Inditex’s upside momentum losing steam

Also, net sales were down 44.3% on year to 3.30 billion euros. In addition, the company said: "Sales trends began to improve in May, though they are not yet at normal levels.

As of 8 June, 5,743 stores (78% of total) were open in 79 markets. Store & Online sales in local currencies in May decreased 51%. Store & Online sales in local currency from 2 June to 8 June decreased 34%."

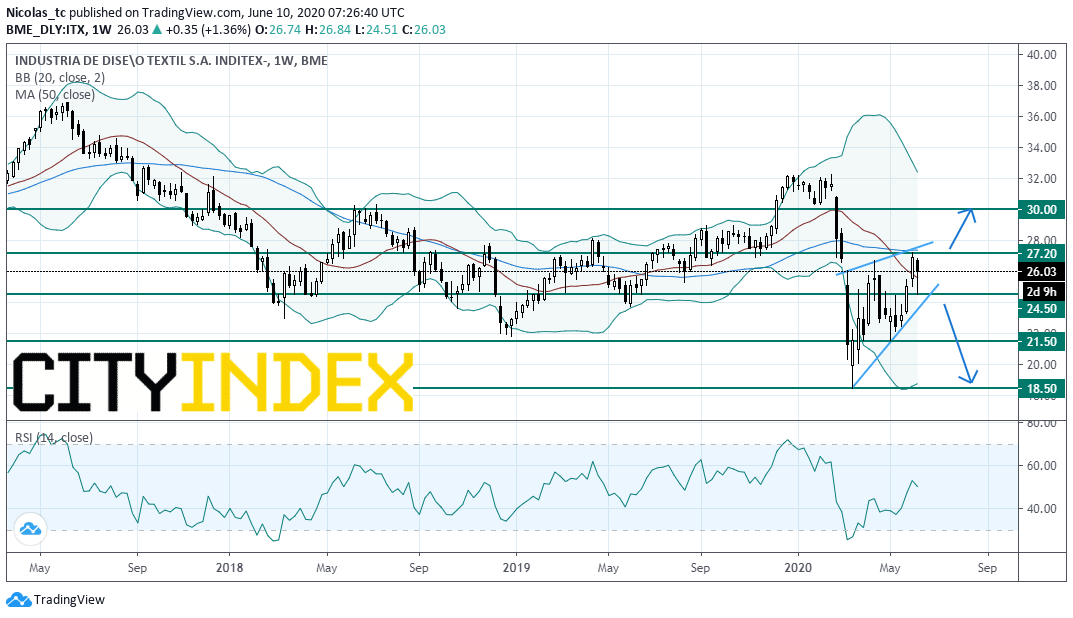

From a technical perspective, the bullish momentum is fading as a rising wedge pattern (reversal pattern) is taking shape (not yet validated). The 20-week simple moving average is still heading downward.

Neutral view between 24.5E and 27.2E. A break below 24.5E would deliver a bearish signal (validation of the rising wedge) and would call for a drop toward 21.5E and 18.5E. Alternatively, a push above 27.2E would call for a new up leg towards 30E.

Source: GAIN Capital, TradingView