brazil, China, France and NATO members whom he considered weren’t spending enough on defence.

Quick to respond, global equity markets sold off and news headlines predicted the end of the Santa stock market rally before it had even begun. We argued that the Santa rally would take place as usual in 2019, including a move towards 3200 for the S&P500 into year-end here.

This time around, due to ongoing uncertainty around the exact timing and nature of continued Iranian retaliation, investors are unlikely to be so quick to brush off President Trumps' latest roll of the dice. Additionally, the timing of the current S&P 500 pullback fits very well within our expectation for a pullback in early January as outlined in recent Week Ahead videos.

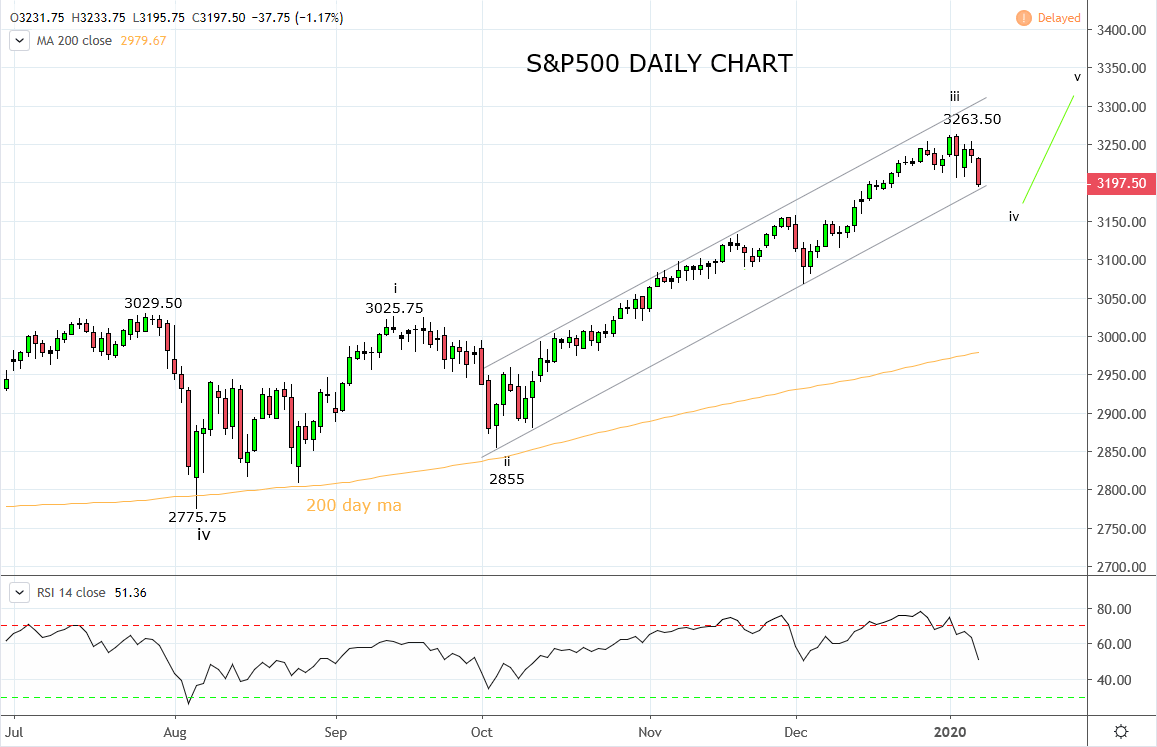

Technically, post the break to new highs in late October 2019, the S&P500 continued higher within an upward sloping trend channel. The current pullback is viewed as a minor Wave iv and is now testing the first level of support which comes from the lower bound of the trend channel 3190/85 area.

Below here, interim support resides 3155 area before medium-term support kicks in at 3070/50 area. With this in mind, dips towards the support regions mentioned above will be viewed as selective buying opportunities, in expectation of the uptrend resuming in February 2020 resulting in a test of 3350/3400.

Only a break and close below 3020/10 would be reason to reassess the bullish view.

Source Tradingview. The figures stated areas of the 8th of January 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation