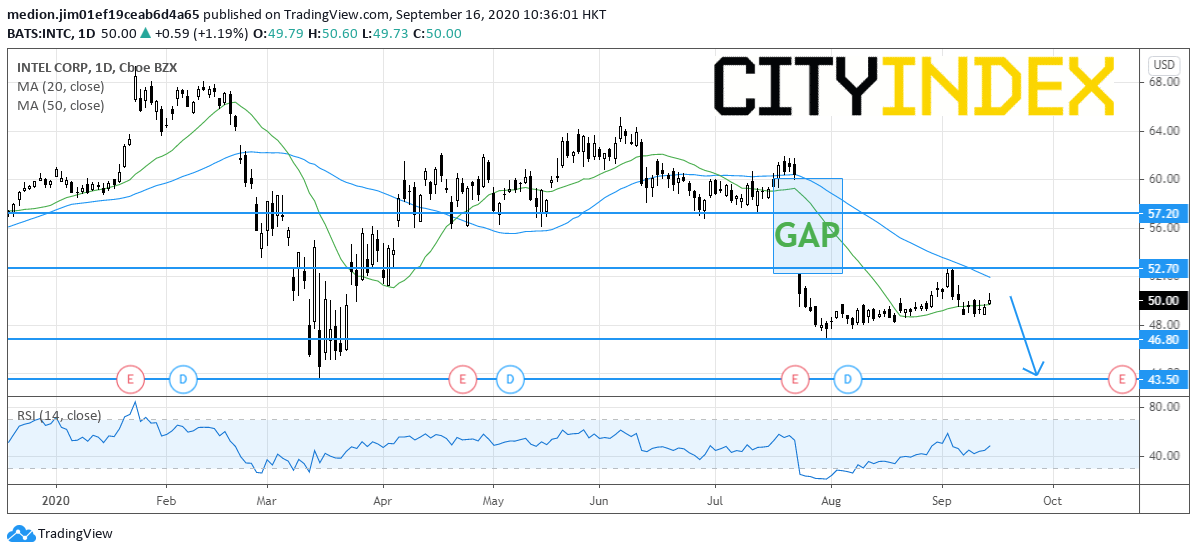

Intel: Under Pressure Below $52.7

Intel remains trading on the downside and failed to post a sustainable rebound. The company posted a large bearish gap on July 24 after the announcement of 2Q earnings. The company reported that adj. EPS was up 29% on year to $1.19 on revenue of $19.7 billion, up 20%.

Intel will release the 3Q result on October 22, Investors would expect the EPS of $1.04, while revenue would be $18.22 billion.

On a daily chart, the stock prices retreated from $52.7 after failing to fill the bearish gap. Currently , it is trading below the declining 50-day moving average. Bearish readers could set the resistance level at $52.70, while the support levels would be located at $46.8 and $43.5 (the low of March).

Source: GAIN Capital, TradingView

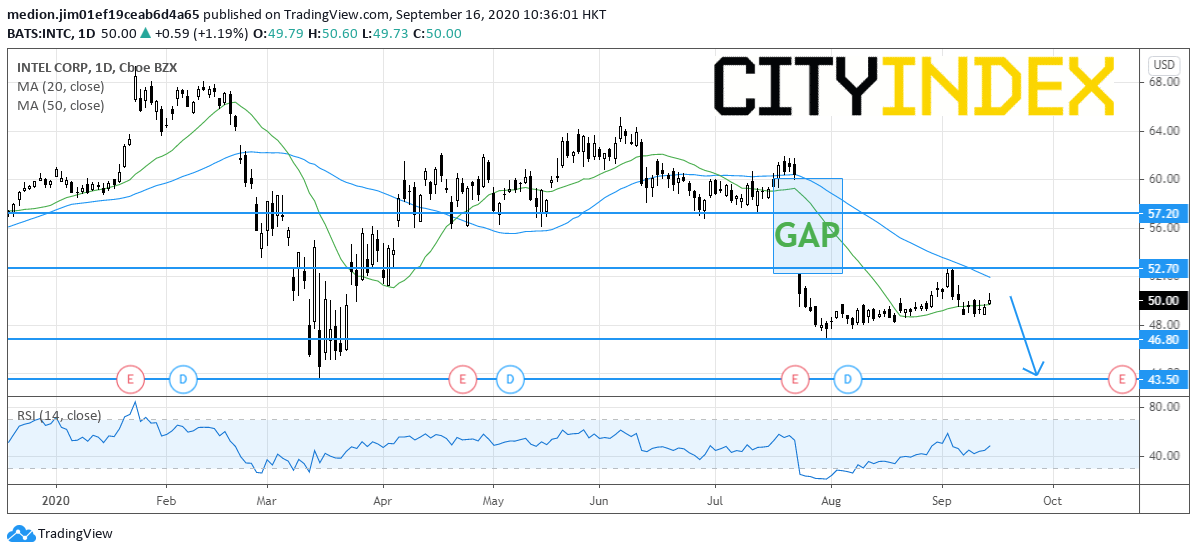

Intel will release the 3Q result on October 22, Investors would expect the EPS of $1.04, while revenue would be $18.22 billion.

On a daily chart, the stock prices retreated from $52.7 after failing to fill the bearish gap. Currently , it is trading below the declining 50-day moving average. Bearish readers could set the resistance level at $52.70, while the support levels would be located at $46.8 and $43.5 (the low of March).

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM